Pimco mener, at asiatiske obligationer er ved at blive lige så efterspurgte som amerikanske T-bonds. F.eks. strømmer kapital fra USA og Europa ind i kinesiske obligationer trods handelskrigen, og det skyldes, at investorerne dér kan finde et højesre afkast på obligatioiner end i USA og Europa. Det kinesiske obligationsmarked er nu verdens næststørste, og statsobligationer giver 3 pct., mens high-yield erhvervsobligationer giver mellem 4 og 5 pct. Men også obligationer fra en stribe andre lande i de nye økonomier giver nye muligheder i nul-rentetiderne.

Emerging Market Bonds: Part of a Resilient Portfolio?

A basket of emerging market bonds may offer the same appeal investors have long sought from U.S. Treasuries.

Trickle, flow, gush

China’s bond market – now the second largest in the world – has seen increased foreign participation, especially in its government bond market, where foreign ownership now exceeds 9%, up from a negligible level just a few years ago.2

The trickle that began in 2014 with a highly controlled quota system turned into a steady inflow after the Chinese government loosened access and China earned inclusion into flagship bond indices. Whether or not this accelerates into an outright gush will depend on the evolving needs of individual investors.

One clear motive behind the influx of capital into China’s bond market is the search for yield. Chinese government bonds yield close to 3%; higher-quality Chinese corporates can yield 4% to 5%.3

With U.S. Treasury yields as low as they now are, some American investors, who have been less aggressive than their European and Japanese peers in searching for yield beyond their domestic market, may step up investments in overseas bond markets.

The basket case

China is not the only market that offers the potential to offset equity risk with bonds that still have room to rally.

Government bonds from a number of high quality emerging markets including Poland, the Czech Republic, Israel, Singapore, South Korea, Peru and Chile, among others, offer similar properties to varying degrees and risk levels.

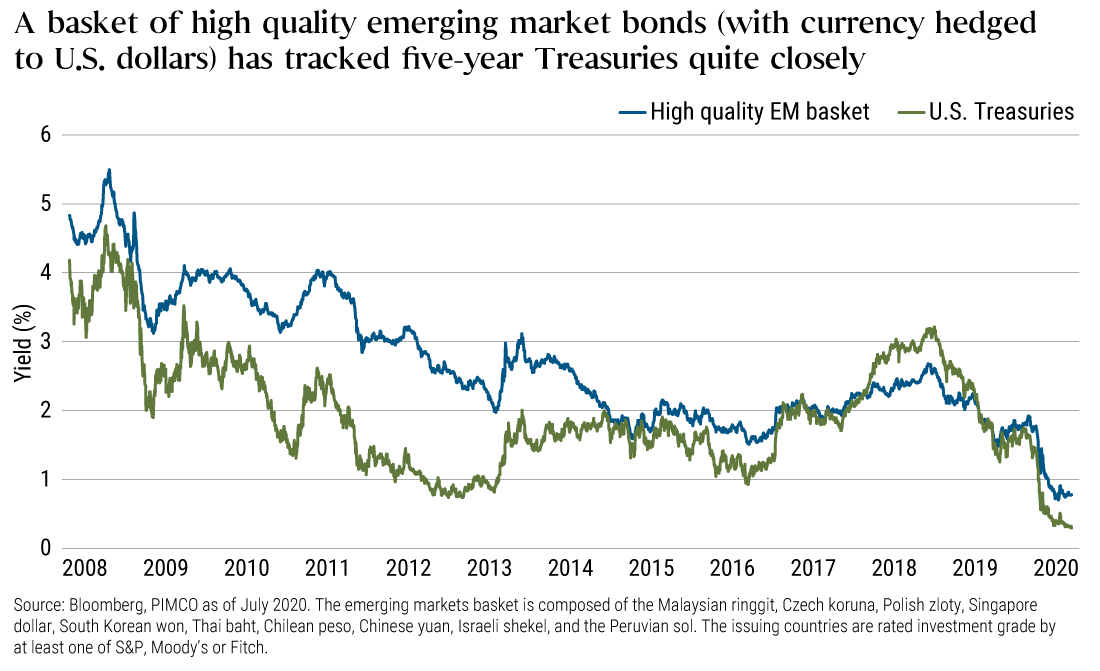

In fact, a basket approach may offer more consistent hedge value than any single country. Historically, a basket of 10 high quality emerging market bonds, including China, have followed moves in U.S. Treasuries quite closely, and have also offered hedge value against global equities with a similar success rate (see chart).

By diversifying across countries, investors also diversify away from country-specific idiosyncrasies, leaving a portfolio that may better track U.S. Treasuries than any individual country.