Ifo-indekset for januar viser igen tilbagegang i det tyske erhvervslivs forventninger og i vurderingen af den aktuelle situation. Indekset faldt til 90,1 mod 92,1 point i december. Faldet var det kraftigste siden april. Det signalerer en skarp reaktion på den lockdown, der blev indført før jul, og som for nylig blev forlænget til midten af februar. Der er dog formodninger om, at Tyskland undgik en double-dip i 4. kvartal. Den ekstremt langsomme udrulning af vacciner har også skærpet den negative stemning.

Germany: Fear is back

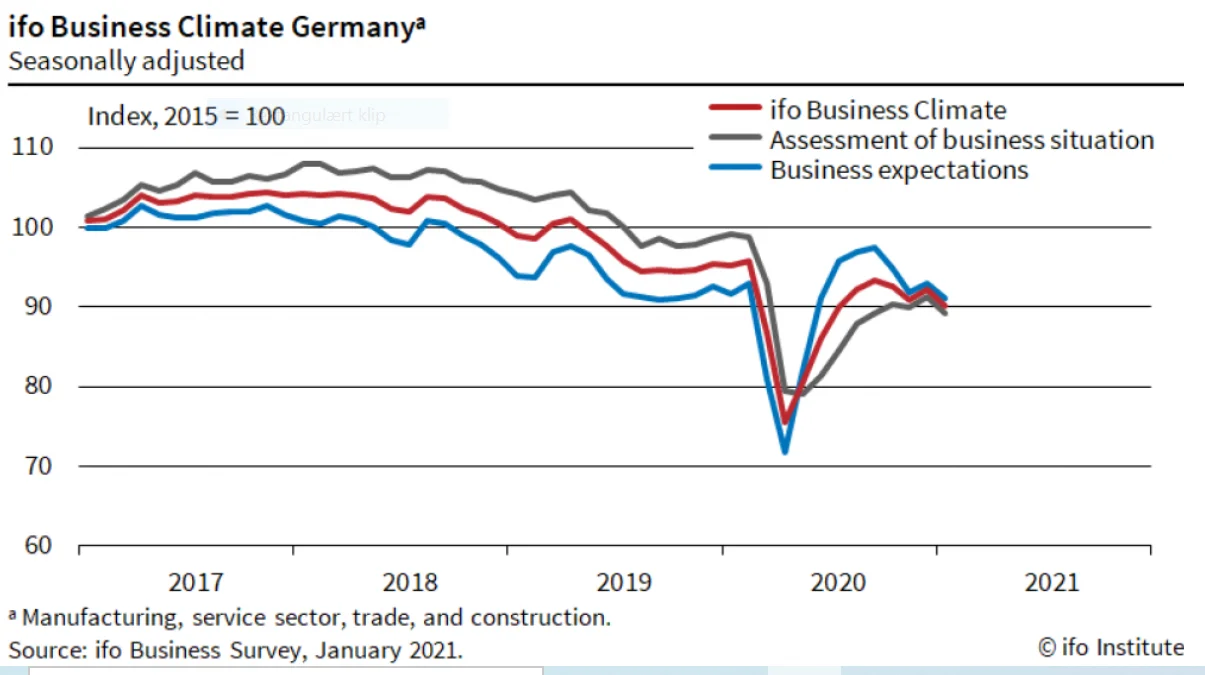

The January Ifo index shows a worsening of both the current assessment and the expectations component and signals a very weak start to the new year for the German economy

Germany’s most prominent leading indicator took a hit in January. The Ifo index dropped to 90.1, from 92.1 in December, and stands at its lowest level since June. The monthly drop was the worst since April. Both the current assessment and the expectations component worsened significantly, with expectations now back at their June levels after several disappointing months.

Today’s Ifo index shows the full impact of the stricter lockdown measures put in place in mid-December, signalling a very weak start to the new year for the German economy.

Worsened outlook

We will only know for sure on Friday, but there is compelling evidence that the German economy avoided a double dip in the fourth quarter. A strong manufacturing sector, strong construction activity and exports should have helped to avoid an economic contraction. The fact that the lockdown measures until mid-December were relatively light should have brought some relief as well.

Looking ahead, however, the stricter lockdown since mid-December will clearly leave its mark on the German economy in the first quarter. The closing of schools and its indirect impact on worked hours and productivity should weigh on economic activity.

Also, the reversal of UK stockpiling in 4Q as well as ongoing lockdowns in many other neighbouring countries does not bode well for exports going forward. However, the biggest difference with the economic impact from the lockdown measures in the second quarter of last year is that industrial activity continues. Last spring, many factories closed voluntarily as supply chains were disrupted. With this in mind, another lockdown in China would be a very unwelcome black swan for the German economy.

With the current lockdown measures in place until mid-February and no significant easing in the offing immediately afterwards, the short-term outlook for the German economy is anything but rosy. As so often heard over the last year, it will take more momentum in the vaccination schemes and a further reduction in the number of infections before the economy can take off again. It currently looks as if it will take at least until spring time before this will be the case.