Uddrag fra Goldman:

As we reported earlier, after several days of patiently – and bearishly – waiting for his opportunity, Goldman’s head of risk and Chief Strategy Officer, Josh Schiffrin, made quite a splash just after 1pm when he announced to the bank’s clients that “I’ve been negative, but now I’m bullish. Time to start scaling in.“

He is not the only one. Goldman FICC trader Paolo Schiavone has also doubled down, and in a late Monday note to clients (available to pro subs in the usual place) writes that there has been significant debate over whether we’ve reached the point of maximum pain for risk assets. As a result, the pricing of recession risk have created an asymmetric risk-reward setup in the short term.

Below we excerpt from his note, the full thing can be found here for pro subs.

There is a reasonable probability that we see a shift in sentiment, if there’s a wave of deal-making, and a potential easing of tariffs could help reset the current trajectory. The possible tariffs recession priced is self-inflected and reversible.

When VIX reaches 50 Equity returns are positive in 83% of cases and with an average weekly return at 4% and a maximum downside of 1.03%. If history is used as a guide here, risk-reward is skewed on the upside for risk assets.

Key Considerations:

1. Risk-Reward Asymmetry: Downside seems relatively priced in with SPX at 4850. Short term 10-15% squeeze seems reasonable vs 10% downside in a 2-month time frame.

- Bond Market & Equity : Neutral bonds, long risk assets appear to be an attractive trade if recession fears are overdone or if we see an easing of financial conditions. The fundamental backdrop remains weak, but it’s worth noting that these setups often produce significant reversals at extremes.

2. Tariff Impact: Short-Term Pain- Higher tariffs have historically had three key impacts: they reduce real income, tighten financial conditions, and increase uncertainty. While these are all negative in the short term, tariffs might be reversed or adjusted, especially as trade deals evolve and alliances shift.

- This is a self-Inflicted Adjustment: Tariffs may be a policy mistake that markets are overly focused on. If there is a concession the recession narrative changes.

3. Market Framework for Risk assets here: Technical / Flows / Positioning / Valuation / Sentiment.

- Technical (50%): Technical indicators suggest a potential floor around the 4850 level on the S&P 500, with this area possibly marking the bottom for Q1. However, this remains contingent on bond market stability and the broader market’s ability to find support in the face of a recessionary backdrop.

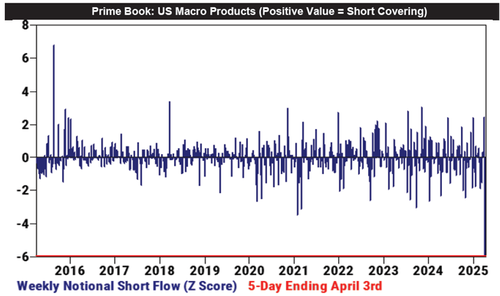

- Flows (40%): Institutional flows have been more volatile, with heavy “real money” sellers. Meanwhile, CTA positioning is at extreme short levels on US equities, which could act as a contrarian indicator for a potential rally if market conditions stabilize.

- Fundamentals (20%): Earning picture remains highly bearish, with no immediate support for risk assets in terms of valuation. However, positioning appears to be reflecting this weakness, making it a ripe environment for a short term reversal.

4.Fade the US Recession in the Next 3 Months: The consensus is overwhelmingly bearish on US economic prospects, pricing in a significant recession. This creates an opportunity to fade this view, particularly as recession risks might be overdone or delayed. Market psychology has priced in the worst-case scenarios.

- Squeezing Trades: There’s a substantial amount of consensus positioning in place, particularly with institutional investors betting on a recession. This makes the market ripe for a squeeze, as the positioning is heavily skewed toward risk-off strategies.

Four Frameworks for Current Market Outlook:

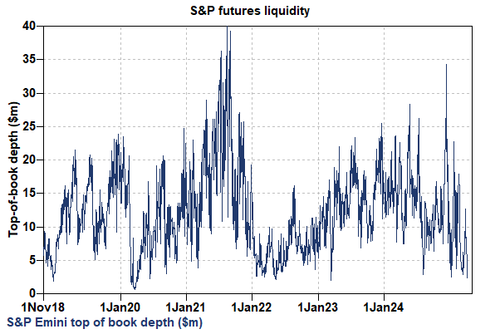

- Risk/Reward/Liquidity/Time: Liquidity is still historically low, market moves could be violent in either direction. That said, the potential upside (10-20%) in greater than a 10% downside. It will be crucial to maintain patience and a disciplined approach to risk management.

- CRIC Framework (Crisis/Response/Improvement/Complacency): We are in the crisis phase. The response phase has yet to materialize fully, and crises are likely to intensify until tangible policy responses are seen. This uncertainty will likely persist, until panic is clearly visible in the market.

- Balance Sheet Risk: 4 Balance sheets: corporate, household, and banking balance sheets are under pressure, with the potential for a 25% market correction if one of these sectors faces significant stress. The risk-off environment could trigger sell-offs in the event of financial instability. Not there yet.

- HOPE Framework (Housing, Orders, Profits, Employment): Housing is already slowing, which could be an early indicator of broader economic deceleration. This could eventually translate to weaker corporate profits and eventually employment, but these changes are likely to be lagging indicators.

The four frameworks above open up the recession vs stagflation debate.

In the short term I see the market pricing of recession as relatively high.

The market is wrestling with whether we are facing stagflation or a policy-induced recession. The distinction matters because stagflation (slow growth with persistent inflation) could be more damaging for risk assets than a policy-induced recession, which could be a temporary economic slowdown.

While escalation risks are still high, the environment suggests that the market is nearing a point where a contrarian rally could be triggered, particularly if policy shifts provide clarity and if positioning dynamics reverse. As a trend follower I often avoid these, but the market set up is interesting here.

I can see a tactical bull market in uncertainty, where the cyclical and most shorted trades find a considerable bid.

Conclusively, Shorting bonds and/or shorting tails isn’t a viable strategy. Unless you think that- tails are bimodal.

Now the market is overweight the growth tail and just not sure how confident we can be that that’s the only tail.

Liquidity will accelerate move on both sides.

We are at record high short in Goldman’s US Macro product in our prime book data…