Uddrag fra Zerohedge:

If you thought today’s PPI was dovish and are buying stocks because of that, well… there’s this…

* * *

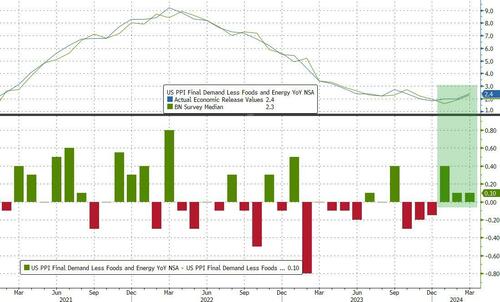

After yesterday’s CPI-surge, PPI followed along, with headline producer prices rising 0.2% MoM (+0.3% MoM exp), pushing the YoY PPI to +2.1% (+2.2% exp) from +1.6% – the highest since April 2023…

Source: Bloomberg

Core CPI rose 2.4% YoY (hotter than the expected 2.3%) – the third hotter-than-expected core PPI print in a row…

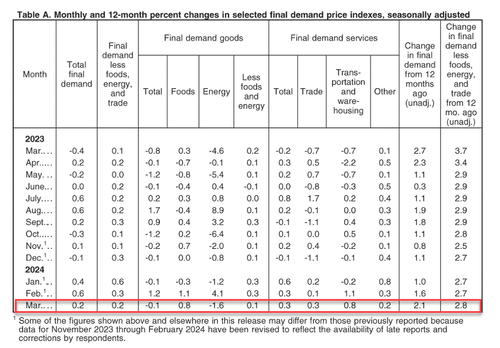

Under the hood, Services prices rose while goods prices declined MoM.

Final demand services: The index for final demand services moved up 0.3 percent in March, the third consecutive rise. Leading the broad-based March increase, prices for final demand services less trade, transportation, and warehousing advanced 0.2 percent. The indexes for final demand trade services and for final demand transportation and warehousing services moved up 0.3 percent and 0.8 percent, respectively. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: A major factor in the March increase in prices for final demand services was the index for securities brokerage, dealing, investment advice, and related services, which rose 3.1 percent. The indexes for professional and commercial equipment wholesaling; airline passenger services; investment banking; deposit services (partial); and computer hardware, software, and supplies retailing also moved higher. Conversely, prices for traveler accommodation services decreased 3.8 percent. The indexes for automobiles retailing (partial) and for machinery and equipment parts and supplies wholesaling also fell.

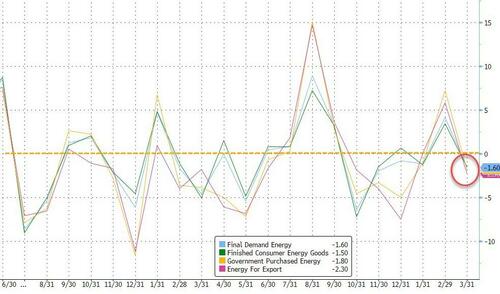

Final demand goods: Prices for final demand goods decreased 0.1 percent in March after rising 1.2 percent in February. The decline is attributable to the index for final demand energy, which moved down 1.6 percent. In contrast, prices for final demand foods and for final demand goods less foods and energy advanced 0.8 percent and 0.1 percent, respectively.

Product detail: Leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent. The indexes for chicken eggs, carbon steel scrap, jet fuel, and fresh fruits and melons also fell. Conversely, prices for processed poultry jumped 10.7 percent. The indexes for fresh and dry vegetables, residential electric power, and motor vehicles also moved higher.

One thing that stands out as rather odd is the 1.6% MoM decline in Energy costs in the month… as prices soared for crude and gasoline?

Leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6 percent…

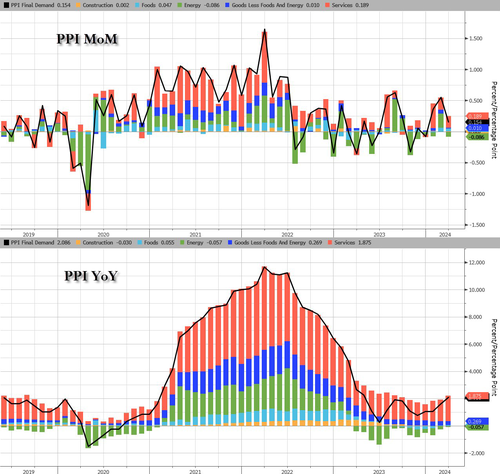

And blame the markets for why the print was hot:

A major factor in the March increase in prices for final demand services was the index for securities brokerage, dealing, investment advice, and related services, which rose 3.1 percent.

And on a YoY basis, Services costs are accelerating…

Finally, before we leave the details, there is this dilemma too… all apparently setting us up for PCE miss and putting June back on the table…