De omfattende protester i mange amerikanske storbyer med undtagelsestilstand virker dramatiske, men deres økonomiske virkning vil være meget begrænset, vurderer ABN Amro. Men derimod viser meningsmålinger en kolossal politisk virkning. For første gang ligger Joe Biden langt foran Donald Trump i kapløbet om præsidentposten.

What the US protests might mean for the economy

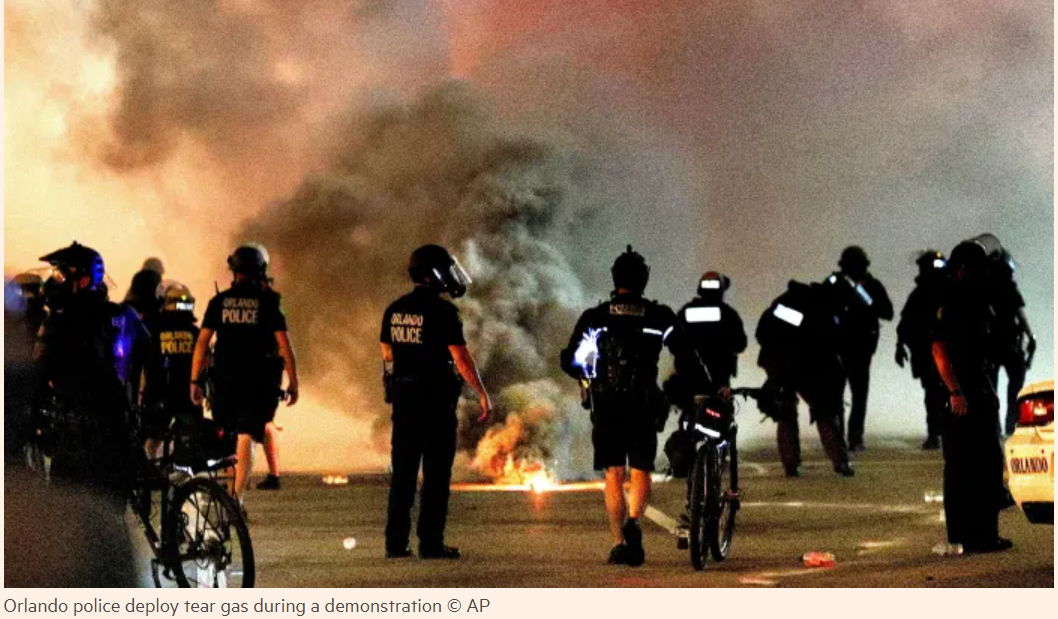

US Macro: Impact of protests probably negligible, unless they persist – Nationwide protests following the killing of George Floyd on 25 May, with at least 12 major cities declaring curfews by last Saturday. The biggest – New York – implemented a week long 8pm curfew on Monday, the first in the city in 75 years.

As the experience of France and especially Hong Kong showed last year, widespread and sustained protest movements can have a significant macroeconomic impact, primarily by discouraging tourism and curbing other kinds of discretionary spending. While it is difficult to disentangle the effects of protests from other macroeconomic drivers, Hong Kong’s economy contracted by 2.9% in Q3 last year, driven by sharp drops in retail sales and tourist inflows linked to the protests.

The protests in the US are not yet that sustained, and due to the US’s size they affect a much smaller proportion of the economy than those in Hong Kong. As such, in ‘normal’ (i.e. absent the pandemic) times the impact would likely be closer to a couple of tenths off annualised growth for Q2.

This means little when the range of forecasts is now in the percentage points. And with the pandemic by far dominating macroeconomic developments – with many of the cities under curfew also still under lockdown restrictions – the impact is likely to be negligible compared to the counterfactual.

Political impact could be more significant – This assumes of course that the protests dissipate and that they are not as persistent as those seen elsewhere. Should they indeed persist, curfews could end up becoming a barrier to the tentative reopening of the economy.

Moreover, the political impact could prove to be more important. While it is still too early to observe a change in opinion polling for the November presidential election (where Biden already leads), betting markets – which tend to lead polling – show Biden overtaking Trump as favourite to win the election, for the first time in two months.

There is also the risk that the policymaking of president Trump becomes even more erratic, if he perceives the threat to his re-election to be greater than it was before.