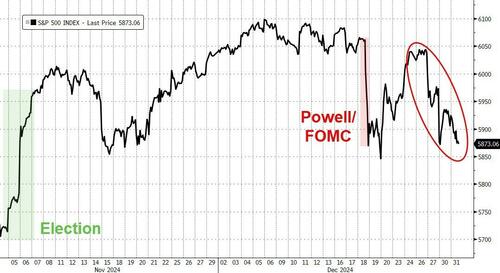

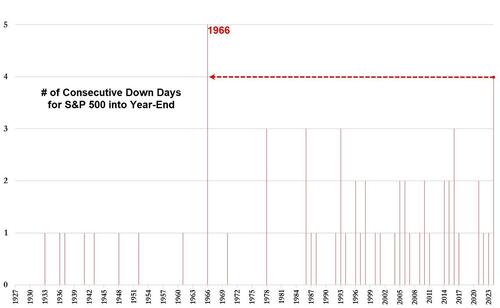

the year ended on a down-note with the S&P 500 down 4 days in a row to end the year…

…something that hasn’t happened since 1966…

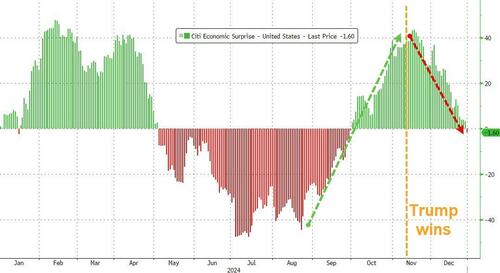

US economic data also ended the year on a definite down-trend, seemingly (mysteriously) turning down right as Trump won the election…

Source: Bloomberg

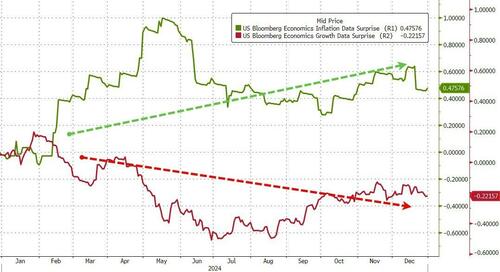

2024 was a stagflationary year with inflation data surprising to the upside and growth disappointing…

Source: Bloomberg

But growth stocks dominated value on the year (second year in a row), helped in the last two months by Trump’s election sweep…

Which drove Nasdaq to outperform its US peers while Trannies ended the year just unchanged…

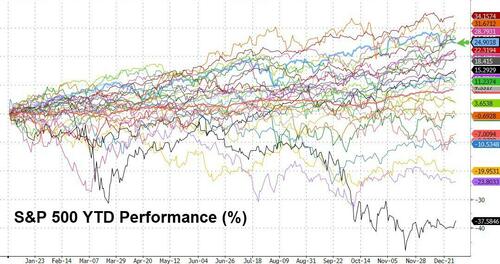

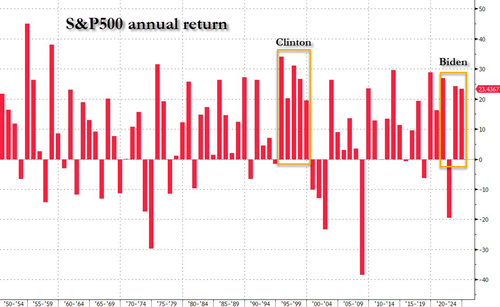

The S&P 500 rose 24.9% in 2024 – almost perfectly matching 2023’s gain of +24.7% (and the best gain since 2021)…

It’s also the 3rd 20%-plus year in the last four – that has not happened since 2000. Clinton was not re-elected after that run… same as Biden wasn’t.

While many would have expected tech to have outperformed but in fact it was banks and consumer discretionary that were best while Materials and Energy were the biggest losers (the post-election moves changed the entire regime with banks – deregulation – dominating as energy faded – drill baby drill)…

Perhaps the most shocking move this year was the pump and dump in GLP-1 drug providers which ended the year basically unchanged (after being up 35% at their peak)…

Of course the year’s big winner was ‘AI’ and everything related to it…

…but Powering and building the Data Centers for AI actually outperformed…

However, while mega-cap tech soared after Trump’s election victory, they have gone nowhere for the month of December…

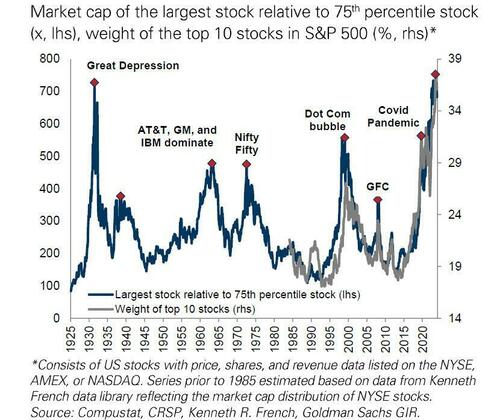

It may not be entirely surprising given the almost unprecedented level of concentration in the market…

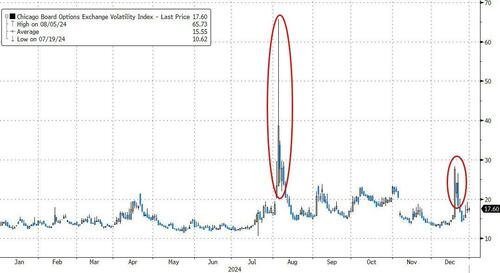

VIX is somewhat elevated to end the year having seen two significant spikes this year – with the early August vol-splosion the stand-out…

The US Dollar soared over 7% higher against its fiat peers in 2024 – its best year since 2015 – with most of the gains coming after The Fed started hiking rates and Trump won…

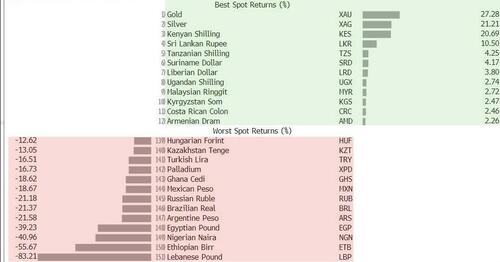

The Lebanese Pound and Egyptian Birr were the worst performers against the dollar in 2024 while the Kenyan Shilling and Sri Lankan Rupee outperformed (along with the precious metals)…

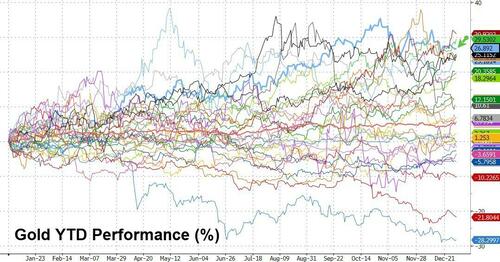

Despite the dollar strength, gold also soared in 2024 to a new record high…

In fact, it was gold’s best year since 2010…

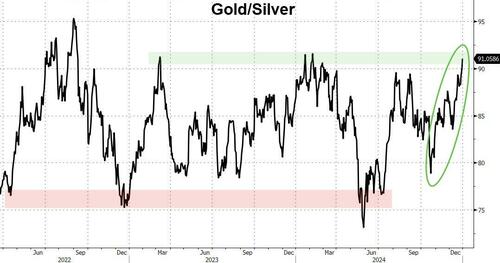

Silver also had a big year BUT the Gold/Silver ratio pushed up to multi-year highs as the year ends…

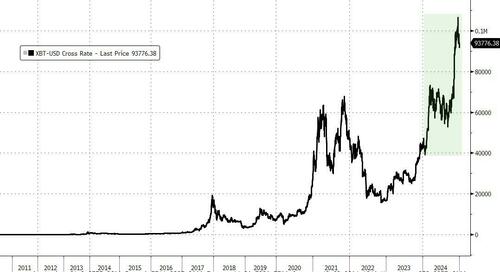

For the second year in a row, Bitcoin’s annual gains topped 100% (+156% in 2023, +119% in 2024), pushing it to a new record high also…

Bonds had a very mixed year with the short-end actually seeing yields lower (by 2bps) on the year while the long-end surged (30Y +71bps)…

The long-end yields have risen for four straight years with 2022 standing out (+194bps), but 2024 stood out for its massive curve steepening (2s30s +74bps) – the biggest steepening year since 2013…

It has been a surreal year for Fed expectations with Dec 2025 pricing swinging from 3.2% to start the year to 4.50% in April to 2.8% in September to around 4.00% to end the year…

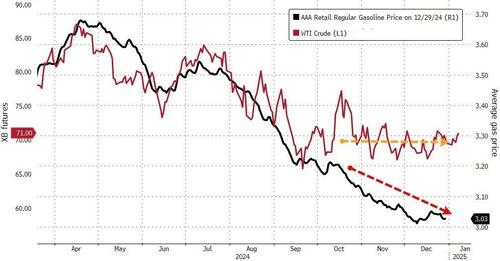

Oil ended the year basically unchanged having traded in a tight range ($67-72) for the last four months as pump-prices kept falling…

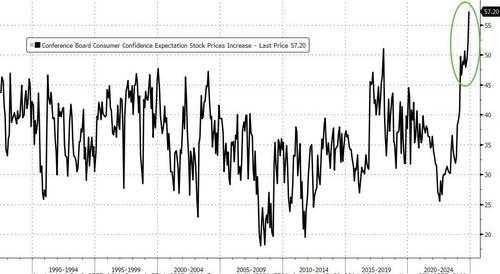

Finally, as a reminder, Americans have never been this confident that stocks will rise in the next 12 months…

We wish them luck… As Warren Buffett’s favorite indicator shows – stonks have never been more expensive.

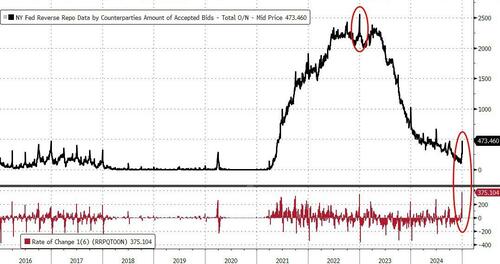

And given the massive (record) surge in demand for the Fed’s Reverse Repo facility into the year-end, we would expect a massive liquidity suck out to start the new year….

Happy New Year!!!