2020 vil vise en højere inflation, og det bliver meget svært at få to-cifrede aktieafkast. Emerging markets og Asien samt cycliske aktier er de bedste muligheder, men en mulighed er også energiaktier på grund af mulige højere oliepriser.

Uddrag fra Saxo Bank:

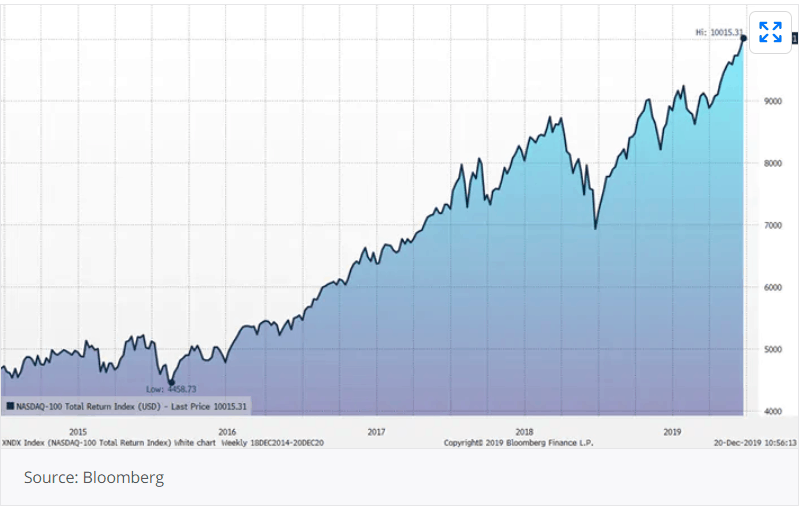

The return in global equities have been much higher than even the wildest fantasies of market participants back in early January last year. Significant positive impulses from central banks and commitments of fiscal spending seem to have stopped the bleeding with global leading indicators suggesting the global economy moved into the recovery phase in October. What does that mean for equities in 2020?

We are leaving 2019 with a feeling of bewilderment and a sense of “can this really continue?”

If 2020 becomes the year of higher inflation and nominal growth then the most recent reaction function during the 2016-2018 nominal growth acceleration is a good guide. In this period nominal growth in the US rose from 2.3% y/y to 6% y/y and the 10-year yield rose from around 1.5% to 3.1% before the wheels came off during Q4 2018. If a similar scenario plays out but with the add spice that the Fed keeps the short-end of the yield curve under control despite rising fiscal deficits then we will see a massive steepening for the yield curve. In this scenario investors should overweight financials and under the inflation trade overweight the materials sector.

One thing is for sure going into 2020. Global equities have discounted a significant rebound in economic activity and profits inflating equity valuations to the high end of the historical spectrum. This means that even under good conditions in 2020 equity returns could be muted despite higher activity in the real economy. The only case for double digit equity returns again next year is a melt-up scenario as in 2000.

As we have been writing about lately the global leading indicators from OECD showed in December that the global economy turned a corner in October transitioning into the recovery phase. Historically this phase has been the best phase for equities on a relative basis against bonds. The excess total return in USD has been 9.4% during the business cycle phase. One possible path next year to this historical relationship is bonds down 10% during the recovery phase and equities unchanged. This could happen as inflation expectations creep higher and with it yields. This would in turn reach an inflection point where high duration growth assets such as technology stocks are hit on valuations as the discount rate suddenly becomes too high to justify the valuations.

As our business cycle map indicates the big trade right now is emerging market and Asian equities. This trade would also fit with a lower USD as the Fed does everything to keep rates low despite a rising US deficit which naturally leads to another round of QE and increasing balance sheet. On a sector level investors should overweight cyclicals and as a joker consider the energy sector as a supply constraint could force oil prices higher next year; this is by no means a consensus view.