Uddrag fra John Authers:

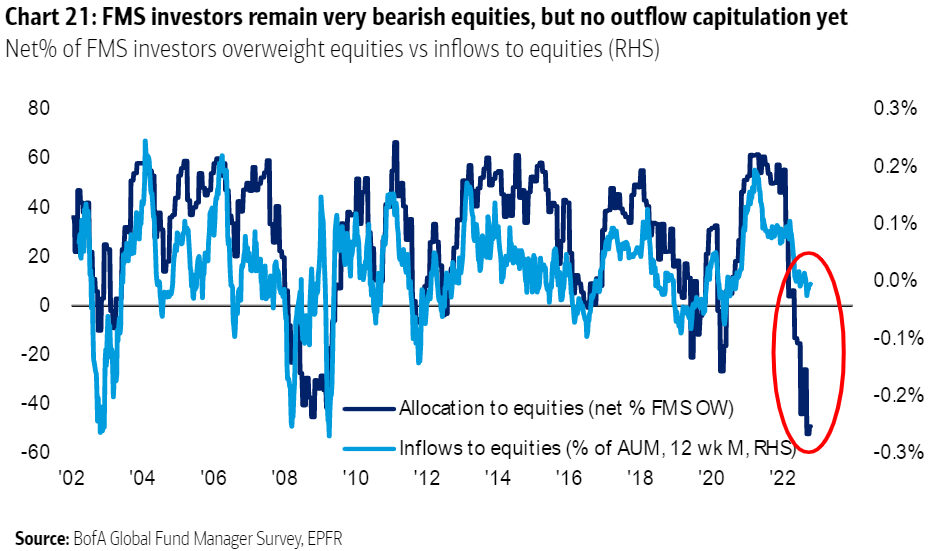

Here comes a brief tour of fund managers’ opinions, in charts. The key is this one: They’re more bearish about stocks than at any time since the survey started (remarkably even including 2008), but somehow flows into equities are still positive:

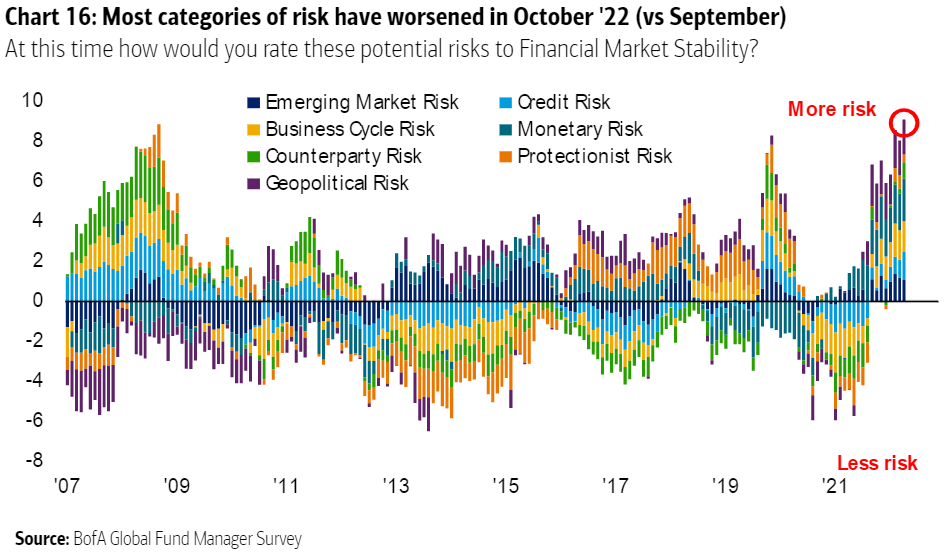

Fund managers also view risks as their most elevated since 2008, and see those risks spread across the world. Amazingly, they entered this year with the view that the world was a pretty safe place:

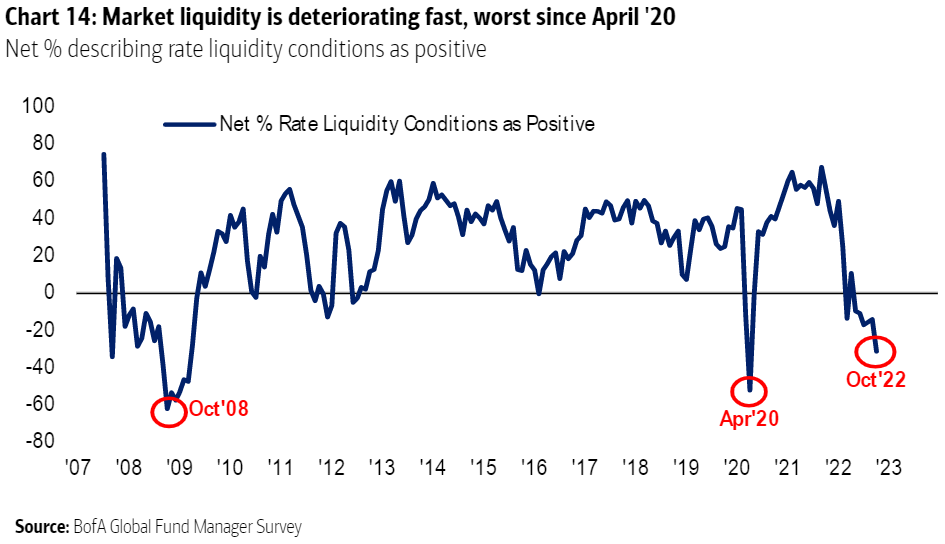

The perception of riskiness might be driven by widespread complaints that liquidity is running out. This is the natural consequence of tighter money from the central banks and greatly increases the risk of financial accidents:

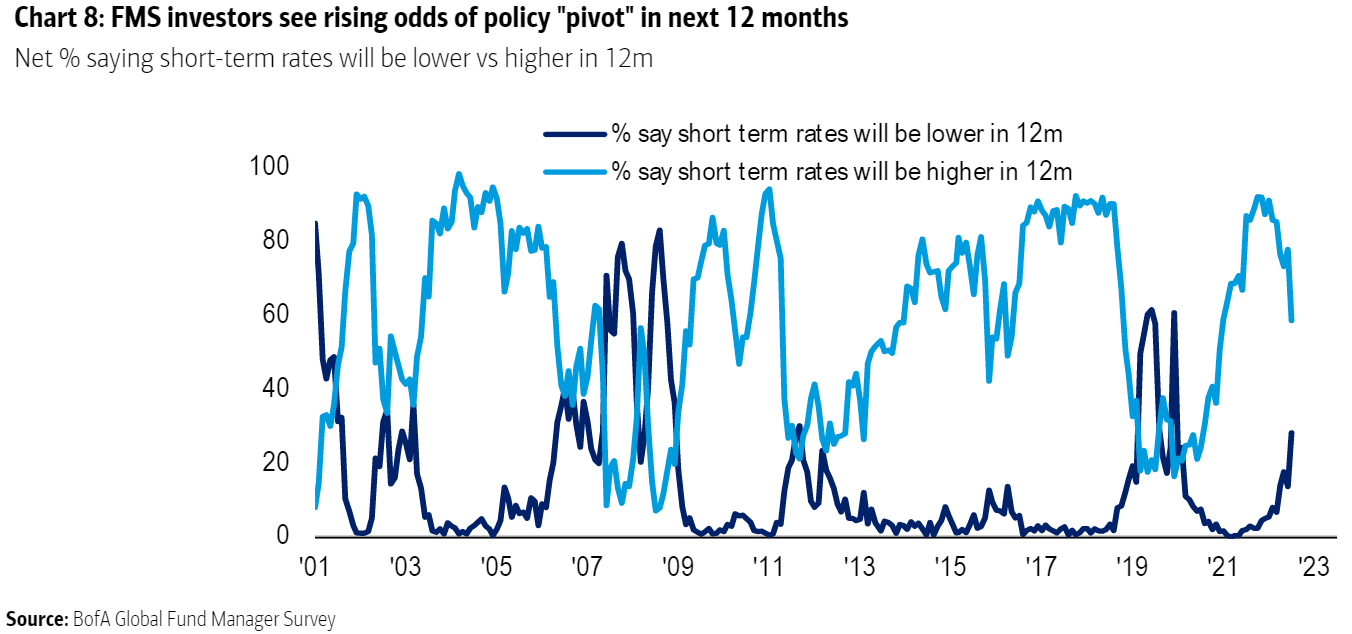

A belief that liquidity is drying up leads naturally to predictions that the Fed will soon have to execute its “pivot” and start to cut rates again. A majority of fund managers still expect rates to be higher 12 months from now, but the margin has tightened in the last few months:

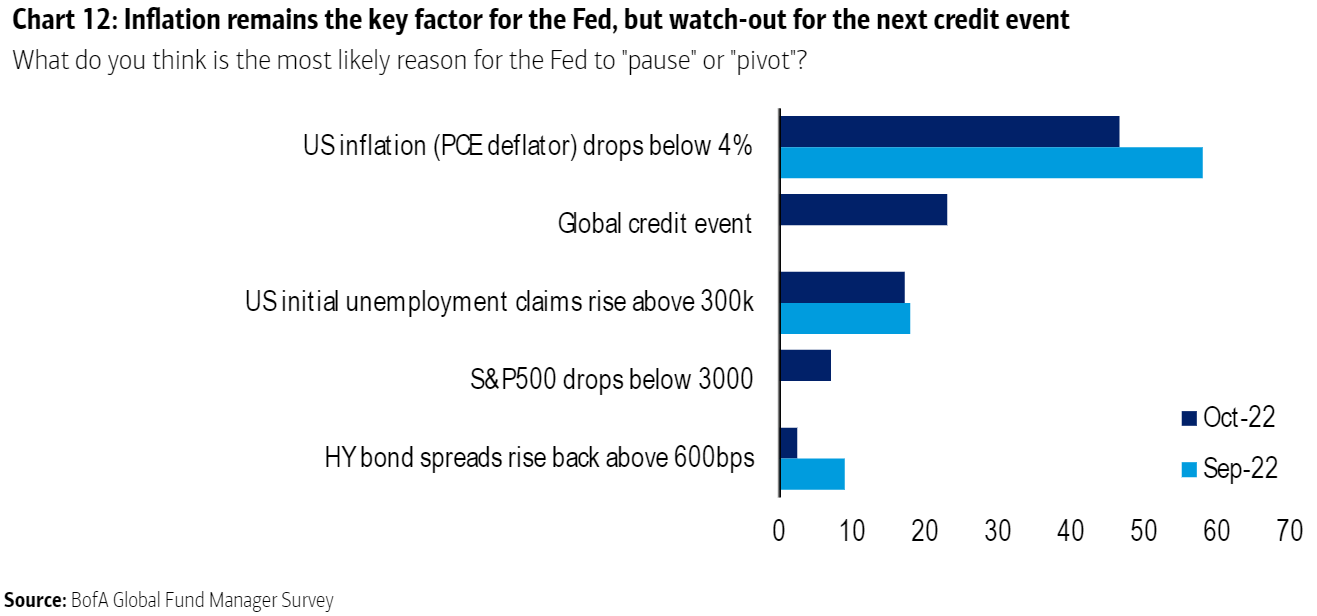

But is this just wishful thinking? And why exactly do they expect the Fed to turn around? Increasingly, it’s because they believe markets will break. Falling inflation is still seen as the most plausible trigger, but over the last month, many have adopted the idea that a “global credit event” (and the most plausible culprit is thought to be another blowup in the eurozone) or a crash for the US stock market will force the Fed’s hand:

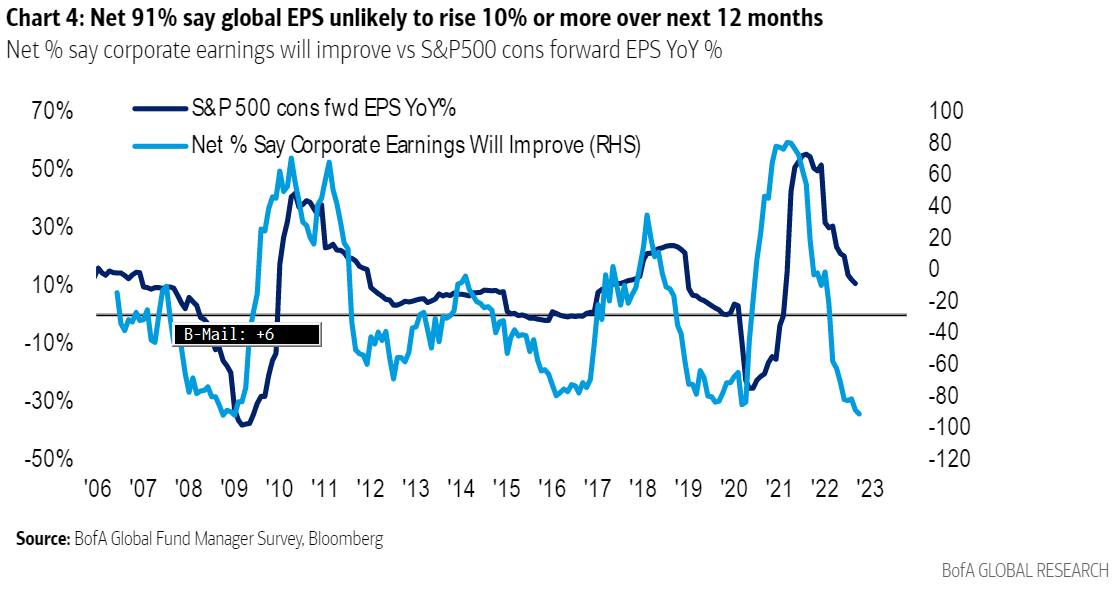

Finally, sentiment ahead of earnings season is miserable, and indeed as negative as it’s ever been (including during the Global Financial Crisis). Past experience suggests that earnings per share estimates should already be diving, so there’s a big disjunction between money managers on the buy side and brokers on the sell side preparing the estimates:

In such conditions, a positive surprise can have quite a galvanizing effect on a share price (of which more later). But as it stands, the good news, which helped stocks to another good day on Tuesday, is that almost all hope has been lost.