Få fri adgang til alle lukkede artikler på ugebrev.dk i 3 uger:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, inden kampagnen udløber 31/8

Uddrag fra Deutsche Bank, Wells Fargo og Zerohedge

At 8:30am on Tuesday, the BLS – now with a new boss-in-waiting, one who has been highly critical of the status quo – will report the July CPI, which according to Deutsche Bank’s Jim Reid could prove to be one of the larger events of the summer for markets. The number will be especially important as many will look to it to see if tariffs are (finally) being passed through to US consumers, instead of just foreign producers of goods (as discussed earlier).

Let’s take a quick look at Wall Street expects:

- Headline CPI is expected to rise by +0.2% M/M at the headline level (down from +0.3%), with the annual rate seen rising to 2.8% Y/Y from 2.7%.

- Core inflation is expected to rise by +0.3% M/M (prev. +0.2% M/M), with the annual rate of core inflation expected to rise to 3.0% Y/Y from 2.9%.

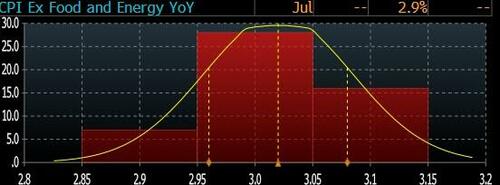

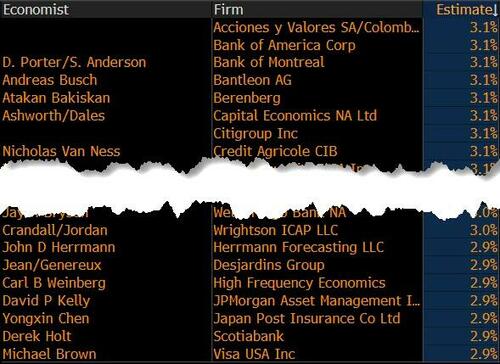

- As shown below, the distribution for the YoY core print is standard if rather top heavy. with more than double the number of 3.1% estimates as 2.9%.

Wells Fargo says that the data will bring further signs of higher tariffs pushing up prices. “It is still early in the price adjustment process to see how higher import taxes will ultimately be distributed between the end customer, domestic sellers and foreign exporters,” the bank writes, “at the same time, growing consumer fatigue is making it more difficult to raise prices in general.”

According to Deutsche Bank, shorter-term trends for core inflation are expected to be mixed. The three-month annualized rate is projected to rise three-tenths to 2.7%, while the six-month rate is seen falling by the same amount to 2.4%. The bank’s economists also anticipate a notable increase in core goods categories (+0.42% vs. +0.20%), which are already showing signs of tariff-related price pressures. This impact is expected to extend to vehicle prices as well. It’s worth recalling that last month’s headline CPI appeared soft, but rates still sold off as the underlying details revealed growing evidence of tariff-driven inflation.

Looking ahead, Wells Fargo expects inflation to pick up, but not ratchet higher, in the second half of this year, and sees both the core CPI and core PCE deflators returning to around 3% in Q4. The June Fed median projections saw headline PCE at 3.0% by year-end with core PCE at 3.1%.

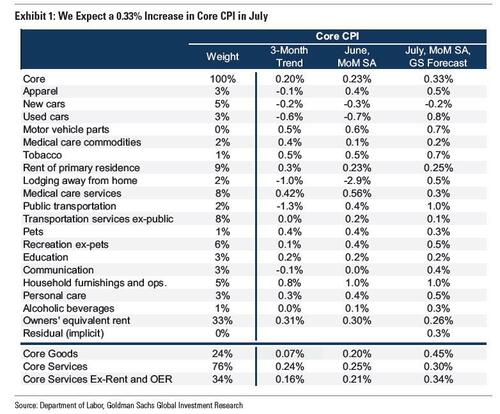

In its CPI preview report, Goldman expects a 0.33% increase in core CPI MoM, corresponding to a year-over-year rate of 3.08% (vs. +3.0% consensus)…

… and highlights four key component-level trends it expects to see in this month’s report.

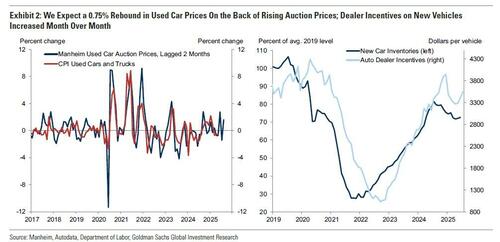

First, a 0.75% rebound in used car prices, reflecting an increase in auction prices, and a 0.2% decline in new car prices, reflecting a sequential increase in dealer incentives.

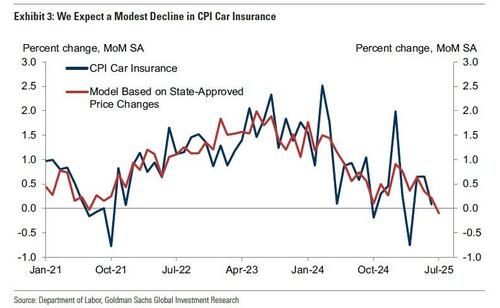

Second, a 0.1% decline in the car insurance category based on premiums in our online dataset.

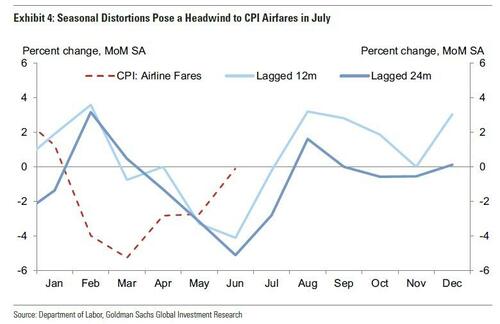

Third, a 2% increase in airfares, though we see two-sided risk to the component, reflecting a headwind from seasonal distortions but a larger increase in underlying airfares based on our equity analysts’ tracking of online price data.

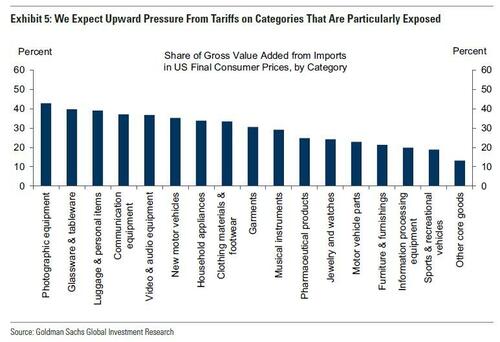

Fourth, Goldman expects upward pressure from tariffs on categories that are particularly exposed, such as the household furnishings and the recreation and communication goods categories, worth +0.12pp on core inflation in addition to the 0.02pp boost from autos inflation.

Over the next few months, Goldman expects tariffs to continue to boost monthly inflation and forecast monthly core CPI inflation between 0.3-0.4%. Aside from tariff effects, the bank also expects underlying trend inflation to fall further this year, reflecting shrinking contributions from the housing rental and labor markets. Goldman economists expect year-over-year core CPI inflation of +3.3% and core PCE inflation of +3.3% in December 2025 (or +2.5% for both measures excluding the effects of tariffs).

Fed Implications:

Some on the Fed are more concerned about the labor market (Waller and Bowman), but others still believe that inflation is further away from the Fedʼs goals. High inflation and fears of higher inflation ahead in response to tariffs is seeing the Fed hold a wait-and-see approach. However, with the recent July NFP report painting a softer picture of the labor market, markets are now looking for a rate cut in September – currently prices a 25bps rate cut with a 89% probability.

Fedʼs Daly has since spoken on the matter, noting the Fed cannot wait forever. Meanwhile, Kashkari said if inflation rises due to tariffs, the Fed could pause, or even hike. He also stated that if the best thing to do now is cut, and then pause, or even reverse the cut later, it is better than sitting on hold until they get clarity on tariffs. A hot inflation report may keep some on the Fed hesitant to endorse rate cuts, but given the latest NFP report which saw a notable slowdown across the last three months, albeit unemployment rate was steady at 4.2%, doves will likely be willing to cut now to help support the labor market while arguing that tariff related price increases will only be a one-time event. The hawks may still argue the Fed is missing its goals on inflation, with the labor market at or near maximum employment. Fed’s Musalem on Friday said the Fed is now missing on the inflation target, but it is not missing on the employment mandate.

Market Reaction:

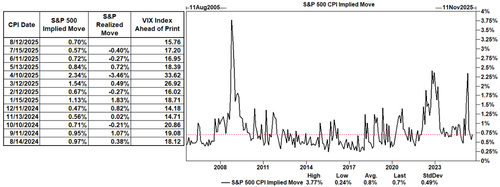

As the following chart from Goldman shows, the market is expecting a 0.70% absolute move (in either direction) tomorrow, the highest since May. That’s with the VIX at just 15.8 ahead of the print, the lowest it has been December.

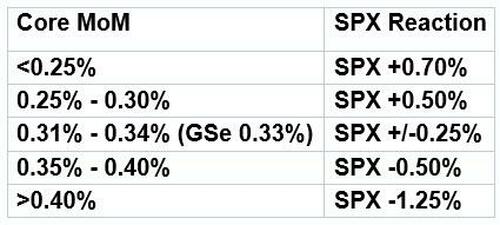

Goldman’s trading desk expects the following reaction function:

JPMorgan’s market intel desk, which started the practice of publishing CPI market reaction functions, naturally has one ready ahead of the print:

- Core MoM prints above 0.40%. SPX loses 2% – 2.75%,

- Core MoM prints between 0.35% – 0.40%. SPX loses 75bp – SPX gains 25bp, probability 25.0%

- Core MoM prints between 0.30% – 0.35%. SPX is flat to up 75bp, probability 35.0%

- Core MoM prints between 0.25% – 0.30%. SPX gains 75bp – 1.2%, probability 30.0%

- Core MoM prints below 0.25%. SPX gains 1.5% – 2%, probability 5.0%

As usual, JPM’s market intel team is optimistic, and writes that “the risk / reward is skewed positively. While inflation is increasingly, the bear case is challenged by speed and magnitude. When the US saw its COVID inflation spike in 2021 and 2022, Headline CPI YoY experiencing an average monthly increase of 0.42% from Apr 2021 to the inflation peak in June 2022. The more gradual pace that we are seeing now is unlikely to bother the market. Regarding magnitude, Feroli sees Headline inflation ending the year at 3.5% Q4/Q4 before falling below 2.5% for much of 2026. It is possible that a hawkish print is a catalyst for investors to sell ahead of negative September seasonality, but we think an in line print continues to market rally.”

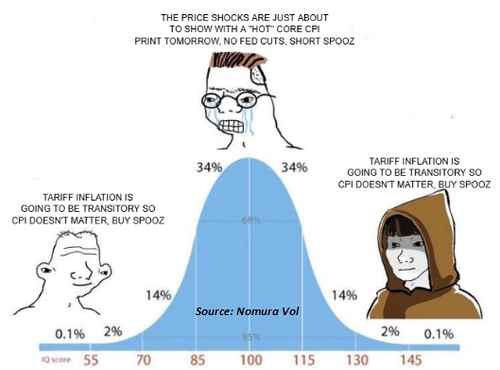

In a somewhat laconic take from Nomura’s Charlie McElligott writes that equities are spending their time worrying about a “hot” tariff-induced Core CPI print tomorrow as “the only scenario where Stocks can go lower,” as recently-priced implied Fed cuts would then risk being delayed / pushed-out again. Some more details:

I think “in-line” Core print of 0.3 ish is fine for Equities, although the permutations matter: if the increases in Goods –inflation are Tariff-centric areas, but Services remain manageable, we’re solid for stat quo extension of “Transitory Tariff Inflation” = still solidly deep-enough “Fed cutting cycle” potential, as Labor is quite obviously normalizing and giving them ample room from current claims of “restrictive” (LOL)

However, if Services are behind an outlier portion of the Core upside, the Stock market may indeed worry about getting the cuts they’ve recently been “promised,” and we could get a wobble in light of the Systematic and Retail “Long” exposure as potential de-risking flow into a selloff

In the bigger picture beyond this week’s Inflation –focus, USD Swaption Skewness (in 1y Tails) again shows enormous iVol tilt for low strike Receivers as hedges relative to high strike Payers, as even though “Recession” is almost nowhere in institutional investors’ minds, the asymmetry is for Fed to cut DEEP and FAST if needed…

Steepeners remain the curve trade of choice (especially after the Stephen Miran appointment to the Fed board, as he has consistently argued that Trump Admin policies are deflationary—hence “dovish” Fed tilt accelerates further)….despite positioning being de-risked well off of prior extremes, as many are grossed-down into this historically tricky window August “illiquid volatility” seasonality (more on that below)

Finally, here is a snapshot of several views from the Goldman trading desk:

Brian Bingham (Short Term Rates Trading)

In light of last Friday’s seismic payrolls report, risks for front-end rates are skewed to the downside and barring a substantial beat – 40bp unrounded or higher – a September cut is all but certain. The market entered NFP long and has increased length in both duration (long sfrm6) and steepener exposure (5s30s tsy) over the past week, while the predominant view has coalesced around the thesis that an in-line CPI report is all that’s needed to green light the resumption of the cutting cycle. But with 23bps priced for Sep and 60bps cumulatively through December, long z5 is an expensive option…particularly considering that the pain trade for virtually every consensus position (long duration, steepeners, long risk, short $) comes via a hot print. Given four consecutive misses relative to consensus forecast (16bp realized vs 27bp consensus, post Liberation Day) we continue to see value in optionalized longs and money market steepeners over the event, but see little value in playing for 50bp in Sep and strongly disagree with the sentiment that FFV5 longs are a free option.

Shawn Tuteja (ETF/Basket Vol Trading)

The market into the end of this week has run with the narrative that CPI is slowly becoming unimportant, as the consensus is building that anything sub 0.44% core MoM doesn’t discredit the Fed looking past tariffs as a one-time tax and re-starting a cutting cycle in September. Conversations have shifted much more to being focused on labor market data going forward and the pace and magnitude of weakness in the overall economy. What’s interesting is even during the few days of market weakness, we’ve seen more clients look to play offense rather than hedge. One risk we see into CPI is the market unwinding some of the gross risk it has — a month ago, we saw a quant de-grossing episode with highly shorted names squeezing, whereas the L/S community performance seemed relatively unscathed by that. What worries us is a rotation that could happen in the “market bullish” scenario of a benign CPI. One way to hedge against that is buying cyclical (RTY, etc.) calls but another way in our view given levels and overall asymmetry could be to strike some semis / AI hedges. While overall index volatility has stopped performing, single name options continue to carry well as the market has traded fairly anti-correlated.

Vickie Chang (Global Macro Research)

The clearer weakening in the labor market recently has led the market to push towards pricing more Fed easing. Our frameworks also show that the market has priced a “dovish policy shock” since payrolls—that has helped support both bonds and equities over the last week, and the market is now pricing a high chance of a September cut. CPI this week will be important in the near term to either interrupting or extending that narrative. The risks around the CPI print are now likely two-sided. A CPI print in-line or below consensus clears the way somewhat for the market to continue to push on pricing a dovish Fed pivot between now and September, with the growth pricing that accompanies that to be determined by the activity data. Our CPI forecasts have that flavor. A very benign print would probably start to encourage the pricing of the possibility of a 50bp cut in September. A high-side print (say, a 0.4% core print or worse) might now lead the market to scale back expectations for a September cut, and could weigh on risk and put a brake on the move lower in US rates. With Jackson Hole and the next payrolls release ahead, we think a sell-off could be short-lived, but this release clearly poses some risk to the recent prevailing trends. Our bias is still to be long US rates, short USD, and to be long risk with protection into event risks. We think that for investors with those views it makes sense either to look at short-term protection (downside in US equities, or US rate shorts), or to consider holding more of the core position through options (our Rates team recommends an ATMF 1m2y receiver). The goal is to maintain some convexity and the capacity to add on any sell-off. USD calls against G10 currencies may also be protective.

Ryan Hammond (US Portfolio Strategy)

With the S&P 500 at an all-time high, our tools suggest the market is pricing a friendly combination of a resilient economic growth outlook and dovish Fed policy. A soft CPI print would likely reinforce this view and support continued S&P 500 upside. A hot CPI print would likely push back on this pricing, but the composition of inflation (e.g. tariff vs. non-tariff categories) will be an important distinction. We think the CPI print will also be an important driver of rotations within the market. Investors continue to assign a high valuation premium to the perceived safety of large-cap companies with “quality” attributes. A blended Quality factor trades at a 57% premium, ranking in the 94th percentile vs. history. Our economists’ forecast for below-trend growth and above-target inflation in the near-term will likely make it challenging for low-quality stocks to outperform on a consistent basis. However, given the asymmetry indicated by current valuations, we think investors should protect themselves against the potential for a sharp rotation toward low quality stocks. Investors should keep in mind the potential convexity of low-quality stocks to the upside in a scenario where the macroeconomic outlook is more positive than feared, such as a soft CPI print.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her