Uddrag fra

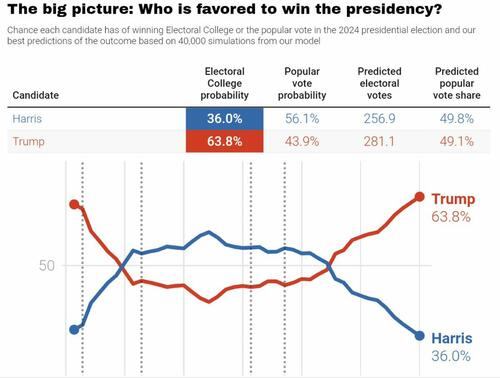

With Kamala’s lead in the polls shrinking or even flipping back to a deficit according to the NYT, and Trump again running away from Kamala Harris in far more accurate betting markets (which unlike rigged polls aren’t 10% oversampled in favor of Democrats), and certainly in Nate Silver’s models, where Trump just hit a new high probability (63.8%) of winning the electoral college…

… the debate this coming Tuesday could be Trump’s chance to seal the deal, as he did two months ago when he steamrolled the vegetable pretending to still be in charge of the country. But even if there is no clear winner, the debate will be an inflection point in either direction for the US election, and for those looking to make a buck from Tuesday’s main event, here are some trade recommendations from Goldman’s head of thematic investing, Louis Miller (full note available to pro subs).

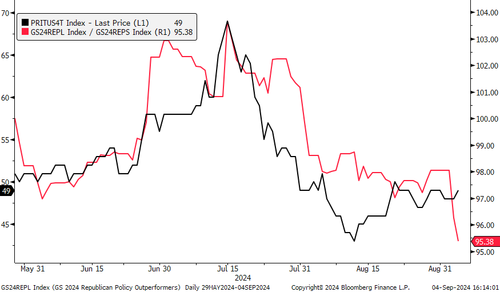

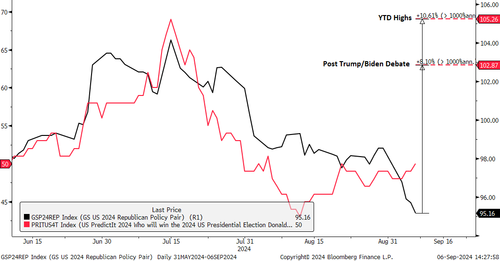

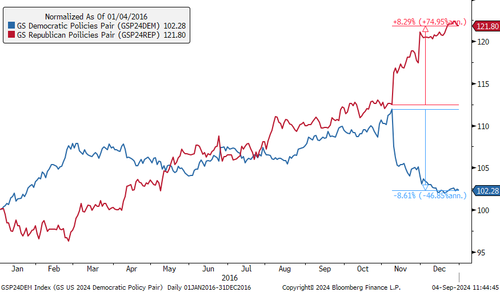

As Miller notes, the market neutral republican policy pair (GSP24REP) has underperformed 8% locally (w/ or without commodities) underperforming its beta to polling, predictit markets, macro drivers and the like. Goldman’s attribution analysis of this underperformance would suggest the market is positioning away from Republican policy and towards Democratic policy, rather than it being a function of a cyclical bias or some factor skew (although it does have a cyclical bias).

That said, Goldman thinks that there is positive symmetry going long the Republican policy pair tactically into the debate, and like buying short dated call options on the Republican policy outperform basket.

Goldman highlights the following pre-debate trades below:

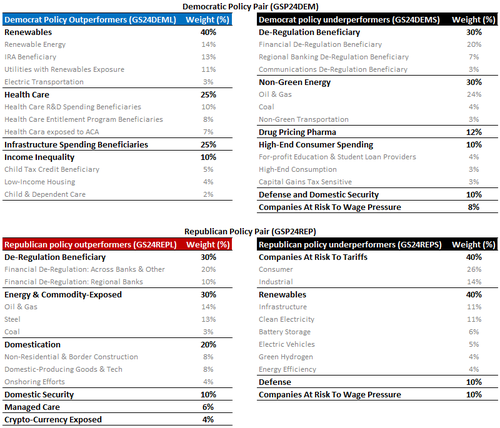

1. Republican Policy Pair (GSP24REP) is composed of long outperformers (GS24REPL, ex-commodity exposed basket is GS24RLXC) and short underperformers (GS24REPS).

- 1 month GS24REPL 103% calls cost 1.65%

- 1 month GS24RLXC 103% calls cost 1.89%

2. Democratic Policy Pair (GSP24DEM) is composed of long outperformers (GS24DEML) and short underperformers (GS24DEMS).

- 1 month GS24DEML 104% calls cost 1.85%

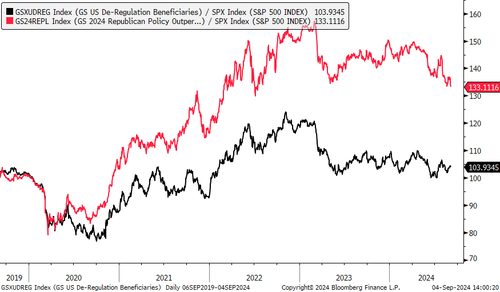

3. De-Regulation Beneficiaries Basket (GSXUDREG)

- 1 month GSXUDREG 103% calls cost 1.03%

4. Companies At Risk To Tariffs (GS24TRFS)

- 1 month GS24TRFS 95% puts cost 1.97%

Some more observations.

Goldman’s election baskets continue to track Trump’s PredictIt odds of winning the election:

Republican Policy Pair (GSP24REP) is composed of long outperformers (GS24REPL, ex-commodity exposed basket is GS24RLXC) and short underperformers (GS24REPS).

- 1 month GS24REPL 103% calls cost 1.65%

- 1 month GS24RLXC 103% calls cost 1.89%

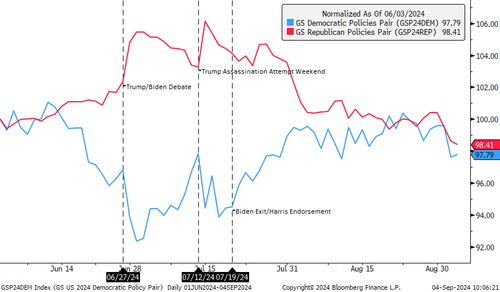

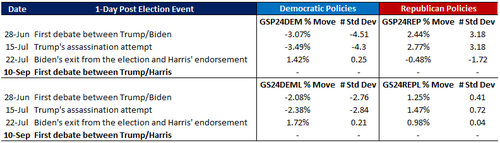

The market has reacted to every election event year-to-date, with multiple standard deviation moves during the trading days post each event. Post NFP, positioning long in Republican outperform/underperform (GSP24REP) after 8% underperformance is an interesting bet.

Market moves post-election events

Since Biden’s exit and Harris’ announcement (19-Jul-24), Goldman has noticed positioning shift from republican policy outperformers to democratic policy outperformers. The attribution analysis according to Bloomberg shows ~5pp of the 7.65pp returns is driven by the selection of the stocks. Naturally, if Trump outperforms Harris during the debate, investor sentiment could shift back towards republican policy outperformers.

Reflecting on performance of the pairs in 2016, Goldman has noticed that the major moves in the pairs surrounded events, most notably the election itself. Expect that the pairs will move similarly in 2024, with opportunities to capture alpha following catalysts that impact odds like debates and then into the election itself.

Republican policies ex-commodity exposed stocks: GS24RLXC is composed of GS24REPL and excludes the commodity-exposed stocks.

Breakdown of the election baskets (all members on MEMB <GO>):

Additional election related trades

Tariffs: According to latest comments from our political analyst, Alec Phillips, if former President Trump wins, we expect he would raise tariffs on imports from China at an average rate of 20pp and on autos from Mexico and the EU. While market participants should take his proposal of a 10% universal tariff seriously, we do not quite view it as the base case.

Corporate Tax: Fiscal policy is likely to be tighter under divided government than under single-party control. If Democrats sweep, personal and corporate taxes and benefit spending will likely rise – 4pp higher corporate taxes and nearly 4pp lower S&P 500 earnings.

De-Regulation: We would expect a second Trump administration to result in an easier regulatory climate for several sectors. We would expect that energy and financial services would, in particular, see lighter regulation in a second Trump term. For energy, this would mean lifting hurdles to oil and gas development, as well as expanding LNG exports and reversing restrictions on greenhouse gas emissions. Financial regulation could also shift, more quickly in the case of consumer finance but potentially more gradually in the case of capital and liquidity requirements.

More in the full note available to pro subs.