Uddrag fra Zerohedge:

Having fallen for four straight months, the year-over-year change in Producer Prices was expected to continue to slow in November to +7.2% (from +8.0% in October) with a 0.2% increase MoM. However,m the headline printed hotter than expected (+0.3% MoM) – the highest since June. This left the YoY PPI at +7.4%, the lowest since May 2021…

Source: Bloomberg

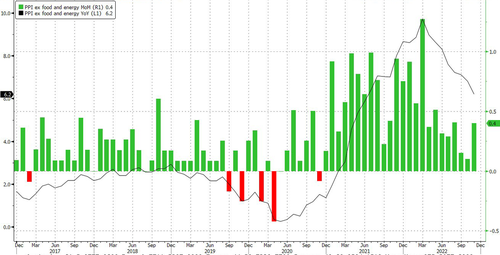

Core PPI (Ex Food and Energy) soared 0.4% MoM (double the 0.2% expectations)…

Source: Bloomberg

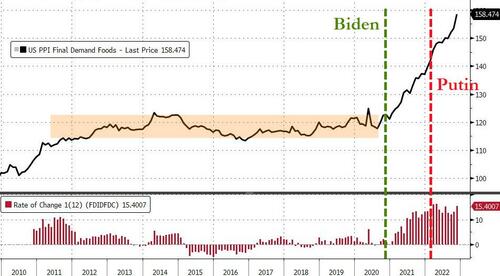

While Energy prices dropped to its lowest since Feb 2022, Food prices soared to record highs…

Source: Bloomberg

About one-third of the November rise in the index for final demand services can be traced to prices for securities brokerage, dealing, investment advice, and related services, which jumped 11.3 percent. The indexes for machinery and vehicle wholesaling, loan services (partial), fuels and lubricants retailing, portfolio management, and long-distance motor carrying also moved higher. Conversely, prices for transportation of passengers (partial) fell 5.6 percent. The indexes for automobile and automobile parts retailing and for traveler accommodation services also decreased.

The November advance in prices for final demand goods was led by a 38.1-percent jump in the index for fresh and dry vegetables. Prices for chicken eggs; meats; canned, cooked, smoked, or prepared poultry; and tobacco products also moved higher. Conversely, the gasoline index fell 6.0 percent. Prices for diesel fuel, residential natural gas, and primary basic organic chemicals also declined. The index for fresh vegetables (except potatoes) jumped 43.1 percent. Prices for raw milk and for nonferrous metal ores also advanced.

The pipeline for PPI remains significantly softer…

Source: Bloomberg

And based on a 16-month-lagged M2 rate-of-change, PPI (and CPI) are about to lurch considerably lower…

Source: Bloomberg

Bear in mind that while PPI is slowing, it is still extremely high and we shouldn’t expect The Fed to pause any time soon at these levels.

TL/DR: PPI hotter than expected because brokers somehow raised prices amid huge outflows and tomatoes soared over 40%