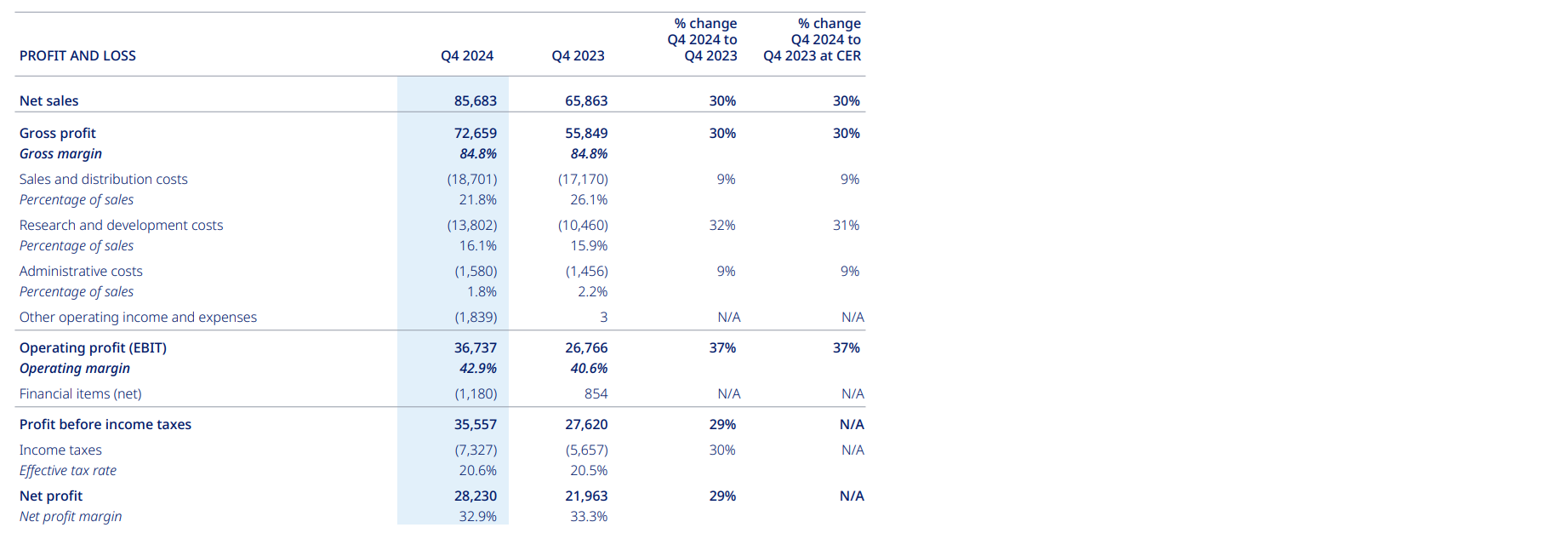

ØU Kommentar: Analytikerne havde forventet et EBIT-driftsoverskud i Q4 på 35,4 mia. kr. – det kom ud på 36,7 mia. kr. i dagens regnskab

Fra Novo Nordisk:

Q4 tal:

Novo Nordisk’s sales increased by 25% in Danish kroner and by 26% at constant exchange rates to DKK 290.4 billion in 2024

Bagsværd, 5 February 2025 – Financial report for the period 1 January 2024 to 31 December 2024

- Operating profit increased by 25% in Danish kroner and by 26% at constant exchange rates (CER) to DKK 128.3 billion. Operating profit was positively impacted by gross-to-net sales adjustments in the US and negatively impacted by impairment losses.

- Sales in North America Operations increased by 30% in Danish kroner (30% at CER). Sales in International Operations increased by 17% in Danish kroner (19% at CER).

- Sales within Diabetes and Obesity care increased by 26% in Danish kroner to DKK 271.8 billion (27% at CER), mainly driven by GLP-1 diabetes sales growth of 21% in Danish kroner (22% at CER) and Obesity care growing by 56% in Danish kroner to DKK 65.1 billion (57% at CER). Rare disease sales increased by 9% in both Danish kroner and at CER.

- Within R&D, CagriSema demonstrated superior weight loss in adults with obesity or overweight in the REDEFINE 1 trial, where people treated with CagriSema achieved a superior weight loss of 22.7%. Further, semaglutide 7.2 mg achieved 20.7% weight loss in the STEP UP obesity trial. Lastly, a phase 1b/2a with injectable amycretin in people with overweight or obesity was successfully completed.

- In December 2024, Novo Nordisk announced that the acquisition of Catalent by Novo Holdings and the related acquisition by Novo Nordisk of three manufacturing sites from Novo Holdings was completed.

- For the 2025 outlook, sales growth is expected to be 16-24% at CER, and operating profit growth is expected to be 19-27% at CER. Sales and operating profit growth reported in Danish kroner is expected to be 3 and 5 percentage points higher than at CER, respectively.

- At the Annual General Meeting on 27 March 2025, the Board of Directors will propose a final dividend of DKK 7.90 for 2024 per share. The expected total dividend for 2024 will increase 21% to DKK 11.40 per share, of which DKK 3.50 was paid as interim dividend in August 2024.

| PROFIT AND LOSS | 2024 | 2023 | Growth as reported | Growth at CER* |

| DKK million | ||||

| Net sales | 290,403 | 232,261 | 25% | 26% |

| Operating profit | 128,339 | 102,574 | 25% | 26% |

| Net profit | 100,988 | 83,683 | 21% | N/A |

| Diluted earnings per share (in DKK) | 22.63 | 18.62 | 22% | N/A |

| * CER: Constant exchange rates (average 2023). |

Lars Fruergaard Jørgensen, president and CEO: “We are pleased with the performance in 2024, where 26% sales growth reflects that more than 45 million people are now benefiting from our treatments. Further, we completed the acquisition of the three Catalent sites, and during the year, we progressed our R&D pipeline, including obesity projects such as CagriSema and amycretin. In 2025, we will continue our focus on commercial execution, on the progression of our early and late-stage R&D pipeline and on the expansion of our production capacity.”

On 5 February 2025 at 13.00 CET, corresponding to 07.00 am EST, an earnings call will be held. Investors will be able to listen in via a link on novonordisk.com, which can be found under ‘Investors’ (the contents of the company’s website do not form a part of this Form 6-K).