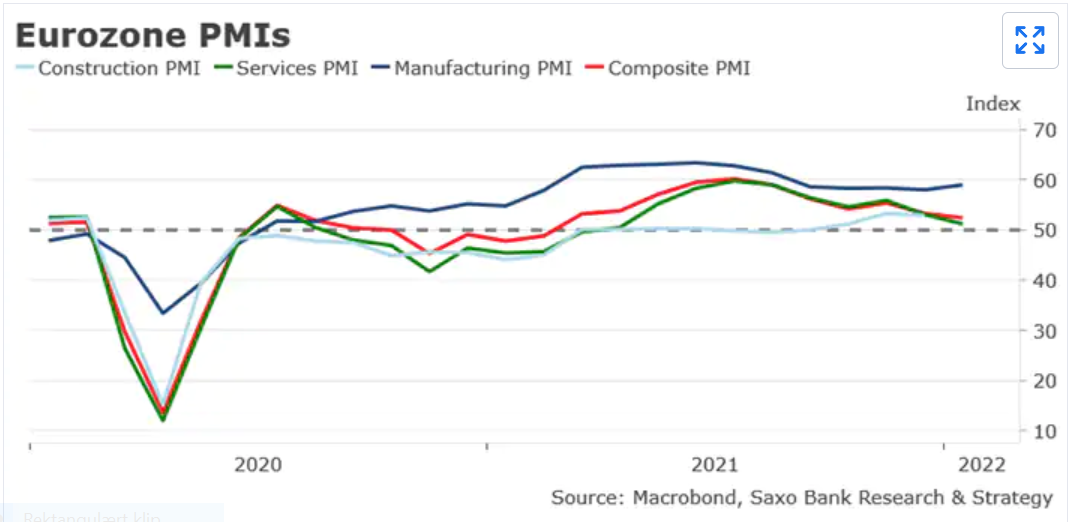

De seneste PMI-tal for produktionen i eurozonen viser, at der er råstyrke i den europæiske økonomi. Saxo Bank venter dog, at der fortsat vil være svage tal for dette kvartal, men der er tegn på fremgang trods Omicron. Inflationen volder stadig hovedbrud for ECB, men Saxo Bank tror ikke, at ECB vil skride til rentestigninger foreløbig, da flere medlemmer af ECB-rådet ikke mener, at tiden er inde til at stramme kursen. Det samlede PMI-tal faldt i januar til 52,4 point, men PMI for industrien viste en svag fremgang til 55,8 point.

Eurozone PMI held well in January despite the Omicron variant and higher costs

Summary: The results of the monthly survey of purchasing power show the eurozone economy is resilient despite the spread of the new Omicron variant and higher costs. Expect GDP growth to be slightly weaker this quarter. But there is a bright side: manufacturing problems continue to ease and the German economy has rebounded in January after a weak end of 2021.

The inflation headache remains but we doubt the European Central Bank (ECB) will act anytime soon to counter inflationary pressures. Over the past few days, several Governing Council members (Klaas Knot, Gabriel Makhlouf for instance) have clearly stated this is too premature to withdraw stimulus and hike interest rates.

Supported by an adequate fiscal policy, accommodative monetary policy and eased financial conditions, the eurozone economic recovery continues in early 2022 but at a slower pace than in 2021. Eurozone manufacturing is going from strength to strength. It improved further from 53.8 in December to 55.8 in January.

Manufacturers mentioned two positive factors: less shortages for critical inputs and easing of transportation delays. From an inflation perspective this is positive because it reduces the upward pressure on producer price growth, though it does not disappear. Other factors are contributing to push inflation higher, such as energy costs and wages in some countries. There are pending issues too, for instance backlogs of work.

It will certainly take months for businesses to realign production with demand, especially if demand remains strong. As the services sector was hit by restrictions implemented to contain the Omicron variant and the services PMI reached a 11-month low, the composite output PMI declined to 52.4 in January from 53.3 in the previous month and slightly below market expectations of 52.6.

This is the second consecutive month of slowing growth. We consider growth still remains well-oriented in the eurozone. But there is a change of momentum. GDP growth is likely to be lower than expected this quarter. Some countries will surprise on the upside (Germany for instance) while others will disappoint (France).

Key details from the flash PMI report:

- Price pressures remain a major issue with input cost and output charge inflation holding close to record highs. Markit notes that « rising costs remain a concern for businesses, with the survey data showing that input prices are continuing to rise sharply and on multiple fronts ». Expect higher prices to be passed on to consumers and subcontractors whenever possible. This might have a negative impact on consumption. It could ultimately force the European Central Bank to adopt a more hawkish stance too.

- The Omicron variant is leaving a mark on the services sector, especially in countries where tougher restrictions have been introduced (i.e. the Netherlands, curfew in Catalonia etc.). But there is growing evidence that businesses and consumers alike are learning to cope with Covid and associated restrictions. Hopefully, we are getting close to the point where the virus will become endemic and will have a much less impact on the economy. On January 23, the WHO Europe Director, Hans Kluge acknowledged « it is plausible the region is moving towards a kind of pandemic endgame » as the new variant could infect 60% of Europeans by March (which is close to the level of herd immunity).

- Whereas the French composite PMI softened to a 9-month low of 52.7 as the services sector saw a marked slowdown due to weaker demand and staff shortages, the situation in Germany improved unexpectedly with a strong rise in the manufacturing sector from 57.4 in December to 60.5 in January. Supply bottlenecks showed further signs of easing, which resulted in a higher than expected manufacturing PMI. This seems to indicate the German economy has rebounded in January after a weak end of 2021.

- The UK flash composite PMI slipped to 53.4 in January from 53.6 in December. This is much lower than expected (55.0). Consumer-facing businesses were hit by the spread of the variant. But the main issue is related to higher cost, like in the rest of Europe. The gauges of costs paid and prices charged by services companies – watched closely by the Bank of England (BoE) – increased in January again after easing back in December from recent all-time highs. We forecast the BoE will hike interest rates at least three times this year, in February, May and August in order to contain inflationary pressures. Each hike is likely to be 25 basis points.