Uddrag fra stribe finanshuse og Zerohedge:

While it is common knowledge by now that the Fed will cut rates by 25bps on Sept 18, the question remains whether the cut will be 25bps or 50bps. The answer will be determined by Friday’s nonfarm payrolls report. Let’s dig in.

First, the big picture.

Just a few weeks after the Kamala Dept of Labor, in a epically botched release, unveiled that it had overestimated jobs by 818K in the past year, effectively making every monthly report a “miss” to expectations in retrospect, Friday’s headline payrolls print is expected to come in at 165k, rising from the prior 114K, but below recent averages, with the unemployment rate forecast to tick back lower, after unexpectedly jumping last month. And while this highly inaccurate data set will be likely revised lower both next month and over the next year, it remains of paramount importance for the FOMC meeting on September 16th, where the Fed’s attention has fully shifted towards the employment side of its mandate, and this report will guide the magnitude of the rate cut at that confab. At Jackson Hole Chair Powell said “the time has come for policy to adjust”, with emphasis on the labour market, especially after the July jobs report, adding “we do not seek or welcome further labor market cooling.” As such, WSJ’s Timiraos noted that a report as weak as July could result in an upsized cut, and while currently, money markets are fully pricing in a 25bps rate cut, they have assigned a probability of around a 40% of a 50bps reduction.

Here is a snapshot of the latest expectations, courtesy of Newsquawk

EXPECTATIONS:

- Consensus expects 165k nonfarm payrolls will be added to the US economy in August, (below the 3mth average 170k, 6mth avg. of 194k, and 12mth avg. of 209k), up from 114k last month, which was the 2nd lowest monthly increase since covid.

- The lower end of the forecast range at 100k (at Landesbank BW), and the upper bound at 208k (from Regions Bank).

- Of note, both Goldman and JPMorgan have come out with below-consensus forecasts (155K and 150K respectively), which hints at a beat tomorrow as both banks have had a dismal track record forecasting payrolls in the past year

- The unemployment rate is expected to tick lower to 4.2% from 4.3% (range: 4.1-4.4%), a level which last month triggered the Sahm Rule recession countdown, and sparked debate of a hard-landing; the labor force participation is expected to remain unchanged at 62.7% in July. For reference, FOMC forecasts made in June saw the jobless rate at 4.0% this December, rising to 4.2% by the end of 2025.

- On the wages front, average earnings both M/M and Y/Y are expected to tick higher, to 0.3% M/M (prev. 0.2%) and 3.7% Y/Y (prev. 3.6%), respectively.

LABOR MARKET PROXIES : Weekly initial jobless claims, coinciding with the BLS’ August payrolls report, marginally rose to 232k from 228k, above the expected 230k, with the four-week average more-or-less unchanged at 236k (prev. 236.75k). Within the ISM Manufacturing report for August, the employment sub-index rebounded to 46.0 from 43.4, which according to Oxford Economics likely reflected a drop back in temporary layoffs following summer auto sector retooling in July. ADP national employment for August printed beneath all analyst expectations, coming in at 99k (exp. 145k), while the prior reading was revised lower to 111k. As usual, analysts provided the usual caveats about how the ADP data does not necessarily provide a reliable signal for how the official BLS data will come in, and in fact has been a contrarian signal for much of the past year.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT:

- Mixed-to-softer big data measures. Alternative measures of employment growth indicate a healthy but slowing pace of job growth in August, with a median pace of +133k across the indicators tracked by Goldman.

- August first-print bias. Nonfarm payrolls exhibit a clear tendency toward weak August first prints, which appears to reflect a recurring seasonal underperformance of the first vintage relative to the final vintage. This can happen because the final vintages are used to calculate the seasonal factors, which are consequently not guaranteed to be appropriate for the initial vintages. In the left chart below, Goldman shows first-print payroll growth in August relative to the previously published three-month moving average. On this basis, August job growth has decelerated each year since 2010, and by a median of 51k. Additionally, the right panel of Exhibit 2 shows that job growth has typically been subsequently revised higher—mostly via the not-seasonally-adjusted component, suggesting that later payrolls submissions from companies have tended to be more positive in August—by a median of 65k. The softness in the first vintage has tended to manifest in many of the same industries—information, professional services, manufacturing, and retail. These four industries have contributed 15k jobs on average over the last 6 months, and economists caution that a sharp drop in their contribution on Friday is possible evidence of an August first-print bias.

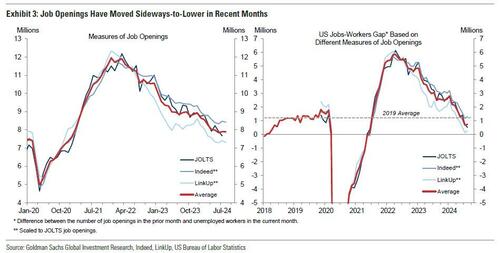

- Job availability. JOLTS job openings declined by 0.2mn to 7.7mn in July, and alternative measures of job openings suggest that openings have moved sideways-to-lower in recent months. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—declined by 0.7pt to +16.1 in August, further below the +30.4 average level of Q1 and below the 2019 average of +33.2.

Worker strikes. The BLS’s strike report noted that a Screen Actors Guild strike will weigh on August payroll growth by 3k.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT:

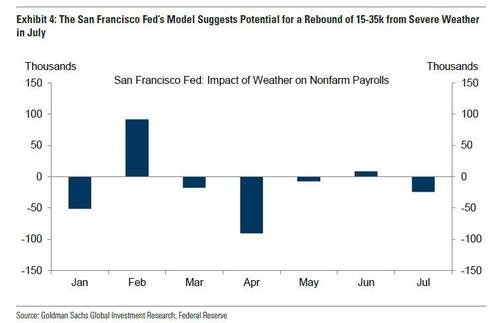

- Payback for extreme heat in July. Extreme heat, in particular in California, may have weighed on job growth in July. The San Francisco Fed’s Weather-Adjusted Employment Change model—which accounts for high temperatures—suggests that seasonally atypical weather imposed a roughly 15-35k drag on July payroll growth. With average temperatures having normalized in August, there is potential for a rebound.

NEUTRAL FACTORS

- Layoffs. Initial jobless claims edged up to an average of 236k in the August payroll month from 235k in July and remained above the 223k average of 2023. The JOLTS layoff rate ticked up to 1.1% in July. The August Beige Book noted that “reports of layoffs remained rare.” The period of seasonally-elevated layoffs at the turn of the year is now behind us, which implies that the pace of layoffs will be a less important determinant of net job gains.

- Employer surveys. The employment components of business surveys declined on net and remained at contractionary levels in August. The employment components of our manufacturing survey tracker (-2.4pt to 46.3) and our services survey tracker (-1.5pt to 47.7) both declined in August. However, the signal from soft data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

FED RHETORIC: The Fed’s attention has now turned towards the employment part of its dual mandate, away from inflation. Highlighting this, Chair Powell at Jackson Hole continued to indicate that a September rate cut is coming, with just the magnitude of the move to be decided. On the labor market, Powell said the Fed does “not seek or welcome further labor market cooling,” which once again shows the importance of the US jobs report, and will seemingly dictate the size of the move by the Fed; as WSJ’s Timiraos noted, a report as week as July might lead to a larger than 25bps rate cut. Note, in wake of the metrics Fed’s Williams is speaking at 08:45EDT/13:45BST at a Council on Foreign Relations Event, while Waller is scheduled for 11:00EDT/ 16:00BST, speaking on the economic outlook.

FED IMPLICATIONS: Capital Economics said the soft July data sparked fears that the Fed could kick off its rate cutting cycle with a larger 50bps rate reduction, but there is reason to treat that data with caution given the spike in the number of people forced to work part-time or unable to work at all due to the weather, suggesting that Hurricane Beryl did in fact have a significant impact. CapEco and Goldman both reckon the weather conditions subtracted around 30k from the July headline, which should be reversed August. More broadly, however, CapEco notes that despite some signs of stabilization, hiring activity has generally weakened, with the ISM and S&P Global indices at pandemic lows and weak service sector data. “Arguably the bigger shock in the July was the 0.2ppts rise in the unemployment rate, which triggered the Sahm rule,” but suggests that temporary disruptions, mainly in the auto sector, were to blame,” adding that “if most of these temporarily laid-off workers returned to their jobs in August as we expect, the unemployment rate would drop back to 4.2% or possibly even 4.1%.” Other analysts have suggested that the August jobs data will be influential in determining how the Fed kicks-off its rate cutting cycle. Currently, money markets are fully discounting a 25bps rate cut, but have assigned a probability around 45% of an upsized 50bps reduction.

MARKET REACTION

We first look at the monthly JPM payroll scenario analysis which is as follows:

- Above 300k. This is a tail-risk scenario. The last time we saw an upward surprise of at least 150k job was the February 2 print, where SPX and NDX added 1.1% and 1.7% on the day, respectively. We could see the market quickly remove the possibility of a 50bp cut with yields spiking. Under this scenario, hourly earnings will be critical to assess if the labor surprise coincides with renewed wage inflation. Look for bonds to reprice higher, providing a headwind to bigger 1-day gains but ultimately the improvement in growth is positive for risk assets Probability 5%; SPX gains 0.25% to 0.50%.

- Between 200k and 300k. Given that the highest estimate on the Street is 208k, with NFP printing above most Street estimates, this will rebuild growth confidence from the August print. The recent GDP, spending, and inflation data will give comfort that the elevated real GDP growth experienced over the last year continues. However, a hotter average hourly earnings print could rekindle wage inflation fears. Further, a print at the top of the range may pare rate cut expectations not just to 25bps in September but towards 75bps for 2024 versus the 110bps of cuts priced into markets currently. Probability 25%; SPX gains 1.00% to 1.50%.

- Between 150k and 200k. This scenario is largely in line with Street expectations. Feroli sees 150k jobs being added with the unemployment rate remaining at 4.3%. This scenario is more in line with a 50bp cut at the September Fed meeting given the strong trend in labor supply and softening in labor demand. Even at the top end of the range, JPM sees a 50bps cut in September given the softening in labor demand and core inflation that appears under control. Probability 40%; SPX gains +0.75% to +1.25%.

- Between 50k and 150k. The immediate reaction is negative as the market quickly adapts to higher recession risks. Given Tuesday’s risk-off positioning, the market may be cleaner going into this NFP event than in previous prints. The market will quickly coalesce around a 50bps cut, with the biggest downside risk that the market adopts the recession / growth scare narrative. Probability 25%; SPX falls -0.50% to -1.00%.

- Below 50k. Another tail-risk scenario since NFP has not been under 100k since December 2020. This will immediately create renewed growth fears, and we may start to fully price in a 50bp cut in September with the possibility of expectations for a 75bp cut being introduced. In this case, aligned with rate cutting cycles of the past, the market may believe that the US is already in a recession, and it would not pay to buy the first rate cut. Probability 5%; SPX falls -1.25% to -2.00%.

Commenting on the possible outcome, JPMorgan’s Market Intel team writes that it sees a bullish outcome after an inline print as it subscribes to the Mike Feroli view of the Fed, whereby there is enough evidence that shows the Fed needs to be materially less restrictive and that neutral rate is likely ~200bps before current levels. Given that the Fed missed on “transitory inflation narrative”, it seems more likely that they front load rate cuts as they assess the 2-sided risk of either (i) recession or (ii) re-igniting inflation. It will be interesting to see the impact on consumer and business confidence and resulting spending behavior.

How to trade it: JPM’s expression of the tactical bull case remains utilizing the barbell but with a heavier tilt towards the Cyclical/Value components. For clients who disagree and are holding a tactically bearish view, driven by negative seasonality and election uncertainty, you may consider being long Defensives such as Healthcare, Utilities, and Staples while using QQQs to get net short. In both scenarios, JPM thinks a bias towards Quality irrespective of sector continues to make sense given bond yields are unlikely to approach pre-COVID levels in the near-term.

* * *

Turning to Goldman’s trading desk, the bank is also modestly bullish going into payrolls while cautioning that “we are still firmly in a good (econ data) is good (for stocks) and bad is bad set up.” As Goldman’s John Flood notes, the stock market wants solid economic data and orderly/proactive adjustment cuts in 25bps increments. Powell’s Jackson Hole speech was quite dovish and he signaled the September cut is happening (only debate is 25bp or 50bp). Goldman warns that if the probability of a 50bp cut in Sept grows it will spook the stock market (U/E rate of 4.3% greatly increases the 50bp cut odds).

The bank also notes that with consensus at 165K, and its own forecast 10K lower, after the string of recent weaker economic data points the whisper for tomorrow’s print has crept lower to 140kish “which is helpful.” Commenting on its own forecast, the bank notes that big data indicators indicate a pace of job creation below the recent payrolls trend, and August payrolls have exhibited a consistent negative bias in initial prints over the last decade. Goldman assumes a modest rebound from severe weather in July and a still above-trend (albeit moderating) contribution from the recent surge in immigration, it estimates that the unemployment rate declined 0.1pp to 4.2% on a rounded basis (a low hurdle from an unrounded 4.25% in July), reflecting the reversal of some of the temporary layoffs that boosted the unemployment rate in July, especially those that appeared linked to summer auto plant retooling shutdowns or extreme heat.

Similar to JPM, Goldman’s equity trading desk suggests the following S&P reaction function to tomorrow’s headline print:

- >250k: S&P rallies 50 – 100bps

- 200k – 250k: S&P rallies at least 100bps

- 150k – 200k: S&P rallies 25 – 50bps

- 100k – 150k: S&P sells off 0 – 50bps

- <100k: S&P sells off at least 100bps

The Goldman treasury trading desk also chimes in, and it says to focus on the unemployment rate, where the Fed’s reaction function should be fairly straightforward with regards to the September meeting:

- 4.19% or lower = 25 bp cut as long as payrolls is positive

- 4.20-4.29% = 25 bp cut if payrolls is above 150k, 50bp cut if payrolls is below 150k

- 4.30% or higher = 50bp cut

Below we lay out some more market views from various Goldman traders starting with Adam Crook who says that “Powell’s Jackson Hole speech laid down the base-case of 25bps cuts at each of its next 3 meetings, given progress on inflation, risks to employment + the growth outlook, and distance of the policy-rate to neutral; with further deterioration in the labor market to result in a more aggressive shift in monetary policy. Our framework from Trading for Payrolls this Friday: i) Headline payroll above ~+140k + U3 at 4.3% leads to the Fed starting with a 25bps cut in September; ii) sub-4.3% will also result in 25 bps regardless of the headline print, as it would need several data beats, and not just one payroll report, for the FOMC to NOT deliver the minimum of 75bps of cuts this year; iii) 4.4% or above, and a 50bp cut will be the outcome in Sep”

In terms of market-reaction, despite the move in pricing over the last 48hrs, the Goldman trader thinks the asymmetry is to a weak number: FX: Sub 100k probably triggers more ‘hard-landing panic’ and a repeat of early-Aug price-action: USD weakness vs Asian funders, USDJPY + USDCNH to revisit recent cycle-lows; in-line or modest beat shouldn’t have any immediate USD-impact, although if the number confirms the asset-supportive soft-landing outlook, overlaying that with an asymmetrically dovish FED, we would expect this to have a modest drag on the dollar at the margin over time. Rates: Front-end rates still have scope to further front-load cuts, even though Rates positioning is somewhat long the front end + in Steepeners, given the market prices still prices a more gradual cutting-cycle than has been realised over prior easing cycles: in Europe, attractive levels for longs with only 60bps priced by December ECB, given even hawks on the Committee are fully committed to a cut in both September + December; in UK, 125bps cumulative cuts by November 2025 (5 inflation report meetings) insufficient given the benign inflation outlook domestically + what is priced into the US. Overall a controlled cycle of 25bps each meeting, with the labor market holding steady, remains the best outcome for risk assets.

In terms of his preferred trade, Crook likes owning downside in high-beta pairs like AUDJPY: “A weak number will cause a further breakdown in USD-correlations. Implied USD correlations in AUDJPY are still priced around +30% compared to as low as 0% at the peak of the early August move.”

Other Goldman traders also chime in with their reactions to the following question:

- What kind of number would be harder for the market to digest now? After Powell’s dovish Jackson hole delivery, would a firmer report be a bigger disruption to positioning, or does the recovery in risk assets make us more vulnerable to a growth scare again?

Here are a handful of replies:

Jan Scheffel (Co-Head of Short Macro Trading) on Short-Rates: “Following the July payrolls report the market went from pricing around 75bps for 2024 cuts to a peak of just under 150bps of cuts in early August before settling into a 95-105bps range over the last couple of weeks. Following Powell’s dovish Jackson Hole comments market participants have used any pullback in rates to receive both September and November FOMC anytime they got to 31-32bps priced for each meeting, as the takeaway from Powell was that at a minimum the FOMC will cut 25bps at each of its next 3 meetings, given the progress on inflation, the risks to the employment and growth outlook and the distance of policy rate to neutral. We agree with the assessment that it would need several data beats, not just one payroll report, for the FOMC to not deliver the minimum of 75bps of cuts this year. We think that an in line payrolls report 150-175k and an unemployment rate of 4.2% would mean that the FOMC would start with a 25bps cut in September.

In Europe and UK we have seen near term pricing completely unwind the post NFP rally. We think that current pricing offer attractive levels for longs with only 60bps priced by December ECB, given that even the hawks on the committee are fully committed to a cut in both September and December. Whilst a October cut may not be the base case, we do think that there is too little risk premium for any type of growth concerns/equity weakness etc over the next couple of months, which could see an acceleration of the cutting cycle.

Similarly, in the UK late 2025 pricing is now around the level we were at prior to the August cut from the BOE, having had an inflation miss last month and Q3 likely running materially below BOE forecast from the August inflation report. We think that 125bps cumulative cuts by November 2025 (5 inflation report meetings) is insufficient given the benign inflation outlook domestically and what is priced into the US market.”

* * *

Brandon Brown (Short macro Trading) on Short-Rates:: “Powell’s speech at Jackson Hole made clear that a cutting cycle with adjustments greater than 25bps per meeting is possible, and further deterioration in the labor market will result in an aggressive shift in monetary policy: “The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.”

Heading into payrolls, all eyes will be on the unemployment rate. Headline monthly payrolls prints have generally been ok, but the rise in the unemployment rate has caught economists by surprise. Immigration has made the breakeven payrolls print required to hold unemployment steady very difficult to predict. As such, officials will have to rely on the unemployment rate, with the headline payrolls print the decision maker if we are to repeat last month’s 4.3% u-rate. In the desks view, a 4.3% u-rate accompanied by a headline payroll number above 140k will most likely result in a 25bp cut. Sub-4.3% will also result in 25 bps, regardless of the headline payroll print. 4.4% or above, and a 50bp cut will be the outcome.

Rates positioning is somewhat long the front end, and still concentrated in steepeners. That said, relative value and other asset classes are likely to come under pressure if the labor market rapidly deteriorates. In terms of broader risk assets, a further increase in the unemployment rate will be unwelcome, signaling higher probability of a hard landing. We think a controlled cycle of 25bps each meeting with the labor market holding steady is the best outcome for risk assets and most market participants.”

* * *

Alan Stewart (Head of EMEA EM Trading) on FX: “Following the dovish turn from JP at Jackson Hole I would expect the dollar smile to be flatter and more saucer shaped (as opposed to the V shape of H1 24 ‘s US exceptionalism environment), and slightly asymmetrically flatter on the left hand (weak US) side. This would imply that the bar to a very impactful number from Friday’s employment report is high and that anything within a 140k-170k range on headline NFP should have a relatively limited impact.

With the ‘24 FED meetings priced at approximately -33bp per clip it would seem reasonable to say that we are priced at the more conservative end of what might be delivered (if you subscribe to the view that 3 x -25bp is the minimum we can reasonably expect). Thus to trigger a genuinely asymmetric reaction in FX markets would require a print that can reprice the 24 FED policy expectations equivalent to at least one 50bp cut (most probably September). Given that Powell’s dovish turn does not yet appear to be universally held across the board, such a print would likely need to come in south of 120k on headline NFP – securing in many minds the idea that labour data is experiencing a significant and sustained downturn (rather than the July print being a one off), but with 120k – 100k not triggering the hard landing panic that a sub 100k print would likely do. In the event of the latter it seems reasonable to expect something similar to what we observed in early August when the dollar weakness was characterised by a substantial outperformance by Asian funders and I would expect USDJPY and USCNH to both revisit their recent cycle lows.

Anecdotally it sounds as if the market whisper is for a modest beat which I doubt has a material impact on FX and at most moves rate pricing more closely to 3 x -25bp. Given this should be considered to be firm soft landing territory, after any initial USD positivity on the headline, it should prove to be a pretty friendly outcome for risk and for EMFX. Given the correction stronger in the dollar we have already seen in the last 10 days back from what we perceived as a 1.0 – 1.5% overshoot to the weak side relative to nominal rates differentials when we touched DXY 100.50 / EUR 1.1200, a modest beat should not have any material or lasting impact on the dollar. Indeed, if it is seen as confirming the asset supportive soft landing outlook, and overlaying that with an asymmetrically dovish outlook from the FED, at the margin we would expect this to have a modest drag on the dollar as it becomes one component of a funding basket.”

* * *

Keith Dell (Head of CEMNEA Rates Trading) on EM Rates: “CEEMEA rates markets on the whole have given back the bulk of the August rally as US data has firmed with rhetoric focused more on 25bp steps. The move has mostly been driven by profit taking and systematic flow as such positioning now is lighter across the board. Our feeling is that market expectation is for a firmer report, but on this outcome the Fed will still push ahead with 25bp steps, as such a bigger reaction will come on another ‘hand landing’ soft print of U/E rate >4.3%. Given the playbook for the July print we would expect CE to outperform and rally back to the summer tights of ~30bp in 5y PLN/CZK/HUF, with ZAR rates to underperform and steepen, and SAGBs at risk of a +20bp widening. We continue to believe the overall environment will prove to be supportive for EM rates however, and look to build into strategic long positions as the Fed rate cutting cycle plays out.”

* * *

Simon Costello (G10 FX Option Trading) on FX Options: “After this weeks string of weaker data we are now pricing the remaining Fed meetings of this year at around 50% chance of 50bps cuts at each meeting From Mondays highs, USDJPY has fallen over 2% as rates have rallied circa 20bps in the front end. From here it is a very binary event with rates (and therefore USDJPY) now having scope to move in either direction. The dayweight is pricing a move of around 1.15% in USDJPY which seems very achievable to us in the context of this week’s move and the recent beta of USDJPY to H5 rates. It is also worth noting that the market is also now rightly starting to treat this print as a broader growth signal rather than a pure nominal rates play. This has consequences for equity-bond correlation which perform like it did in late July/early August when recession risks were first meaningfully put on the table. In FX the implication is a break down in USD correlations – a weak number can cause a move lower in the high beta currencies such as AUDJPY and we think at current prices this is where the largest opportunity lies… Implied USD correlations in AUDJPY are still priced around +30% compared to as low as 0% at the peak of the early August move. “

* * *