Pimco forudser et stærkt globalt opsving i år som følge af en stigning i vaccinationerne. Selv om Pimco venter en inflation, der ligger under centralbankernes målsætning, så forudser Pimco en stærkt svingende inflation i første halvår. Pimco venter især investeringsmuligheder i de sektorer, der har været hårdest ramt af coronaen og nedlukningen, f.eks. byggeriet, industrien, flysektoren og en del af finanssektoren. Pimco venter en udvikling, som de færreste nogen sinde har oplevet: Meget høj vækst, enorme offentlige kapitalinsprøjtninger og en voksende inflation.

These are two of the key takeaways from our latest Cyclical Forum and strategy meetings, in virtual format again but bringing together the whole of PIMCO’s global team of investment professionals. Our economic teams laid out the baseline forecast for a strong recovery across the world and inflation that – in spite of all the reflationary talk – we think is likely to remain below central bank targets over the next one to two years, notwithstanding a temporary spike over the next several months (which could cause a “head fake” in markets). We will lay out that baseline and the risks around it below.

But, those forecasts aside, our forum discussion often returned to the potential for financial markets to maintain focus on inflation risks, at a time when central banks globally have pledged to go very slow and when fiscal policy, this year at least, should boost growth – with a very big boost indeed in the U.S.

We have seen a sharp rise in bond yields, albeit from low levels, and a rise in volatility. The front ends of yield curves have tested, a little at least, the thesis that central bankers will hold their nerve and stick to their long-term patient planning.

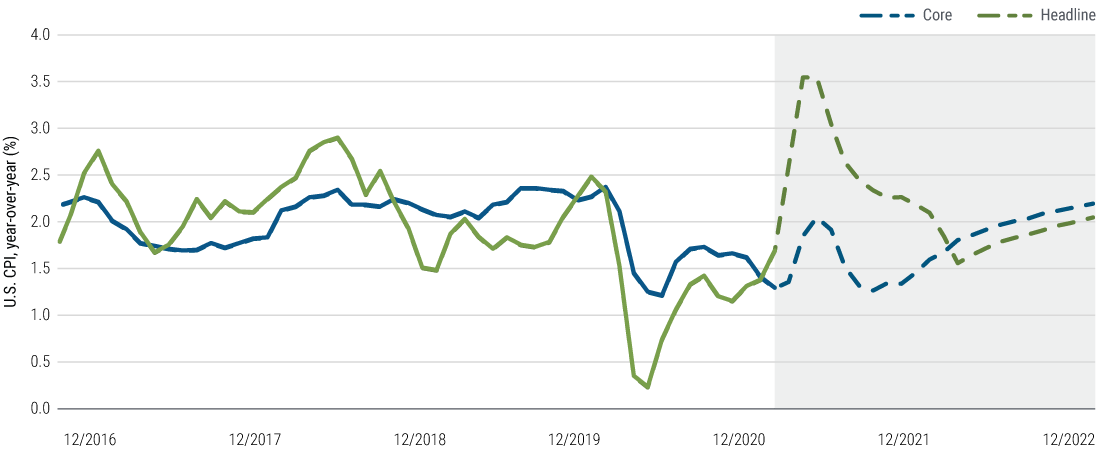

It is quite likely in our forecasts that the coming near-term rise in inflation won’t be sustained (see Figure 1). But it also seems quite likely that financial markets will continue to remain focused on upside inflation risks in the near term and that volatility will continue to be elevated, compared with recent history at least.

Figure 1: PIMCO forecasts a bumpy near-term path for U.S. inflation

Meanwhile, the good news on vaccines and the economic expansion should be mostly priced in. Indeed, we need the expectations of medical efficacy and strong recovery to be vindicated to validate risk asset valuations that we think are fair to somewhat frothy. But it remains the case that this is a very different economic cycle, coming out of a recession driven by lockdowns and voluntary social distancing rather than underlying economic and financial strains, and there is a higher than usual amount of uncertainty in the outlook.

While there is a lot of potential for medium-term economic scarring, there is likely to be a strong cyclical boom this year. And it is a very unusual combination: growth that is likely to be as strong as all but the most seasoned of analysts have witnessed, combined with a new fiscal orthodoxy – to a greater or lesser extent in the U.S. and Europe, respectively – that has shifted to a focus on securing that ongoing recovery above all else, plus a central bank focus on lifting inflation and achieving inclusive maximum employment, again with different degrees of commitment across countries.

An inflation head fake it might turn out to be, but we understand why there might be some elevated uncertainty about the true direction of travel.