Uddrag fra Goldman:

Just last week, Ant Group, the Alibaba-linked fintech giant, entered the humanoid robotics industry, joining a growing number of Chinese companies expanding in the hot space. Meanwhile, across the Pacific, Mark Zuckerberg’s Meta recently unveiled plans to develop a humanoid robot, while Tesla has repeatedly showcased its bi-pedal, autonomous humanoid robot, designed to perform unsafe, repetitive, and boring tasks. What’s clear is that global Big Tech’s interest in humanoid robotics has surged.

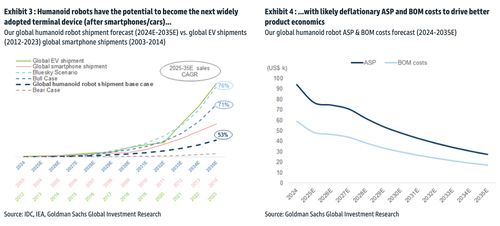

Goldman’s Jacqueline Du, Yuichiro Isayama, and others provided clients with new insight into the emerging global humanoid robotics industry, forecasting that the “fast-growing” sector could potentially expand into a “blue-sky” scenario, where the total addressable market increases from $38 billion to $205 billion by 2035.

“With a significant number of listed supply chain companies, especially in Asia, having publicly disclosed plans to enter or further progress in humanoid robot-related businesses, we see a comprehensive ecosystem taking shape with a fast-growing global humanoid robot demand potentially unlocking US$38bn/US$205bn TAM in our base/blue-sky scenarios by 2035E,” the analysts said, adding, “In addition, given the still early development stage and various possible technology options, we think the competitive landscape will continue to evolve.”

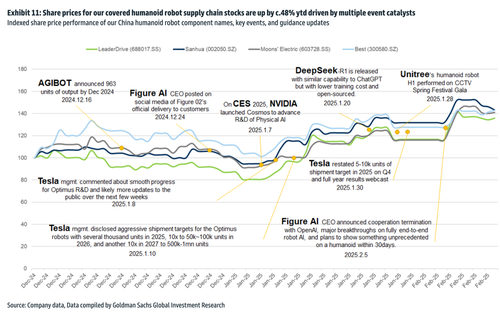

The analysts highlighted the humanoid robotics supply chain stocks in their coverage have jumped 48% on average year-to-date (vs. flat CSI 300), suggesting that the market has factored in about 500,000 global humanoid robot shipments by 2027E (vs. GSe by 2032E/2028E in base case/blue-sky scenarios), assuming a 40X exit P/E multiple.

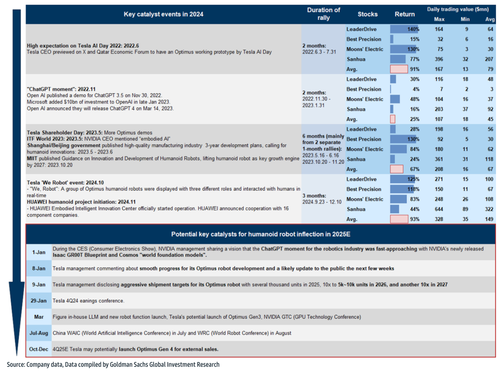

They expect further price gains for humanoid robot supply chain stocks: “With this, we think advancements in embodiment AI, more specifically visibility on the technology inflection point, will be important to drive further share price performance ahead with high sensitivity for both the shipment outlook as well as stock valuation multiples.”

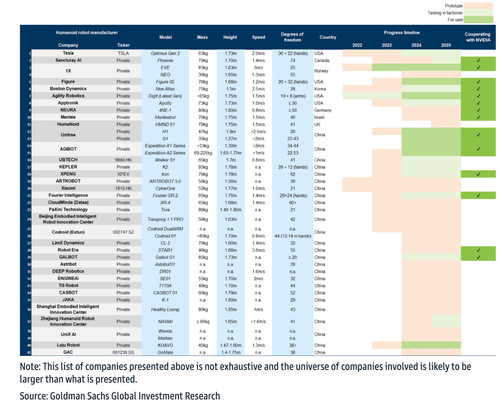

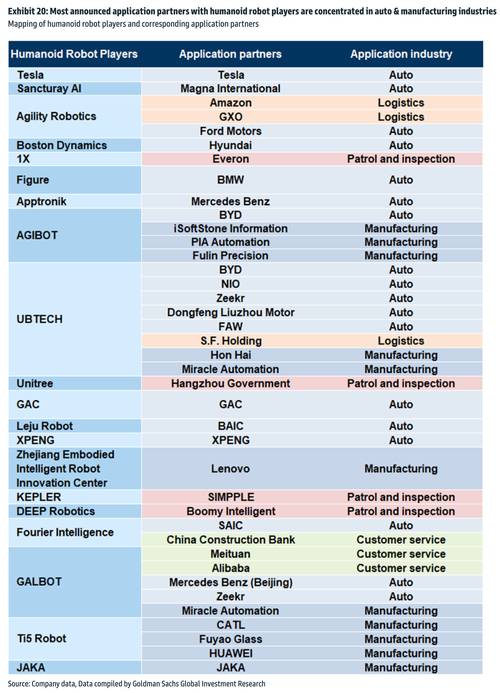

Analysts mapped out the top humanoid robot players with several of these manufacturers entering volume production, such as Tesla/Agility Robotics/Figure AI in the US and Unitree/AGIBot/UBTech in China.

A number of these companies have publicly announced plans to enter or expand their involvement in the space.

Get ready for the robot invasion … the good news is that robot costs will crater, thus driving affordable solutions.

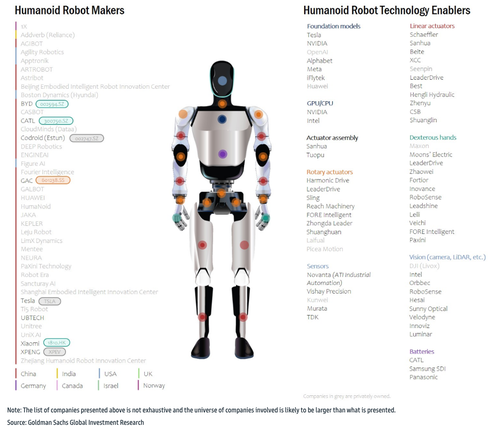

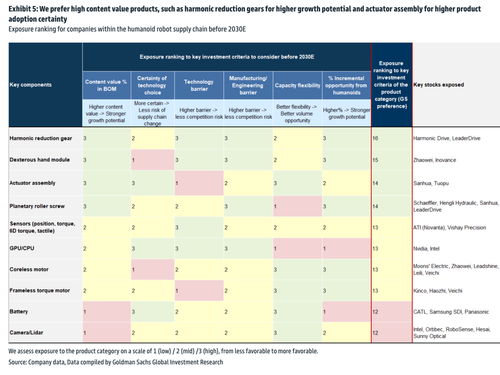

Analysts pointed out that the “best investment opportunity” right now remains in “supply chain component stocks as key robot players are either private (except for Rainbow Robotics in Korea and UBTech in China) or are R&D projects under large businesses (Tesla, Nvidia, Apple, BYD, Xiaomi, Xpeng etc.) which is also the case for robotics foundation model players (Open AI/Google/Meta/Nvidia etc.).”

Additional color on the global humanoid robot supply chain:

Given the AI bubble… What has the market already priced in the global humanoid robot space?

Most of the announced application partners for humanoid robot stocks are concentrated in the automotive and manufacturing industries.

Several positive developments in the tech space plus upcoming catalysts.

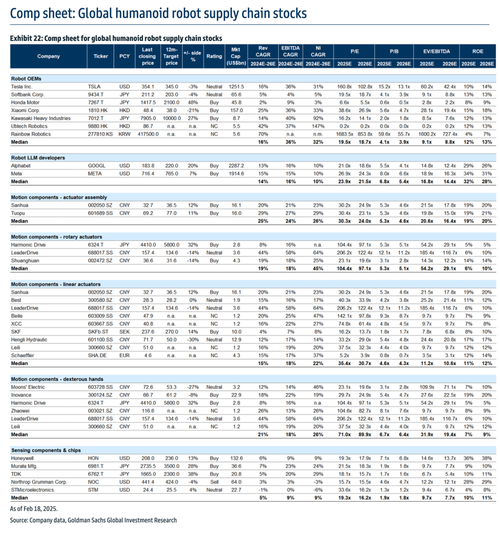

Comp sheet for global humanoid robot supply chain stocks.

Guess we’re just investing in our demise as more than ever: Skynet “secured”…

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her