uddrag fra Goldman:

“DeepSeek is something we are going to be talking about a lot this week and especially ahead of Mag 7 earnings where the focus will be on upcoming AI related capex outlays.”

The Goldman trader goes on to not that what makes DeepSeek important is not necessarily that it’s Chinese or rapidly ascended to one of the most popular downloads in the Apple App Store…

… but that it appears quite a fundamental advancement in the efficiency of AI technology: “For a lot of complicated reasons it’s basically a huge upgrade to effectiveness of inference. By some measurements, 40-50x more efficient than other models. If you can do more with less it naturally leads the question to whether you need so much capacity.”

Privorotsky concludes that, “given the immense amount of market cap added on this thematic I think we hit hard in reverse in the tends of last week. The power up baskets are going power down. Semis/ai/tech are going to be under pressure today. Think maybe now we understand why NVDA has been de-rating to the extent it has.”

So we have one bear; He is hardly not alone.

Taking a closer look at the sharp reversal in sentiment, Goldman FICC trader François Theis looks at China as an AI disruptor (must read note on the multiple recent AI model launches and implications for China internet/cloud/data centers can be found here for pro subs), and writes that the Asian AI ecosystem in full profit taking mode (GS Japan AI -3.08%, GS Asia Power Grid -3.3%) with the Nasdaq plunging.

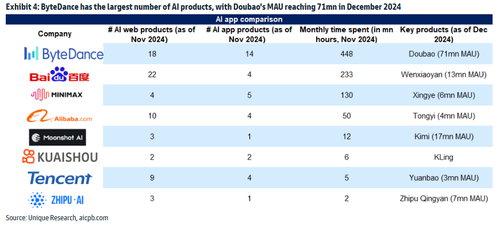

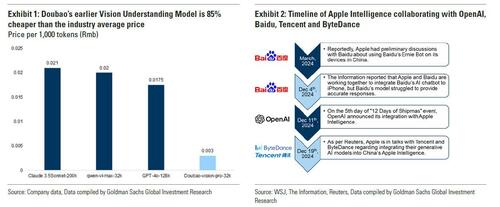

Goldman highlights that the recent model improvements and cost efficiencies have likely come from the mixture of expert architectures, increased emphasis on post training, cost optimization, the reinforcement learnings aspects of modes. Ronald Keung also stresses that open-source Chinese models including DeepSeek R1/V3 and Alibaba’s Qwen have drawn sider developer interest since launch on the back of their transparency and the significantly lower pricing point per token vs global models. In a chip constraint world in China, many players have maximized their model output. This is not just Deepseek, many established players have large number of AI products:

The Key implications according to Goldman

- First of all remains around Softbank’ Stargate return on investments and capex efficiency (and hence beneficiaries around supply chain and energy requirements)

- Potential competition between capital rich internet giants vs start-ups given lowering barriers to entry here

- From Training to more inferencing that requires significantly lower computational resources vs pre-training (questions around GS Asia Power Grid recent return)

- Potential for further global expansion for Chinese players with the obvious caveat (around geopolitics)

- For Chinese cloud/data center players, we continue to believe the focus for 2025 will center around chip availability and the ability of CSP (cloud service providers) to deliver improving revenue contribution from AI-driven cloud revenue growth, and beyond infrastructure/GPU renting, how AI workloads & AI related services could contribute to growth and margins going forward. Pls see here for our base/bear scenarios for capex estimates (available to pro subs)

- Aex beneficiaries: Tencent best positioned in introducing To-C AI agents applications thanks to its ecosystem. Expect internet giants’ cloud businesses (Alibaba is China’s largest public cloud hyperscaler), and data centers (GDS, VNET) to benefit from ongoing public cloud and AI computing demand growth from multi-year higher AI adoption.

- Report of note last year on the debate over upside to US productivity: Top of mind: Gen AI: Too much spend, too little benefit?

Finally, here is Goldman’s Keita Umetani giving a backgrounder on deepseek and how Goldman is trading it:

As Umetani writes, he is “not the only one to admit that this weekend was the first time I heard of Deepseek. If you have heard, am sure you’re already well positioned for what could be the next ground-breaking AI announcement YTD. But for others, let’s dig deeper into what it is, why you should be worried, and how to trade around it.”

Introduction

China’s recent AI breakthrough from the lab Deepseek has taken Silicon Valley by surprise, showcasing a new open-source model that outperforms established leaders like OpenAI and Google. Deepseek reportedly developed its latest model in just two months for around $5.6 million, a stark contrast to the billions spent by American firms. To give you some context, Open AI is spending $5bn USD/year on similar product; Google expects capital expenditures in 2024 to soar to over $50 billion; Microsoft shelled out more than $13 billion just to invest in OpenAI (Source: BBG)

Who created the DeepSeek?

The origins of Deepseek remain somewhat mysterious, as little is known about its founder and the lab itself, which emerged from a hedge fund. This uncertainty highlights the increasing complexity of the AI race between the U.S. and China. Other Chinese AI initiatives are also gaining traction, demonstrating that China’s capabilities in AI are rapidly advancing and could potentially challenge previous assumptions about their technological gap with the U.S. Former Google CEO Eric Schmidt has acknowledged this shift, noting that China has caught up significantly in recent months, raising questions about the competitive landscape of AI development (Source: CNBC)

Performance

The rise of powerful open-source models has enabled developers to build on existing technologies with far less investment, making it easier for smaller teams to compete. Deepseek’s approach focuses on iterating on established models rather than starting from scratch, which has allowed it to close the gap efficiently. This has raised questions about the sustainability of high investment in individual models, especially for OpenAI, which has yet to turn a profit despite significant funding. As the AI landscape evolves, the need for creative solutions may be just as important as capital investment. OpenAI faces increasing pressure to justify its model’s costs against emerging competitors. The changing dynamics suggest that building AI models could be a financial trap, as highlighted by industry voices (Source: WSJ)

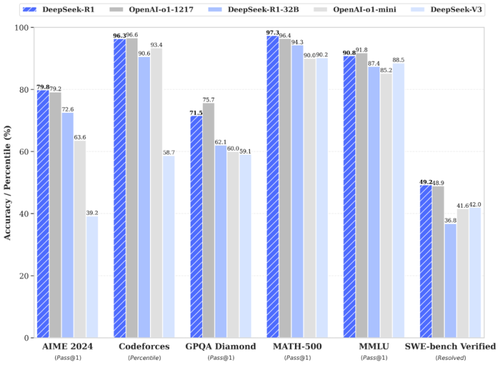

This new open-source AI model outperformed established models, including OpenAI’s GPT-4 and Meta’s Llama, across various tests. These included a subset of 500 math problems, an AI math evaluation, coding competitions, and assessments for identifying and fixing bugs in code. For instance in MATH-500 it recorded 97.3%, compared to its competitor’s 96.4% (Source: CNBC and Link).

Following this achievement, Deepseek introduced a new reasoning model named R1, which also surpassed OpenAI’s advanced o1 model in several external evaluations. Recently, the lab released a benchmark called Humanity’s Last Exam, developed with the assistance of professors in math, physics, biology, and chemistry, who provided some of the most challenging questions imaginable.

How to trade

From a few conversations I have had with various investors this morning, the initial thoughts are similar – negative capex impact and a meaningful change of narrative in the US AI space is worrisome, in terms of R and I in ROI. Can we continue to justify the Investment when/if the Return does not follow? The clear consensus for the time being is cautiously bearish US tech until we hear the upcoming earnings from the mag7 this week including Meta and Google. All eyes on Wednesdays but can you wait to put on below trades until then?

Trade Ideas

Vanilla puts and put-spread

1/ .NDX 21Feb25 97% SQ Put @1.06% Ask 23%iv -24.5%d

2/ .NDX 21Feb25 Put Spread @0.89% Ask -20%d

* 97% P 1x: 0.9993% Ask 22.26iv

* 90% P -1x: 0.1093% Bid 24.43iv

Tactical binary

3/ 21Mar25 NDX < 96% & HSCEI > 102% @ 8.00% Offer, 5.50% Mid

Indivs NDX 23% / HSCEI 41% / Corr +15

4/ 21Mar25 NDX < 95% & USDCNH > 100.50% @ 9.5% Offer, 7% Mid

Indivs EQ 20% / FX 40% / Corr -15

5/ 14Mar25 NKY < 95% & USDCNH > 100.50% @ 10% Offer, 7.5% Mid

Indivs EQ 22% / FX 41% / Corr -10

6/ 14Mar25 NKY < 95% & USDJPY > 99% @ 9% Offer, 7% Mid

Indivs EQ 22% / FX 64% / Corr +50

Max loss=premium paid on all above structures

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her