of OilPrice.com

The strongest solar power generation in Germany since September sent intraday power prices in Germany, Belgium, and the Netherlands to below zero for the early Monday afternoon, in yet another spate of negative prices that undermine investment in renewable energy capacity.

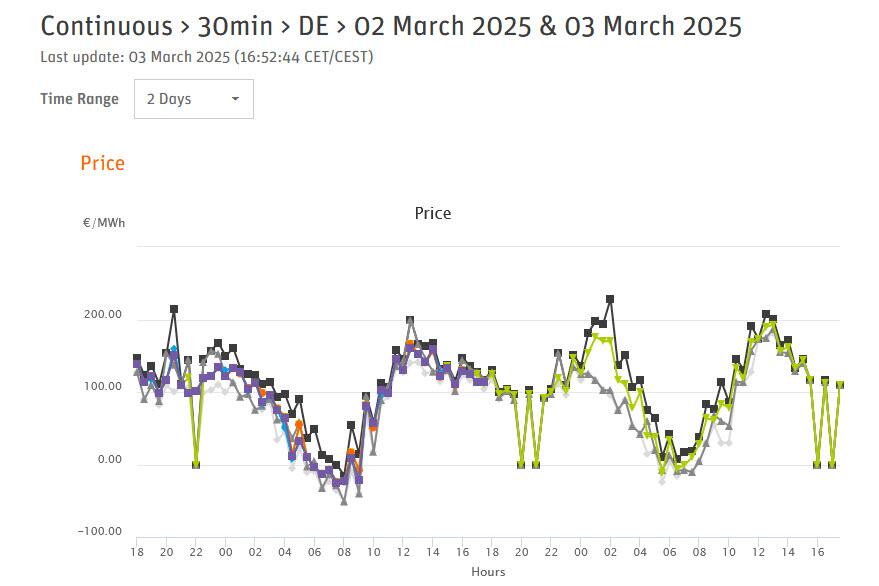

With the strong German solar power output, the intraday prices for the hour from 1 p.m. to 2 p.m. plunged to minus -$18.55 (-17.73 euros) per megawatt-hour (MWh), per data from Epex Spot SE cited by Bloomberg.

The interconnected power systems in northwest Europe also led to negative intraday electricity prices in Belgium and the Netherlands on Monday.

Negative power prices, while beneficial for some consumers in some countries, generally discourage investments in new capacity as renewable power generators don’t profit from below-zero prices.

Last year, European wholesale electricity markets saw zero or negative power prices for the most hours on record, amid soaring renewable energy generation and a mismatch between supply and demand hours for solar power. This year, another record for most hours with negative prices is expected.

“Volatile wholesale electricity prices create uncertainty for renewables companies over the impact on revenues and future investment, underlining the need for storage and grid expansion,” the International Energy Agency (IEA) said in its World Energy Investment 2024 report last year.

More recently, Aurora Energy Research in January warned that negative prices, market saturation, and grid congestion present major challenges to renewable energy development in Europe.

Intermittent renewable energy capacity in Europe will more than triple by 2050, the power market analytics firm said, but noted that this growth would still fall short of meeting climate goals, also due to negative power prices.

“Negative prices and grid constraints are significant risks for renewable assets in the market today, which will be further exacerbated with more renewables deployment,” commented Rebecca McManus, Renewables Lead, Pan-European Research at Aurora Energy Research.

“It’s vital for developers to explore opportunities to de-risk projects such as portfolio diversification to mitigate impacts.”