Steen Jakobsen fra Saxo Bank kommer med en utvetydig advarsel til investorerne. Han bruger det gamle udtryk: Sell in May and go away. Han ser nemlig en række risici på markedet – meget høje værdiansættelser og geopolitiske spændinger samt det tyske valg, der kan ændre finanspolitikken i Europa. Det øger alt sammen risikoen for markedet, og han er enig med analytikere i USA, f.eks. hos Morgan Stanley. Derfor bør investorerne reducere risikoen markant i den kommende måned.

Macro Digest: Sell in May and go away. Also, German politics turning hard left!

Summary: Sell in May and go away… We are reducing risk into May as global liquidity, internals and valuations have gone too far. Reduce to 50% of exposure by the end of April.

Reasons why?

- Expected return after incredible run higher indicates a loss 75% of the time (BofA source)

- Geopolitical risk is rising: Navalny and Russian troops on Ukraine border, Iran, China vs. USA, Taiwan, with wide ranging impact beyond politics: Energy prices, semiconductors flow, marginal recycling of capital to finance US deficit.

- We see both commodities & yields rising from here. There is slowly a recognition that inflation is structural and an “under-measurement” of realised inflation, bottlenecks getting worse, and now companies are repricing products higher.

- The credit impulse has peaked in China, the US and UK, only Europe now “waiting” for opening. The marginal change of earnings, rates, flow, liquidity means higher inflation + price of money.

Policy response: We fully expect a massive fiscal spending increase in Q3, when rising inflation + price of money meets the post-opening economic reality. China GDP for Q1 was disappointing in composition, we expect similar outperformance on headlines in US and Europe, but without a forward carrying momentum.

So H2 will see rising 10Y to 200 bps then 250 bps, on the back of equal moves in the term structure (on rising deficits) and inflation expectations. This will create havoc and a need for further intervention. The Fed and ECB are far, far, far behind the curve as illustrated by both the rise in German Bunds (+35 bps since the beginning of the year) and the US long yields rising in reaction to a huge earlier rise in breakevens.

I find it a struggle to navigate the present macro environment of low volatility, high correlations, and low volume, but fortunately sometimes a fellow macro traveler, in this case Michael Wilson of Morgan Stanley can aspire me to think “differently” about the market.

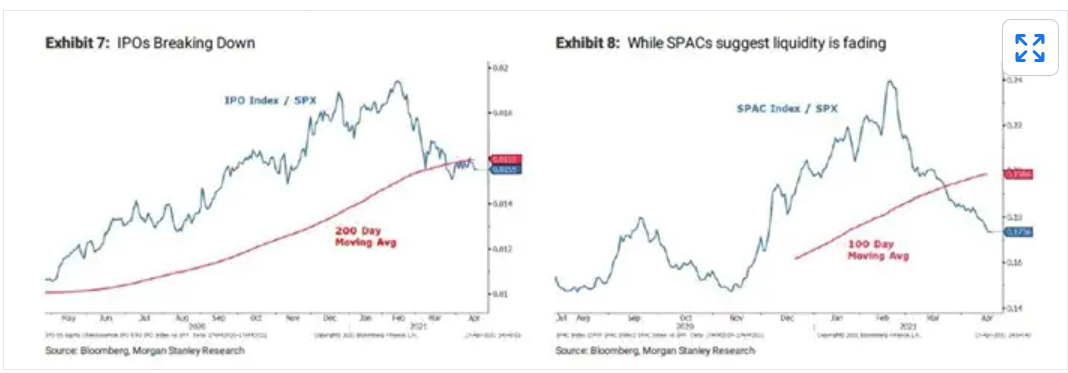

Morgan Stanley and Michael Wilson are noticing that the IPO and SPAC space is losing momentum and as such could be “… a warning sign on real time liquidity dynamics”…. I will freely interpret this to mean that the recent heavy load of IPOs and SPACs has been so large that they take liquidity from the rest of the market and in the process make fund managers sell some names to make room for the new ones.

We also have crazy stories like the valuation of the New Jersey Deli listed in the US with a market cap of $120 million. Greenlight Capital’s David Einhorn notified the market about that one.

Meanwhile the market overall is powering to new highs, the S&P 500, the Nasdaq 100 hit all time highs and the EURO STOXX 50 is hitting a post-global financial crisis high, under the umbrella of fiscal dominance….paying for shortcomings on earnings, yield and market functioning (price discovery).

Another great note is from BofA global research named: Five reasons to curb your enthusiasm (on US equities):

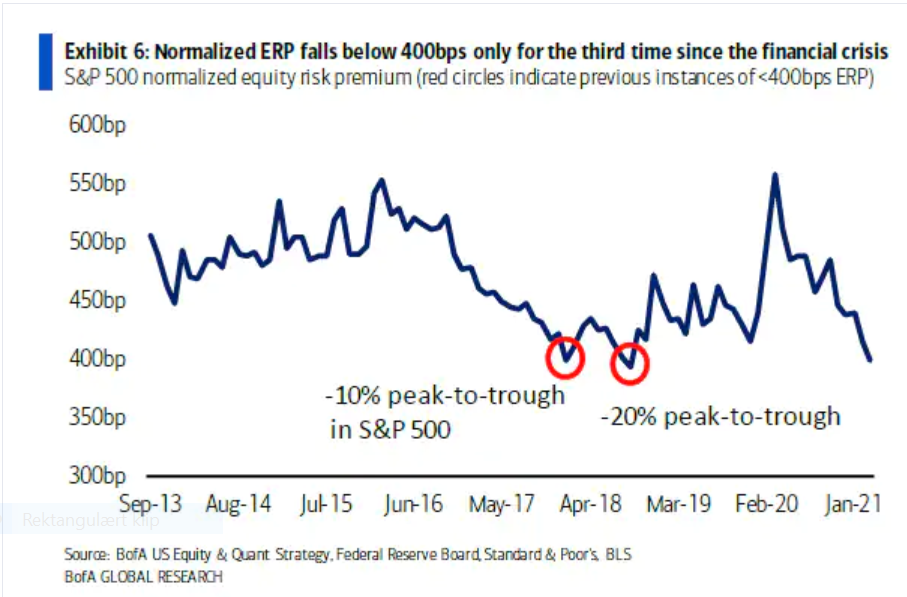

The five reasons amount to: Euphoria (according to their sentiment measure), S&P 500 Index expected return now less than 2% for next decade, the outsized 12-month performance from March 2020 to March 2021, is >50%, which has not been seen since 1936, the fair value model @ 3635 S&P, the Equity Risk Premium is below 400 basis points – only happened twice before: Jan 2018, Sep 2018, with -10 and -20% return following.

Finally, we need to talk about Europe, but in particular Germany. The 10YR German Bunds have risen over 50 basis points from the lows and about 25 basis points since the beginning of the year.

The likelihood of a Green Party government is rising by the day, compounded by a corruption scandal related to PPE procurement hitting the ruling CDU/CSU government, as well as the infighting between the CSU and CDU. The Green Party is extremely Pro-Europe, meaning that a future government with the Greens would increase not only the spending on the green transformation, but also on deeper European integration. This is music to the ears for the likes of Draghi and Macron.

Geopolitically, the Greens are distinct in that they have promised to close down the Nordstream2 pipeline that provides natural gas directly from Russia and is nearly complete. I personally think Germany has already moved 120 degrees from the frugal, austere fiscal approach of the 1990s and 2000s, but if the Greens have the election they are expected to have, then Europe will be changed overnight.