Saxo Banks investeringschef Steen Jakobsen er i tvivl om centralbankchef Powells rentekurs. Han mener ikke, Powell er kommet med en klar melding om, hvordan renten kan holdes på det lave niveau. Hvordan kan USA blive ved med at tiltrække udenlandsk kapital til den rente? Den måde, som et gigantisk infrastrukturprogram skal udvikles på, kan føre til en kraftig inflation og dermed igen rentestigninger. Hvordan kan centralbanken håndtere en inflation, der får lov til at stige kraftigt i år, hvorefter den skal være lavere de næste par år? Der svæver alt for mange spørgsmål i luften efter Jerome Powells udmelding i denne uge.

Macro Digest: Doing a double-take on the FOMC meeting

Summary: The initial read on the FOMC meeting yesterday was straightforward and the market celebrated the Fed indication that it will not lean against the economy or inflation in coming quarters as the US emerges, possibly white hot, from the Covid pandemic.

But a bit of deeper thinking on important longer term questions about the sustainability of rising debt levels amidst rising longer yields is cause for pause. Steen Jakobsen, Chief Investment Officer

The quick conclusion on the FOMC meeting yesterday is that the Fed will allow both the economy and inflation to run as hot as they want to.

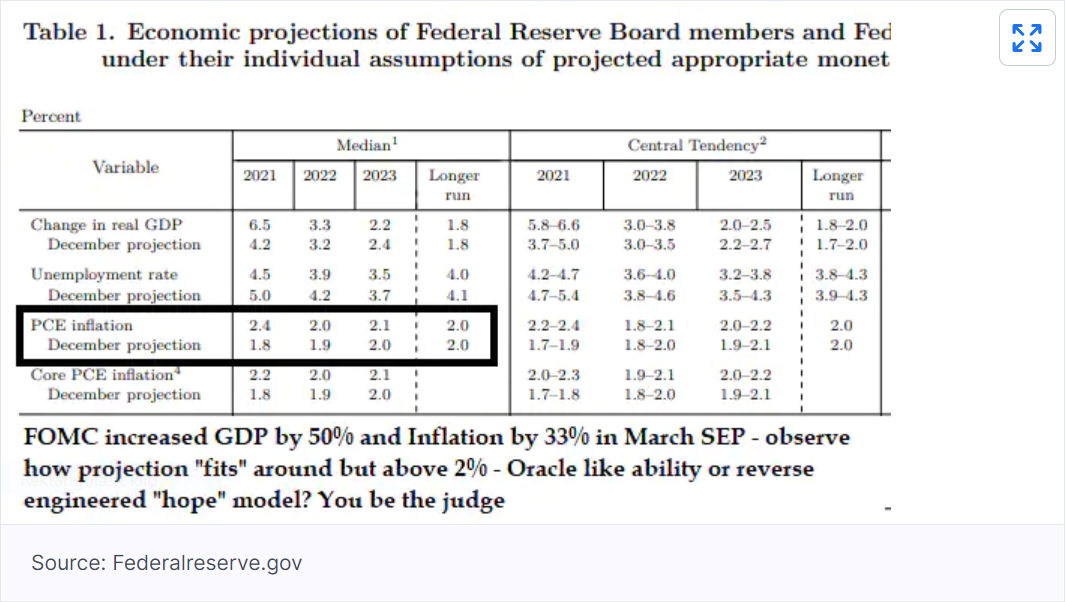

We got a clear definition of what the desired level of inflation is for the Fed from Chair Powell: above 2% for a sustained period. And sustained really does mean sustained. In other words, the Fed says it will ignore the wild incoming inflation prints that will arrive in coming months due to the spring-summer basing effects from the collapse in prices late year during the Covid outbreak. The Fed staff projections suggest that inflation will rise significantly this year, but ease for the following two years – effectively placing all of its chips that inflationary pressures will be transitory.

But I have a hard time understanding how the Fed mathematically will differentiate between transitory and sustained inflation. When does the former end and the latter start?

While the Fed clearly showed it does not want to touch the Fed funds rate or the issue of tapering until inflationary outcomes are clear, we did not get any hint of how the Fed sees its role in the asset-liability management of the Fed balance sheet, and overall the $28 trillion of USD public debt.

The CBO office estimates that the US will consistently run a deficit in excess of 5% of GDP every year to 2050. Currently, the pace of Fed QE purchases is just under $1 trillion per year, which is just below 5% of GDP in a year that is forecast to produce a deficit of 14% of GDP and next year 7% (although that could be far higher with new stimulus/infrastructure). As such, there must be an “upper bound” to what real rates the US can pay to keep the ship afloat, given the blitz of incoming treasury issuance.

This part remains ignored, at least in communications, from the Fed and remains the biggest equation to solve for. At what yield level at various points on the yield curve will the US be able to attract capital – not only domestically where the savings rate has been very high during the pandemic, but from the rest of the world?

How this FOMC meeting impacts risk sentiment is difficult to distill into a single up/down call. The easy call is to say that this is risk positive because the Fed will not stand in the way of an economy realizing its maximum near term growth potential and that the post-vaccine normalization will see blockbuster growth numbers on returning demand, with supportive government and central banks cheering it on.

The big “but”, however, is at what price? US fiscal dominance will crowd out private investment, increase regulation massively, and given the priority of the Green transformation, will allocate too much capital into a physical world constrained by the supply of needed resources and infrastructure.

A green transformation is of course needed, but governments are making the process difficult for themselves by doing what amounts to the construction of a railroad in reverse. Normally you would lay down the tracks, before ordering and producing the trains. Not so in 2020s, where we are building the trains (EVs) and deal later with the tracks (Green electricity production and necessary infrastructure).

This disconnect will be expensive and inefficient and will continue to drive up prices in everything from corn, to metal and on to timber as the investment in the black energy that still drives nearly everything will mean higher energy prices. Inflationary pressures will translate to lower margins, lower earnings, higher funding costs. I think you get the drift by now.

My real conclusion is that too many questions remain unanswered by Fed, despite a valiant effort by Chair Powell yesterday. For me, the Fed is running a dogmatic model of focusing on full employment at all costs, regardless of inflation and higher rates. This at a time when the data, due to the pandemic and policy response, is too volatile to be useful. The collapse of GDP last year and the strong recovery now confuses the Fed’s linear models as well as most people in the market.

My point here is that the driving forces of risk: the convexity as long interest rates rise, mean that big impulses come from seemingly small moves and become reflexive. This is the exact opposite of linear models used for most economic predictions. Beware of this risk over the next month or two. By allowing the economy to run hot and inflationary, the Fed is signaling more volatility and more negative convexity. That to me is the real conclusion.

In practical terms I remain neutral on markets until I get clear signal from break-evens, Gold, and the US dollar. For now I fear that we are still unresolved and without a plan for post pandemic resolutions to deficits in productivity and debt. Debt starts to matter when rates go up, and yesterday the Fed confirmed and “allowed” the market to take nominal rates higher. That’s a big risk to take.