Pimco vurderer, at 2022 bliver præget af stor volatilitet og megen usikkerhed. I den sidste fase af det aktuelle opsving kan der ventes hurtige forandringer. Men Pimco hæfter sig også ved, at væksten er blevet høj med 5 pct. i 2021 i industrilandene – det højeste niveau i tre årtier. Produktionen af industrivarer er kommet over niveauet fra før pandemien, mens servicesektoren ligger bagefter. Men inflationen er blevet meget højere, og det skaber usikkerhed. Derfor “kan noget ske”, som Pimco udtyrykker det. For aktiemarkedet vurderer Pimco, at store selskaber samt højkvalitetsselskaber vil outperforme i denne fase. Det samme vil chip-sektoren på grund af digitaliseringen. Men den høje inflation vil reducere aktieafkastet generelt.

Investing in a Fast‑Moving Cycle

Economic Outlook

Uncertainty has become an ongoing theme in markets, economies, and communities everywhere, and in this environment, PIMCO investment professionals gathered – virtually, once again – for our recent Cyclical Forum.

More volatility, more uncertainty

Over the secular horizon, we expect a more uncertain and volatile macro environment with economic cycles becoming shorter in duration, larger in amplitude, and more divergent across countries (for details, see PIMCO’s Secular Outlook, “Age of Transformation”). These secular themes appear to be playing out over the cyclical horizon as well: Much of the global economy has transitioned quickly from an early cycle recovery to a mid-cycle expansion, necessitating a faster policy shift from the extraordinarily easy conditions that prevailed in 2020 and 2021, in our view.

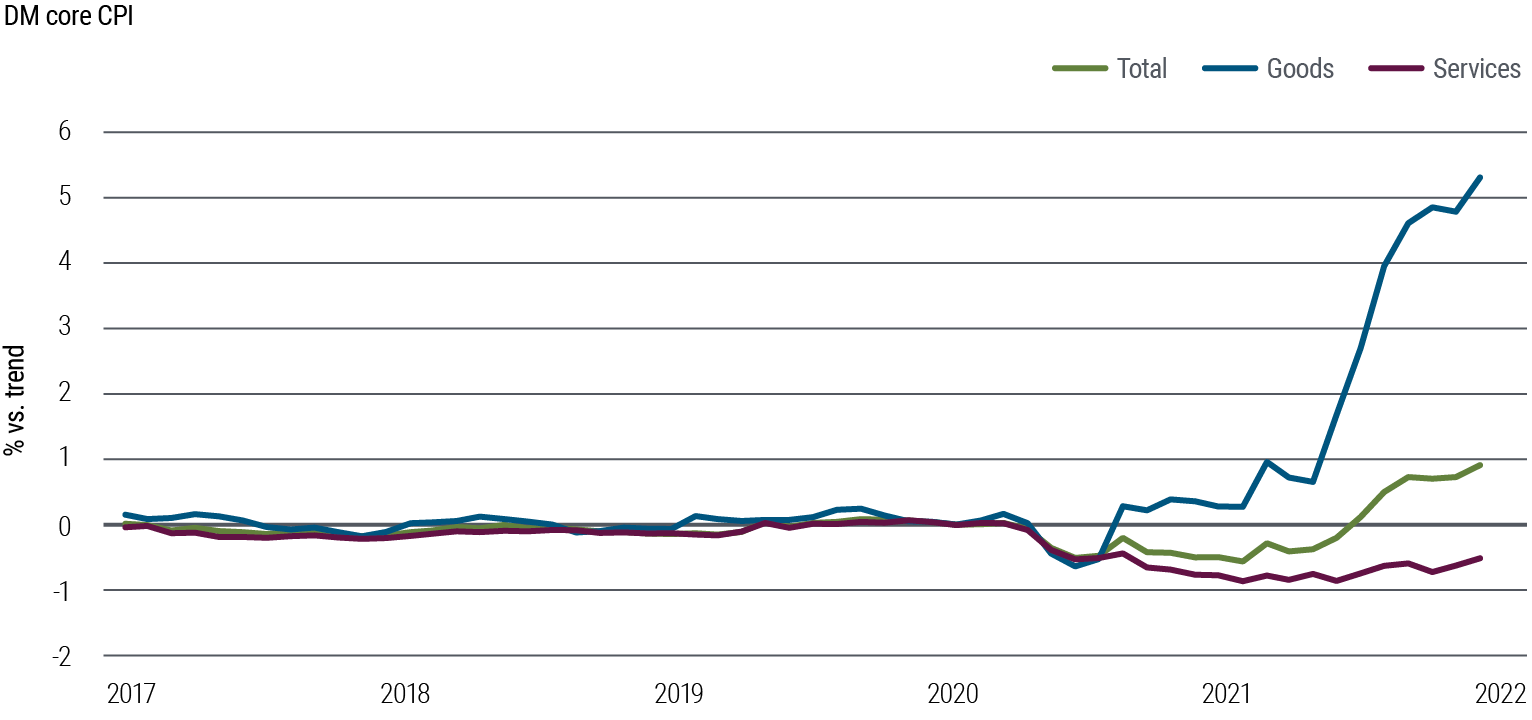

Further complicating matters, the speed of the recovery coupled with the volatile path of the virus have also contributed to more significant frictions in both goods and labor markets that have elevated inflation.

The road to recovery is paved with stones

Since we last shared our Cyclical Outlook in June (“Inflation Inflection”), the robust global recovery has continued, although unevenly across regions and sectors. Overall, government policies to support demand amid one of the largest economic contractions in modern history produced one of the fastest recoveries. Developed market output fully recovered to its pre-pandemic peak in the third quarter of 2021, and at a 5% (annual average) projected 2021 growth rate, was on track to expand at the fastest pace in over three decades. (Growth and output data are according to Haver Analytics.)

Nevertheless, with the largest economic effects of the pandemic likely in the rearview mirror, peak policy support, and therefore peak real GDP growth, was also likely realized in 2021. In the U.S., Canada, and the U.K., employment and wage subsidy programs implemented during the pandemic to support household incomes and consumer spending expired in the third quarter after becoming less generous throughout the year, while similar programs across European countries expired at year-end.

In China, the tighter credit conditions that have persisted until very recently and the regulatory policies implemented as a result of the government’s common prosperity initiative have slowed growth.

Figure 1: Goods consumption in developed markets still above pre-pandemic levels as services consumption lags

Figure 2: Core goods inflation is significantly higher than pre-pandemic across developed markets

Third, many central banks reacted to these developments either by bringing forward plans to tighten monetary policy, in the case of most developed market (DM) central banks as mentioned above, or hiking more aggressively in the case of various EM countries, including Brazil.

2022 outlook: The ‘Goldilocks’ scenario

Due to the combination of these factors, we are lowering our 2022 real GDP forecasts across regions. We now expect DM GDP growth to decelerate from a 5.0% annual average pace in 2021 to 4.0% in 2022 (versus 4.3% previously).

We are also raising our inflation forecasts across regions. We still expect DM inflation to eventually moderate back toward the respective central bank targets by the end of 2022, but only after peaking at 5.1% in 4Q 2021.

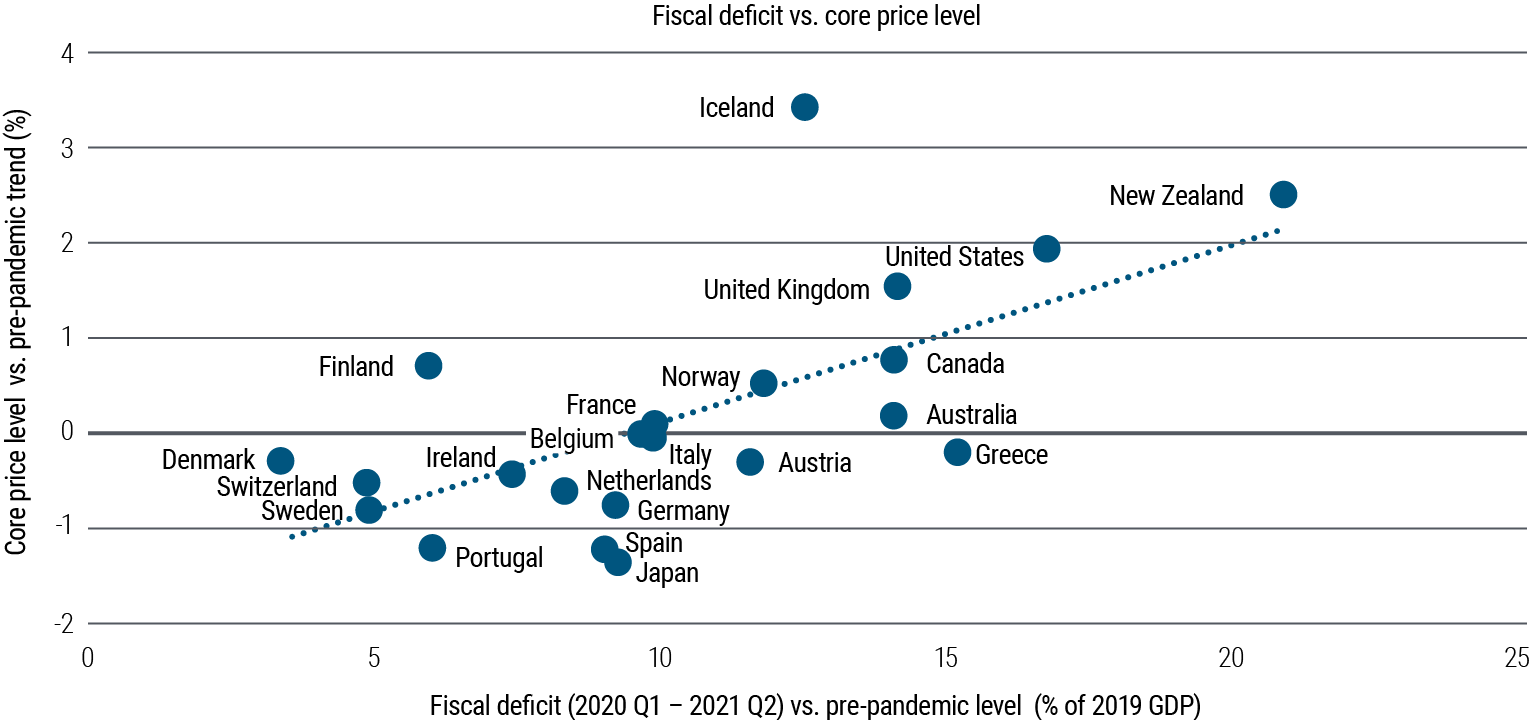

Figure 3: Fiscal spending contributed to inflation across several major economies

Investment implications of a fast-moving cycle

You can see from our economic outlook that multiple issues have the potential to influence the investment outlook, in particular the speed, depth, and evolution of the nascent efforts by central banks to reduce their extraordinary monetary accommodation.

We plan to focus on the volatility that can result from the rapid pace at which the economic cycle is moving toward late-cycle dynamics, a time when, like today, inflation tends to quicken and may prompt a tightening in monetary policy, unnerving many investors.

Markets nonetheless appear priced for a blue sky scenario where central banks achieve the elusive soft landing without any meaningful amount of rate hikes. Yet, history reminds us that sometimes “stuff happens” when monetary policy pivots.

Equities

As our asset allocation team discusses in their recent outlook, “Opportunity Amid Transformation,” PIMCO has a constructive view on global equities given the slowing yet positive earnings backdrop. That said, we are preparing for late-cycle dynamics, placing greater attention on security selection.

We expect large cap and high quality companies stand to outperform late in the business cycle, consistent with historical patterns. Companies with pricing power also stand to gain, in our view.

The semiconductor sector has potential to outperform over the long term, benefiting from strong demand related to transformational themes discussed in our Secular Outlook, including digitalization as well as many parts of the net zero carbon effort.

Inflation trends are expected to adversely affect the earnings multiples for share prices, with a decline of a few percentage points likely in the base case.