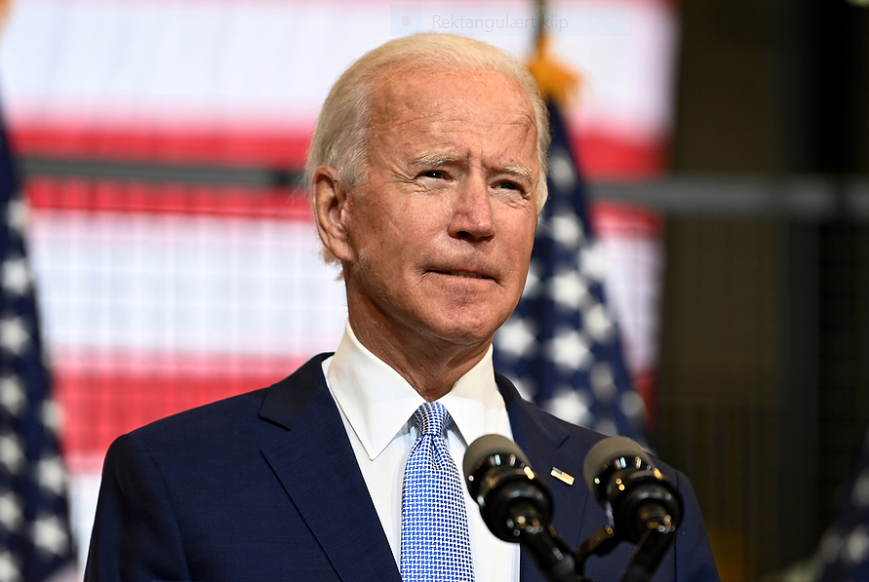

Pimco regner det for sandsynligt, at der bliver skattestigninger for virksomheder og velhavere i de kommende år for at finansiere Joe Bidens finanspakker og infrastrukturprogrammet. Det første udspil kommer i dag. Skatten for velhavere ventes at stige til 39,6 pct., og der kan blive en række ændringer inden for fradrag, ejendomsskatter og skatter på kursgevinster. Selskabsskatten ventes at stige til 28 pct. Den blev reduceret voldsomt under Donald Trump.

Will Taxes Rise in the U.S.?

Democrats could begin working on a tax bill later this year, but resulting tax hikes may be weaker and less of a headwind to growth than some fear.

Although the ink on the $1.85 trillion COVID relief bill, “American Rescue Plan,” is hardly dry, many investors understandably are focused on what is next – and specifically on potential tax increases in the U.S. While work has not started in earnest on a tax bill – or on an infrastructure bill that tax changes would likely fund – we believe taxes will probably increase, with several important caveats.

First, we do not see a tax bill passing until later this year at the earliest and, as a result, we see tax changes being prospective, not retroactive, with changes implemented for 2022 at the earliest. We also expect tax changes to be significantly more surgical than the broad-based changes that then-candidate Joe Biden laid out on the campaign trail. And of course, there is a risk that the razor thin majority in the U.S. Senate, not to mention the narrow Democratic majority in the House, could make passage tougher, if not impossible, especially as we get closer to the 2022 midterms.

What tax changes do we expect?

Individual taxes

- Individual tax rates: Raising taxes on high earners ($400,000 and above), most likely to 39.6%, is low-hanging fruit, and we should expect that to be included in any tax package that gets traction.

- SALT relief: At the same time, we expect some relief as it relates to the state and local tax deduction (SALT). We could see either an increase in the current cap of $10,000 or a full reinstatement of the SALT deduction (although it is expensive), but either way, we are confident that if a tax bill gets traction, there will be some SALT relief – one simply has to look at Democratic leadership, namely Speaker Pelosi from California and Senate Leader Schumer from New York to understand that it will be a high priority.

- Estate tax, step-up and capital gains changes: We could see changes to how inherited wealth and investment income are taxed, but changes to these provisions may be harder to get the unanimity among Democrats required to pass. We could see the estate tax exemption decline from its current $11.7 million, but it is unlikely to decline to the $3.5 million level that the Biden campaign plan proposed. Eliminating the step-up in basis for inherited wealth also has support among Democrats and could be phased-out.

We could also see changes in capital gains rates on investment income for those making more than $1 million, but we do not believe they would rise to the level of ordinary income rates (e.g., to 39.6%); more realistically, we think the rate would land in the upper-20% range and it could be phased in.

- Wealth tax and financial transaction tax (FTT): While these provisions may be in the conversation initially, we do not expect either a wealth tax or FTT to be included in a final tax bill.

Corporate taxes

- Corporate tax rate: While Biden has proposed an increase in the statutory corporate tax rate to 28%, we are skeptical that it has support among centrist Democrats in either the Senate or the House. As a result, we think the corporate rate will ultimately land at 24% or 25%.

- Minimum rate: Even more than the tax rate, Democrats are focused on companies paying some tax. Biden has proposed an alternative minimum tax; companies will pay the greater of their corporate income tax rate or a 15% minimum tax. Janet Yellen recently indicated she is working with the OECD to help with compliance.

- Carried interest loophole: We expect this to be closed.

- Social Security taxes: We do not expect any changes to the payroll tax, despite Biden’s proposal for a 12.4% payroll tax on earnings over $400,000. It is impossible to make changes to Social Security via reconciliation – a procedure that only requires 51 votes to pass, or 50 if the vice president breaks a tie – which is the process that Democrats will need to use to pass any tax increases.

Timing

We expect a tax bill will likely gain traction later this year to fund other policy changes (including green infrastructure, a permanent child tax credit, among others). Importantly, Democratic leaders have very little wiggle room to pass a tax bill – indeed, Speaker Pelosi can lose only five Democrats in order to pass a bill and Leader Schumer has to get every single Democrat on board, even to pass the bill by reconciliation, assuming no Republican votes for it. Some Democratic members could become resistant to any tax changes the closer we get to the midterm elections in 2022.

The bottom line: While tax increases are likely on the horizon, they are also likely to be watered down in the final version, take longer to pass, be less of a headwind to economic growth, and, as a result, give even more runway for equities and risk assets to rally.