Den overraskende udskiftningen af den russiske regering lægger op til betydelige politiske ændringer på sigt, og samtidig er der udsigt til en finanspolitisk stimulering af økonomien.

Uddrag fra ING:

The resignation of the Russian cabinet and proposals of constitutional reform are aimed at boosting local confidence through promises of a better income trend and smooth political transition in 2021-24. The prospects for financial assets, especially bonds, will largely depend on the scale of the budget easing, which now seems increasingly likely

Several important events took place on 15 January in Russia (in order of appearance):

- During his annual state-of-the-nation address, President Vladimir Putin announced measures aimed at supporting lower income families with children, worth 0.3-0.5% of GDP in extra spending

- He also proposed amendments to the constitution that would boost parliamentary control over the Cabinet, codify the powers of the State Council and cap the maximum amount of presidential terms at two, regardless of whether those terms are consecutive or not

- Dmitry Medvedev, who has been Prime Minister since 2012, resigned, while Mikhail Mishoustin, head of tax service, has been nominated as new PM

First, there seems to be a roadmap for political transition. One of the key questions following Vladimir Putin’s re-election for the second consecutive presidential term (fourth in total) in 2018 was the upcoming transition in 2024. The proposed constitutional reform (speculation of which has been circulating for two-three years) therefore is not a shock, but rather a long-awaited answer: it appears that Vladimir Putin is planning to vacate the presidential post, while retaining control over the executive branch either through the State Council or through an empowered parliament. In a way, this should lower some political uncertainties, which might have a been a concern for the local corporate sector.

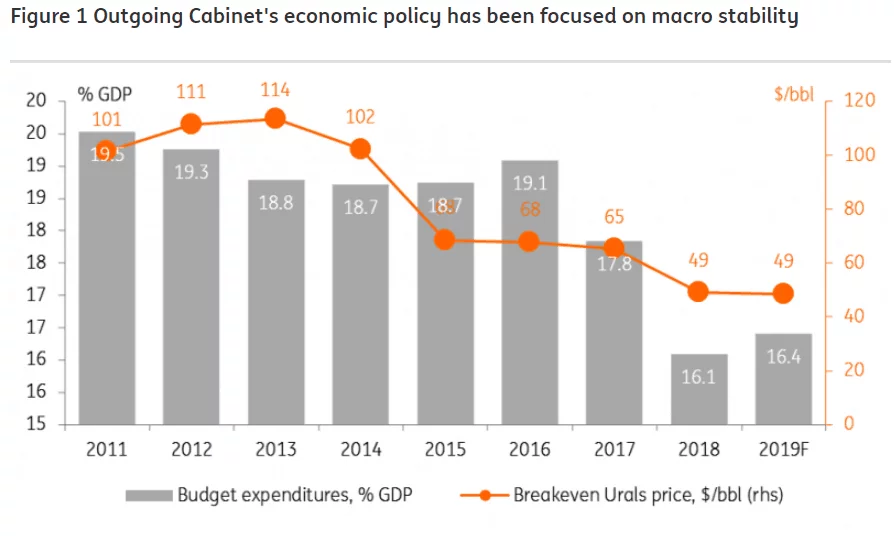

Second, economic policy may shift from macro stability towards more fiscal stimulus. The outgoing Cabinet’s key achievement was the dramatic improvement in Russia’s fiscal position, with the budget breakeven oil price dropping from US$110-115/bbl in 2012-13 to below US$50/bbl in 2019, partially due to a reduction in state expenditures by around 3-4% GDP, more robust tax collection, increase in VAT rate and retirement age in 2018. While these measures were necessary to rebuild fiscal reserves, which now exceed 7% of GDP, and keep state debt low, they also contributed to stagnation of household income and consumption, leading to disappointing approval ratings. As a result, it is no coincidence that the resignation (speculation of which has also been circulating for two-three years) of the current Cabinet comes hand in hand with the call for a stronger parliament and announcement of additional social policy initiatives on top of the already announced plans of investing a portion of fiscal savings into local projects.

Third, Cabinet will focus on boosting efficiency of state administration. The new PM nominee has been credited with massive upgrade in the tax administration system, allowing to increase its transparency for the business and to boost collection for the budget. This suggests that overall increase in efficiency and quality of state services may be on the agenda, which is a positive sign. The new PM’s brief experience in financial markets in 2008-10 is also a positive sign. Meanwhile the technocratic nature of the new appointment, as opposed to previously rumoured Alexei Kudrin, the head of Audit Chamber, or German Gref, Sberbank’s CEO, suggests that the Cabinet is unlikely to take more active role on the broader policy agenda, keeping the question of structural reforms open for now.