Uddrag fra Authers

The New York Fed defines it as “the compensation that investors require for bearing the risk that interest rates may change over the life of the bond.” Most of the time, it will be positive; investors generally will want some compensation for such risks.

Shifting short-term expectations of the Fed will tend to move bond yields, as has visibly happened over the last year. The point of the term premium is to explain any rises or falls in yields that can’t be put down directly to the Fed:

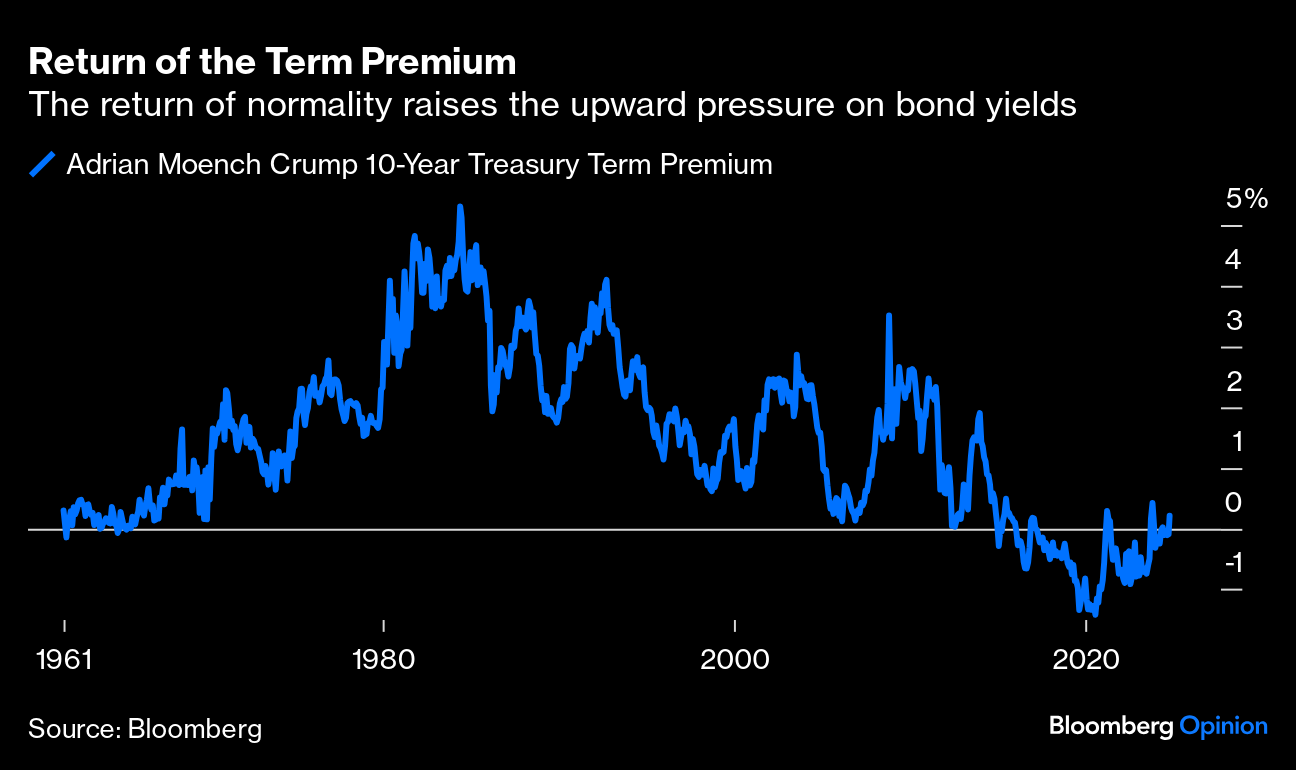

The last big splurges of interest in the term premium came when it was negative. There were fears about what would happen when it returned to positivity, as that would require longer yields to rise. This is the Adrian Moench Crump version of the term premium, named for the economists at the New York Fed who invented what is possibly the most cited way to measure it:

There is nothing sinister about a positive term premium in itself. As the chart shows, it’s more of a return to normality after a few years either side of the pandemic that look anomalous. That anomaly was driven more than anything by the remarkable amounts of liquidity thrown at the bond market after the Global Financial Crisis. Why demand a premium when there are so many eager buyers among central banks?

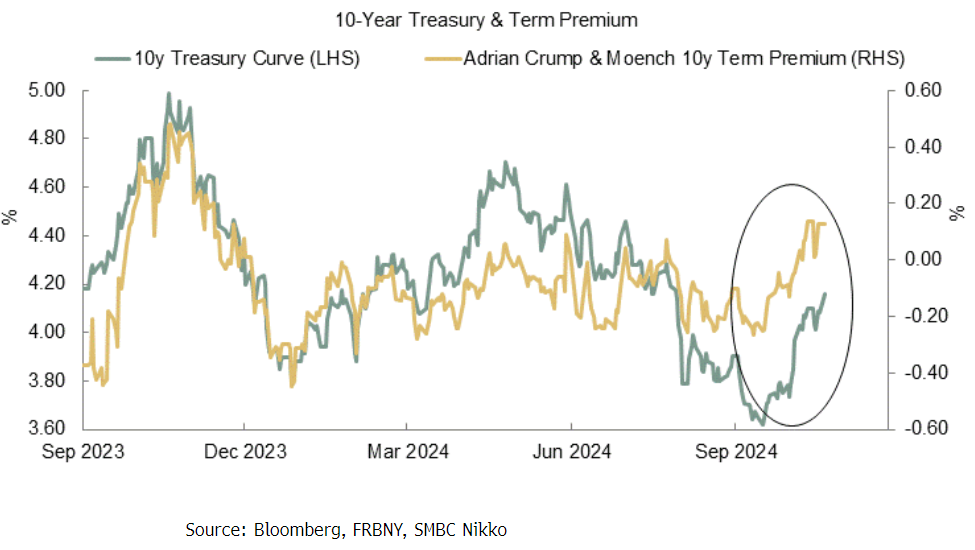

Joe Lavorgna of SMBC Nikko offers this chart to demonstrate that the increase in yields over the last month is largely (he reckons around 80%) about the term premium:

Lavorgna suggests that this has implications for the Fed, as it reduces the need to cut base rates further. By extension means that shorter-dated Treasury yields need to adjust higher:

The rise in term premium is the result of higher real interest rates and stronger economic data. Thus, there is no fundamental reason for the Fed to cut again on Nov. 7. If this is indeed the case, the front end of the Treasury curve needs to significantly reprice.

This intensifies the upward pressure on longer term yields, which is why the returning term premium can compete with the possibility of an imminent second Donald Trump presidency in the battle to take credit for the resurgence in yields. It also raises the question of exactly why the premium is returning now.

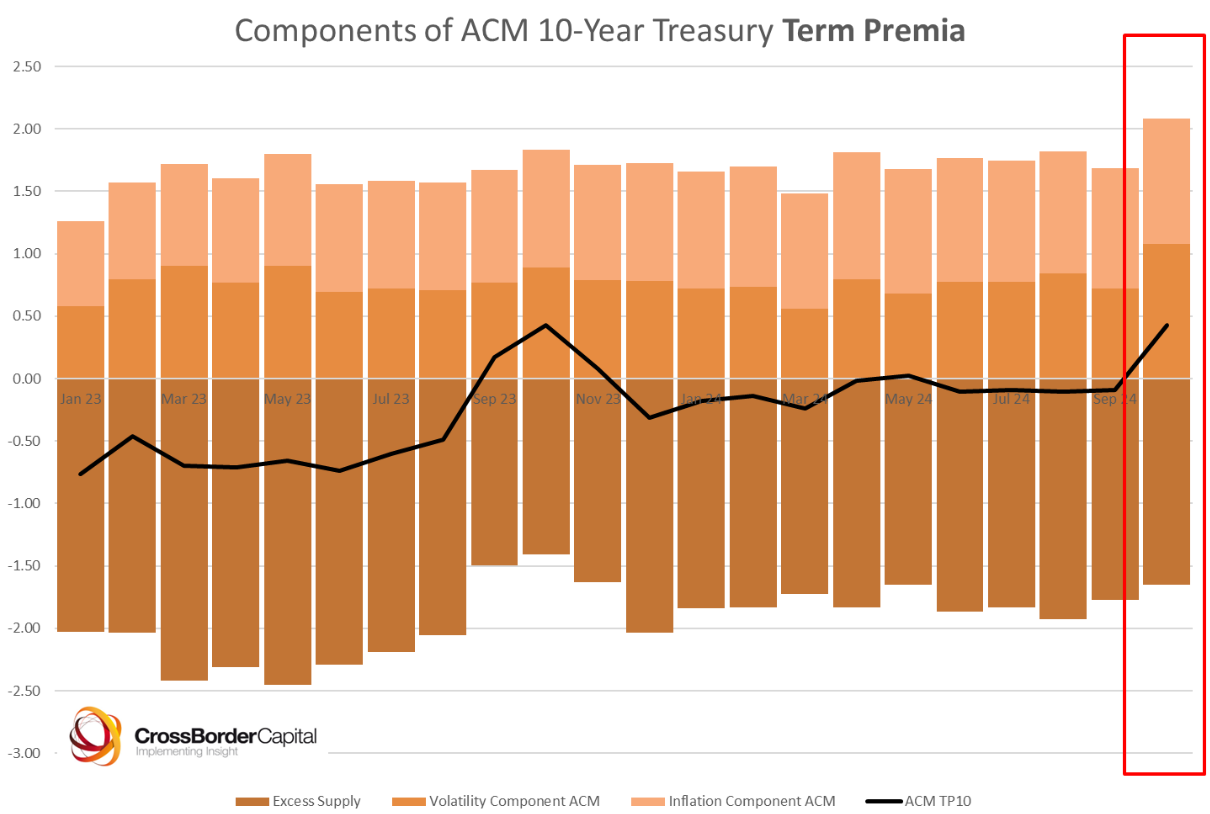

Mike Howell, an expert on liquidity who runs CrossBorder Capital in London, suggests that we need to be careful with the Adrian Moench Crump concept: “It conflates several subcomponents, namely, volatility risk, inflation risk and excess supply/demand effects. All three are important, but they may mean different things.” By his calculations, illustrated below, 36 basis points of the rise in the last month can be attributed to bond volatility (or in other words, a possible Trump effect), with a shift in inflation risk adding 5 basis points and change in supply and demand adding 12 basis points:

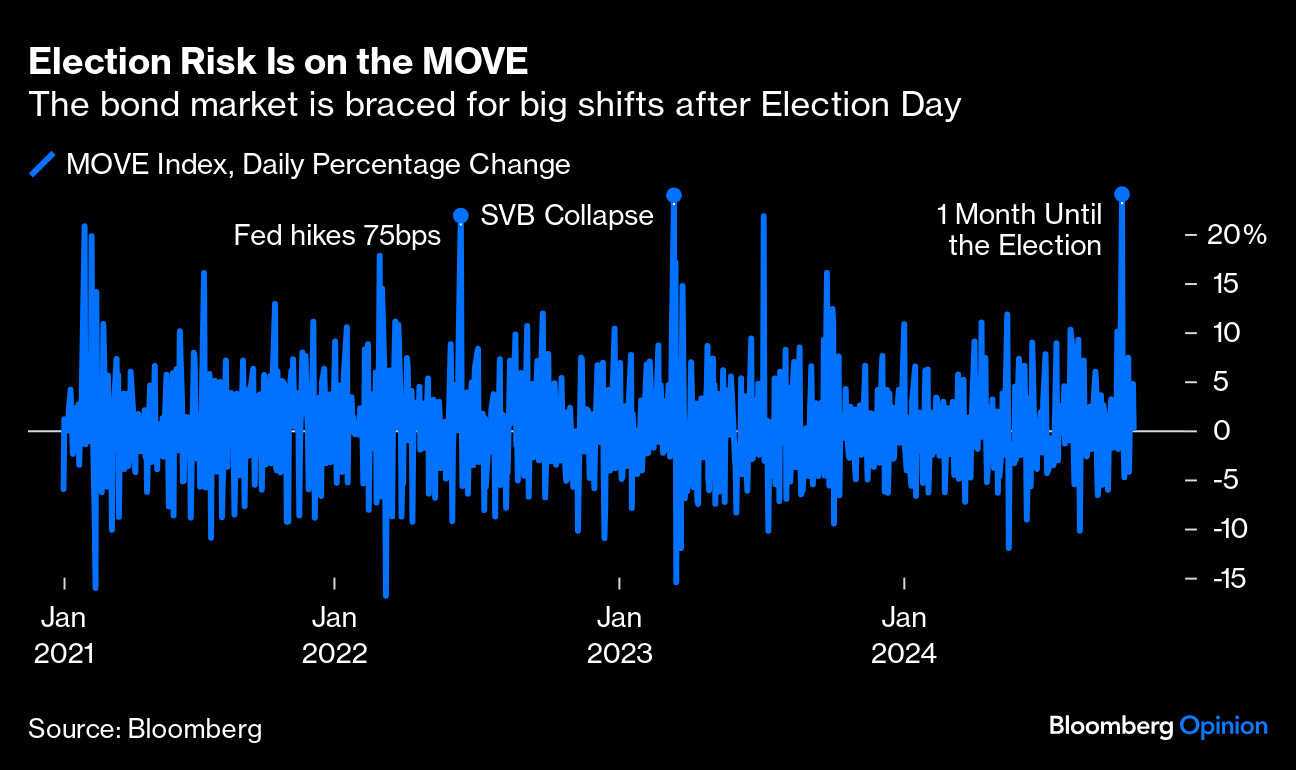

If the term premium owes much to volatility, that in turn suggests that maybe we can blame Trump after all. Bond volatility does appear to be driven very directly by the approaching election, as can be seen from the most widely followed measure of concept, the MOVE index (which originally stood for the Merrill Lynch Option Volatility Estimate). Harley Bassman, who invented the MOVE while at Merrill Lynch, has a fascinating illustration that you can read here. (It goes into the math, which I will avoid.) He explains the significance of the spike in the MOVE on Oct. 7 that leaps out from this chart:

It was the biggest single-day percentage jump in the index since Joe Biden took office, beating the day when the Fed floatedthat it intended to do a 75-basis-point hike in June 2022, and the collapse of Silicon Valley Bank in March 2023. Nothing remotely so momentous happened on Oct. 7. Instead, Bassman explains that the jump came from the interaction of the index’s structure with the election date. The MOVE is based on one-month options each day, and on that date for the first time the new one-month option expired after the vote. That revealed that the market sees an extreme risk of shifting yields:

Using the proper calculations, the market is pricing an 18bps rate movement (either direction) on the days immediately after the election. This is the largest Event Day I can recall over my career. While there have been plenty of periods of extremely high Implied (and actual) Volatility such as the Great Financial Crisis or Covid; to paraphrase Don Rumsfeld, those were not “known unknowns” that could be considered in advance.

The election is a classic known unknown, a risk that we can see coming on a fixed day, and bond dealers think it will be hugely consequential. If uncertainty is that high, then naturally the term premium will be higher, dragging yields with it. Note, however, that while the MOVE is now at its highest for the year, there is minimal sign of such anxiety in stocks, as shown by the VIX index:

Equity investors have earnings season to keep them occupied, and last night’s surprisingly strong figures from Tesla Inc. drove a 10% after-hours rise for its shares that should keep the S&P 500 bubbling along nicely. A Trump presidency likely means more corporate tax cuts, and we know from the experience of the 2017 tax cuts that they directly feed into stronger stock markets.

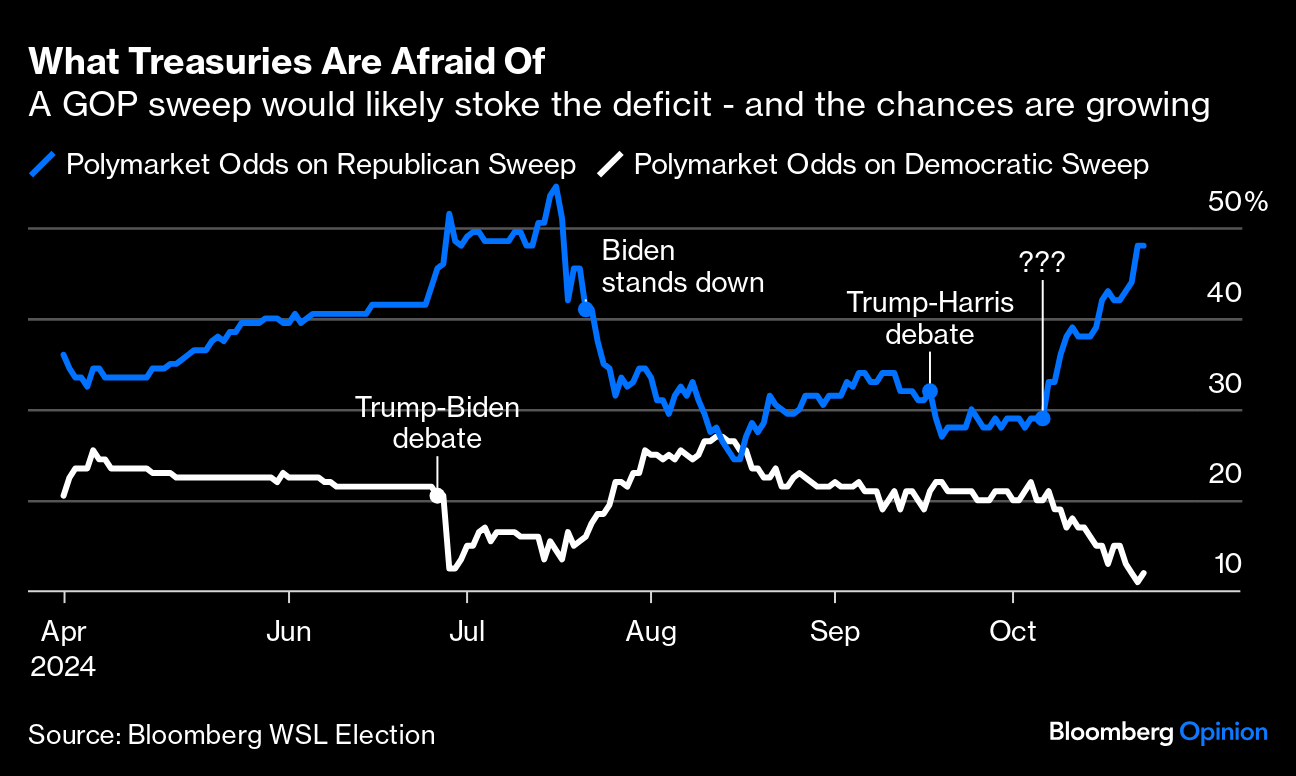

To explain why Treasury traders seem so anxious, look to the possibility of a Republican clean sweep of presidency, Senate and House of Representatives. With the improvement in Trump’s chances, and the dwindling odds on Democrats being able to keep control of the Senate, the chances of a sweep are now put at almost 50%. That would allow much greater freedom of movement to make sweeping tax cuts, and thus arguably push up the deficit and bond yields. The traditional rule of thumb is that bond markets prefer political gridlock. This is how Polymarket, in vogue at present, has recorded a sharp improvement in the chance of a Republican sweep, for no obvious reason, over the last two weeks:

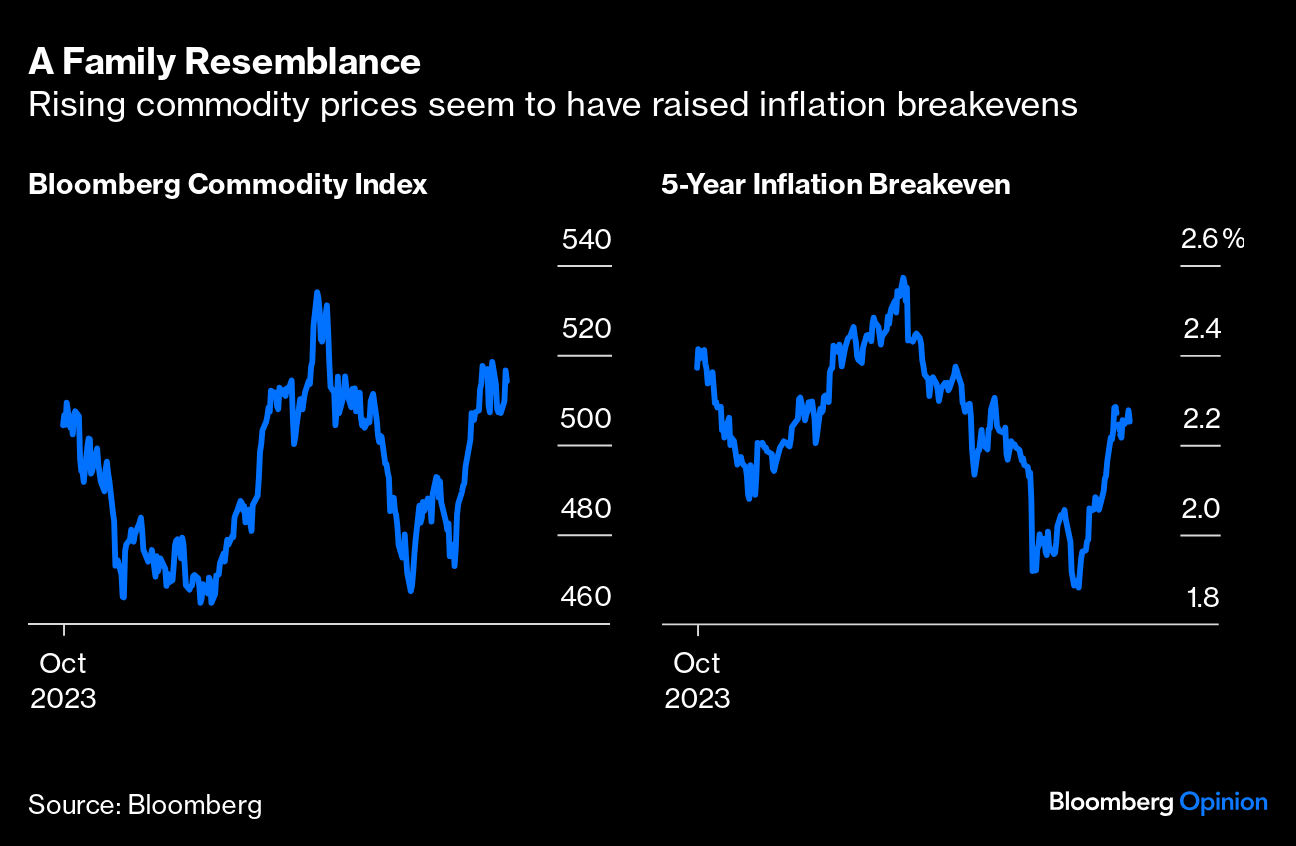

There are other potential culprits, starting with China. Commodity prices have enjoyed a bounce as investors try to get a handle on just what the Chinese stimulus will entail. That in turn has pushed up inflation breakevens in the bond market:

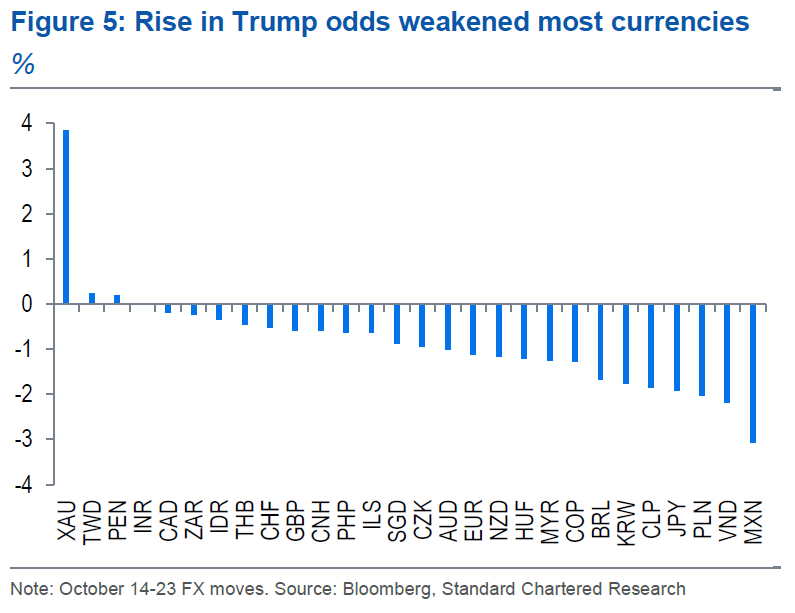

It’s hard to blame the rise in yields on the notorious bond vigilantes concerned about the rising deficit, as that would naturally be accompanied by a run on the dollar as yields rose. That is what happened during the UK gilts crisis two years ago, with higher yields doing nothing to protect the currency from dropping to an all-time low against the dollar. This isn’t like that. The big rise in Trump’s prediction market odds started, coincidentally, immediately after this month’s payroll data. Steven Englander of Standard Chartered Plc mapped below what has happened to a range of currencies against the dollar since then. With the conspicuous exception of gold, they have all weakened. The worst affected have been those that were expected to benefit most from companies moving production away from China, such as Vietnam and Mexico, as Trump now seems determined to deter this:

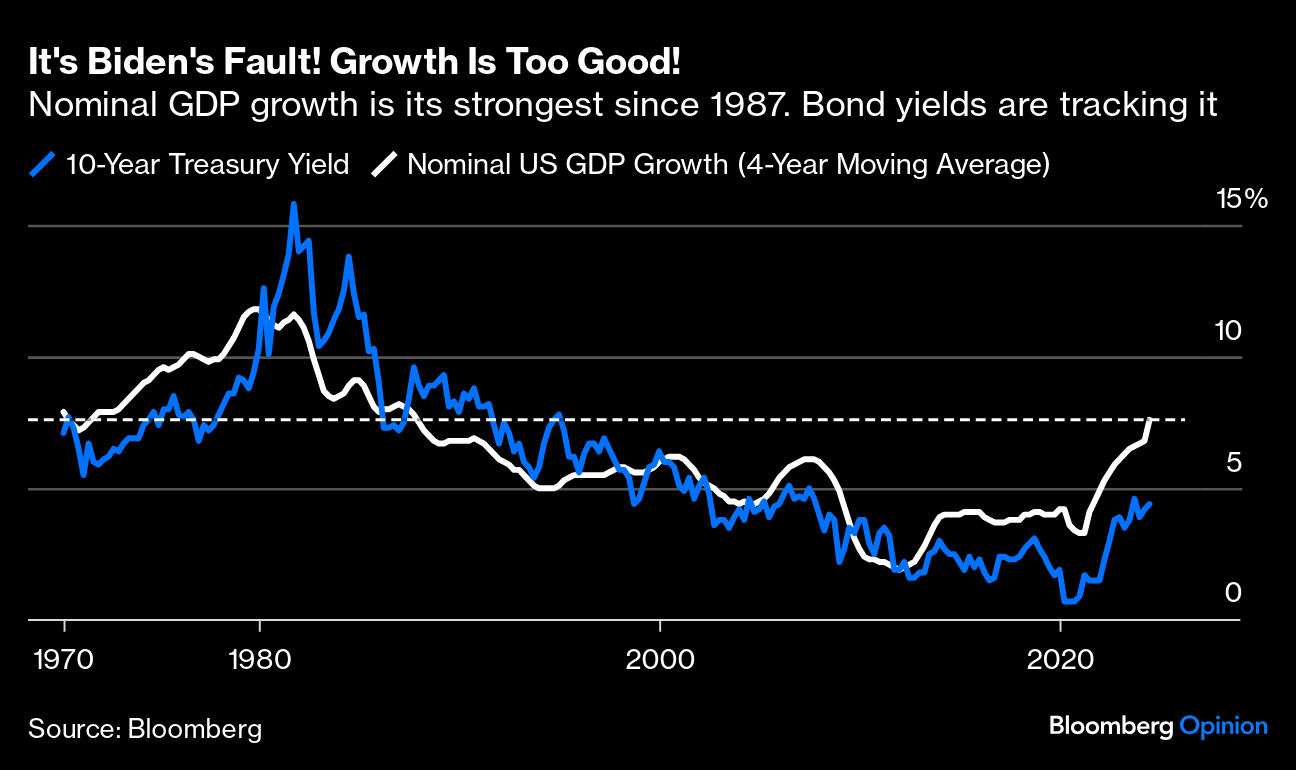

But there’s one final potential candidate. Howell of CrossBorder Capital suggests there might be a Biden effect. Over time, the bond yield is supposed to track nominal GDP growth, which is its highest since the 1980s (not that anyone would guess that from the election campaign):

The operative word is “nominal” of course. Inflation has ensured that the very robust growth since 2021 hasn’t translated into any equivalently strong rise in living standards. But it’s worth remembering that there’s real economic strength at present. That’s good news even if one of the side effects is rising interest rates.