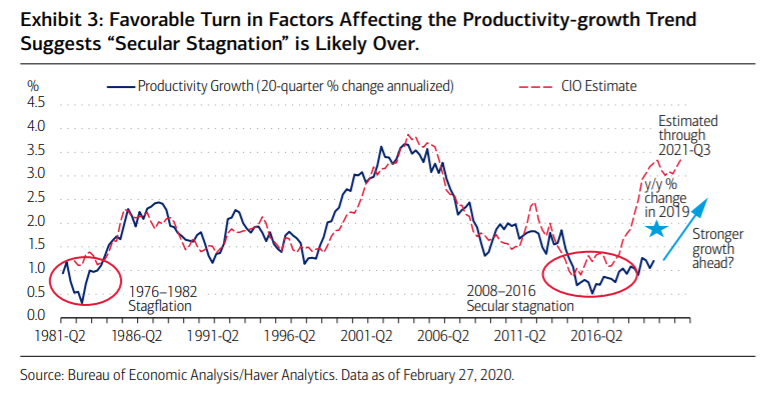

Produktiviteten i USA har i en meget lang tid været stagnerende, men nu er der tegn på en stigning. I 2019 nærmere produktiviteten sig 40 års gennemsnit.

Uddrag fra Merrill:

Productivity Trend Up

Productivity growth is the source of rising real wages and standards of living. Without rising productivity, real GDP per capita, as a measure of standard of living, would only increase if a larger share of the population worked, or if population declined.

Over the

past two decades, the U.S. experienced both declining labor-force participation and weakening productivity. As a result, the 20-year growth in output per capita collapsed to its slowest pace in 70 years.

Persistently poor U.S. productivity growth between 2010–2016 in particular raised significant questions about its trend and reduced expectations for potential GDP growth.

Numerous reasons have been offered for this underperformance, including: 1) recent digital technology is not as impactful as the steam engine or electrification were; 2) mismeasurement issues related to the rising share of services in the economy, which suffer from productivity measurement challenges; 3) slowing business dynamism; 4) increased

business concentration; and 5) slow adoption of new technology. Indeed, according to a June 2018 McKinsey article, Is the Solow Paradox Back?, adoption barriers, lag effects and transition costs are delaying the impact of digital technologies, with only a small fraction

of activities and processes digitized so far and many companies still trying to understand how they can benefit from the new technology.

Interestingly, the list of reasons why productivity growth during the past decade was about half its 2.2% post-World War II (WWII) average omits the most obvious reason, which, in our view, is the economic, financial, confidence, regulatory and tax backdrop. For example, years of deficient demand after an incomplete policy response to the Great Recession and

its aftermath kept housing, small-business sentiment and consumer spending extremely depressed. The stop-go pattern of the current expansion has precluded businesses from fully using their operating leverage, constraining productivity growth to a below-average pace.

The hollowing out of the U.S. industrial base over the past 20 years, which coincides with China’s accession to the World Trade Organization (WTO) and the growing share of the

less productive and slower-productivity-growth service sector, also played a role, as did the lagged effect of the dollar depreciation and eventual undervaluation from 2002 to 2014.

Encouragingly, these overlooked factors, which tend to lead productivity growth trends, have reversed in favor of a productivity reacceleration.

As a result, despite widespread

expectations for a persistently weak productivity performance, nonfarm-productivity growth has doubled from a 0.7% average between 2011-2016 to 1.5% between 2016-2019. With a gain of 1.7% in 2019, it approached its past 40 year average pace of 1.84% even with no productivity growth in the manufacturing sector, which was in recession (Exhibit 3).

Exhibit 3: Favorable Turn in Factors Affecting the Productivity-growth Trend

Suggests “Secular Stagnation” is Likely Over.