Saxo Banks Chief Investment Officer, Steen Jakobsen, kommer med endnu en advarsel om markedsudviklingen, og denne gang er advarslen kraftigere end tidligere. Han taler om nødsignaler, som investorerne ikke må ignorere. Energipriserne er eksploderet og vil føre til højere inflation, som kan føre til kursfald. Kursværdierne på aktierne har aldrig været højere. September og oktober kan blive meget vanskelige måneder. Hvis det ender i endnu en nedtur, kan regeringer og centralbanker føle sig forpligtede til at komme med mere stimuli, og det kan af politiske grunde føre til flere grønne investeringer. Men de løser ikke energibehovet her og nu. Vi kan stå over for en energikrise, der overskygger klimakrisen. Det er altså en særdeles farlig krise-cocktail, der truer. Saxo-advarslen med dens grafer er værd at have i baglommen i efteråret.

Macro Digest: Don’t ignore the distress signals of the market

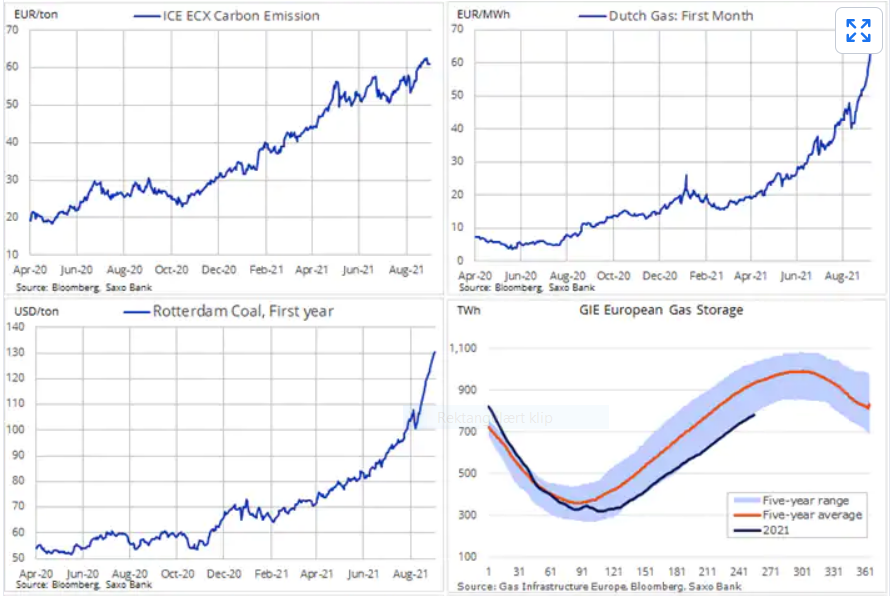

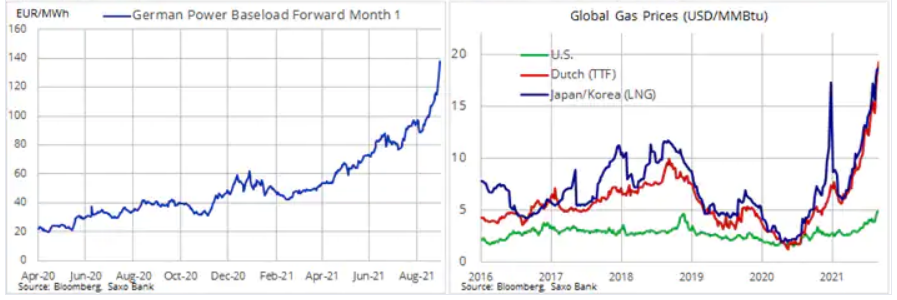

Summary: Inflation seems to be the only factor that can change the direction of the stock market. Energy prices are now trading between 50% and 500% higher than average, depending on the fuel, and this represents a tax on consumption and business profits. We expect falling profit margins from here, but also a fragile risk market as interest rates looks ready to move higher to counter this cost pressure. This article looks at valuations, energy and the realisation dawning on market: the physical world is too small for the ESG focus and Green Transformation.Steen Jakobsen

Chief Investment Officer

- What: There is need to reduce risk into Q4 – Stagflation light is a real risk.

- Why: In the official narrative, inflation is moving from “transitory” to “temporary” (but is actually structural in our view) with waning real growth as energy prices are out of control. We are talking about 2-3 times more expensive energy costs for consumers and companies. This will hit margins and is a tax on growth.

- What to do: No reason to panic, but reduce risk or buy protection. Long volatility or Long puts.(Talk to your account manager or GST support for ideas…) Alternatively or in addition, look to buy Commodity Indices which continue to perform under supply constraints and rising energy demand. (See the example below).

- What else: Seasonality is bad in September and October and the German election could lead to Bund yields rising, Middle East (Iran, etc.) could see crude oil above $80.

- Saxo Strats views: We are moving to reduce only on equity exposure until further notice and buying PUT on US indices….

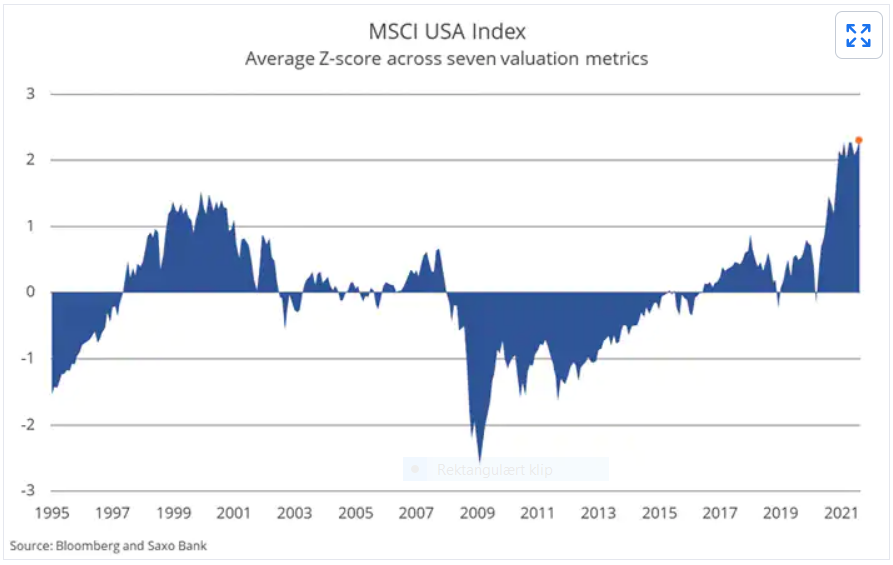

Chart: our internal valuation model. Below is a Z-score model derived from seven different measures of the stock market valuation. This is to avoid bias in data, but this chart is clear: the market has never been more expensive, ever!

On top of this several chart lines are at risk …. Most of them originating from the pandemic outbreak lows in 2020…..

Then this from Kim Cramer Larsson – our in-house chartist:

“With its close below support at 34,714 Friday Dow Jones Industrial Average Index has established a bearish trend. RSI below 40 is confirming the bear picture and we could see lower levels over the next week or so.

To reverse the downtrend a close above 35,510 is needed. First warning of that scenario unfolding would be for the Index to break back above the rising trend line its broke last week.

However, what is interesting is that the Future has not yet confirmed a bearish trend. The Future closed just above its support at around 34,572 Friday and has started the week on a positive note. However, RSI dipped below 40 indicating negative sentiment meaning the support could easily come under pressure next few days. A break and close below could fuel selloff down to strong support at around 33,285.”

Cost pressures / Inflation remain very underestimated:

And then there are inflation expectations, which have seen in a seismic shift by some measures, including the New York survey of 1- and 3-year forward inflation expectations. Fed officials often refer to whether inflation is well-anchored – in our view, it is rapidly becoming downright unhinged. A further rise in rates to reflect these higher inflationary outcomes and rising expectations is coming and soon, driven by supply chain disruptions and this massive increase in energy input prices. I advise several companies, speak in front of even more, and none have hedged this move – not a one.

Conclusion:

Only inflation can stop this equity market, it’s that simple. And we know the response function from policymakers as well. If or when this market drops, then ever large fiscal and accompanying monetary interventions will be mobilized and most of it tilted to more ESG and Green Transformation priorities.