Inflations-presset i Europa bliver kraftigere end ventet, fremgår det af Saxo Banks Macro Chartmania. Et såkaldt surprise-indeks fra Citigroup viser langt kraftigere stigninger i Europa end i USA. Saxo Bank siger, at inflationen bliver en udfordring for ECB. Inflationen drives i vejret af forsyningsvanskeligheder, høje energipriser og voksende lønninger, især i Tyskland. Det kan påvirke kursudviklingen på aktiemarkedet. Saxo Bank vurderer, at det vil give small cap-aktier en fordel i forhold til de store selskaber. Det viser historien med stigende inflation. De mindre selskaber bliver en slags sikker havn i disse situationer.

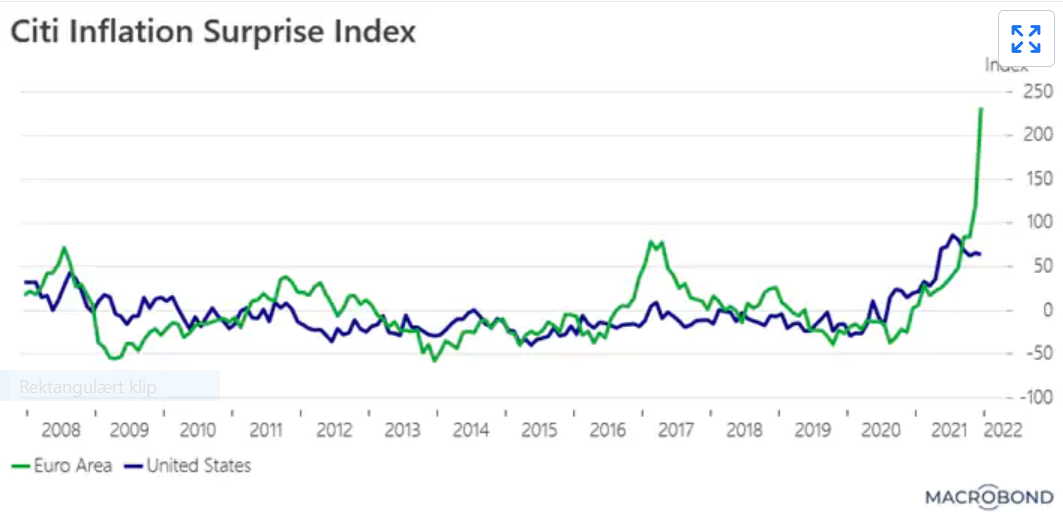

Chart of the Week : EZ inflation surprise index jumps to its highest on record

This week, we focus on Citigroup’s inflation surprise index which measures inflation figures relative to market expectations. Our chart compares the evolution of inflation surprises in the United States and in the eurozone.

Click here to download this week’s full edition of Macro Chartmania. More than 100 charts to follow the latest market and macro developments.

Our chart shows that for the eurozone, the level of surprise has hit its highest level on record. Inflation surprises have run comparatively hotter in the eurozone than in the United States where they have peaked.

The market has clearly underestimated the inflation risk in the region – and there may be more upward movement to come in the short term. The eurozone price producing index for November will be released later this morning (at 1000 GMT).

Expect a new surge to 22.9% year-over-year versus prior 21.9% in October. This will fuel a higher consumer price index in the coming months. The increase in prices is becoming so painful that companies have no other choices but to pass along costs to consumers to preserve margins.

What are the drivers behind this acceleration ? Are they here to stay ?

Base effects are a significant contributor. But it should not play a major role any longer. The removal of VAT base effects in Germany (which is a key contributor to the overall eurozone inflation) ensures a fall from Q1 onwards.

There is also an emerging debate about wage-price spirals in the eurozone. Wage agreements have indeed been higher in several countries (especially Germany). But there is no evidence in the recent data that the eurozone wage pressure is building up.

On the contrary, supply bottlenecks coupled with higher energy prices are two major factors behind the rise in inflation. Bottlenecks in Asia will be persistent as long as China follows a strict zero Covid strategy. Don’t expect China to re-open its borders this year (see this excellent article from The Economist). On 3 January, Moller Maersk, the world’s largest container shipping company, indicated that transportation bottlenecks are not coming to a halt any time soon. The company expects that transportation costs will stay elevated most of 2022.

The question remains whether the recent fall in energy prices (particularly natural gas prices) will persist. Without any spare gas production capacity left in Europe, the demonstrations in Kazakhstan – a net gas exporter (15 bcm in 2020) could have an impact on the local production and push European gas prices higher again, in the short term. But the energy component (9.5% of the headline HICP) could ease from March/April onwards with better weather conditions.

That being said, we believe inflation will remain on average still uncomfortably high this year in the eurozone. It will thus seriously challenge the European Central Bank’s accommodative stance. The services component (41.8% of the headline HICP) could still be a headache, in our view. The second biggest increases in prices were seen in services in November’s data, just after energy. There is no clear indication this will ease anytime soon. This was confirmed by the release of the eurozone December final services PMI yesterday morning.

Although there was a marginal easing of price pressures, the eurozone is still in excessively hot territory – increases in both input and output costs were the second-quickest on record.

How could the equity market perform in a regime of higher inflation ?

Inflation has been a volatility-driver for the equity market. Historical returns for the equity market tend to be lower when inflation surprises are higher.

There is also the historical tendency for small cap stocks to perform significantly better in those high inflation surprise zones than tech and large cap stocks. The simple explanation behind that is smaller companies can manage inflationary pressures more quickly than larger ones. Small caps serve as refuge from price increases for investors in periods of higher inflation. This will certainly happen again in 2022.

See our Inflation Watch to find out how the return of inflation could impact the financial markets and get actionable investment insights and strategies.