Saxo Banks cheføkonom Steen Jakobsen er på banen igen med en analyse, som mange vil betragte som provokerende, og han siger selv, at mange vil opfatte ham som marxist. Men han er liberal. Dog erkender han, at kapitalismen i mange år er løbet af sporet med voldsomme prisstigninger på aktier og ejendomme, nulrenter og enorme stimuli. Det har ført til voksende kløfter mellem de rigeste og resten, mellem boligejere og lejere, mellem unge og ældre, mellem uddannede og ikke-uddannede. Vi har en kulturkrig, og det viser sig også omkring centralbankers og regeringers støtte til økonomien, en støtte, der forværrer kløfterne. Derfor foreslår han, at cntralbanker og regeringer holder en pause på ti år og intet gør – ingen stimuli. Nu må markedet finde en naturlig balance, mens klimakrisen bliver løst.

Macro Digest: Why now is the right time for policymakers and central banks to do…nothing!

Summary: The market is pre-occupied with the woes in the Chinese real estate sector, but my macro take remains is that China is merely dealing with the inevitable now rather than later and what is happening there will eventually happen in the rest of the world as well. And everywhere, we may already well on our way into a new phase for this market as our misguided policy hopes are running up against the cold hard reality of the limits of the physical world. Steen Jakobsen

Chief Investment Officer

The market is pre-occupied with the demise of China’s real estate sector, but my macro take remains one of “what happens in Vegas, er, China, won’t stay in China” and will have to happen in the rest of the world as well. The only difference here is the timeline – which in China’s case is here and now while in Europe it will emerge from unsupportable demographics as ever more young voters are disenfranchised just as the largest demographics with bloated pension accounts are set for retirement….

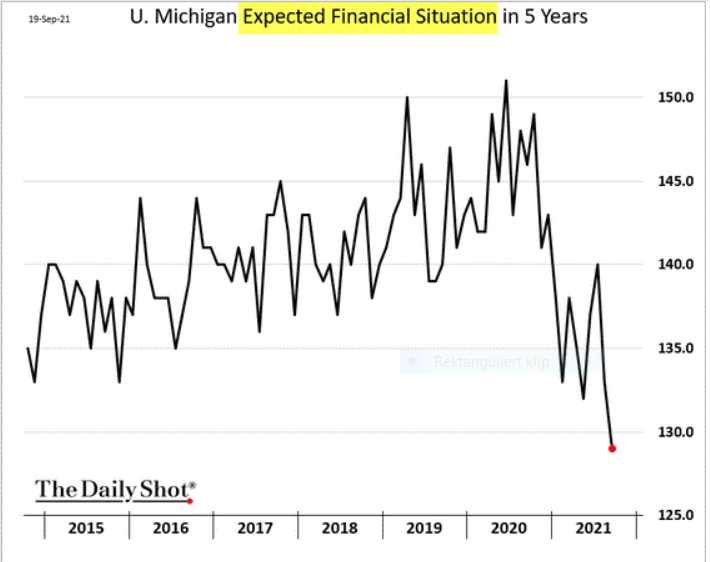

The access to important aspirational assets like a well paid job and especially a decent house or apartment, has never been worse for the “have nots”. And it’s a direct consequence of the failed monetary policy of “trickle down” policies. QE and liquidity provision reward the already wealthy by pumping up asset values, so much so, that the idea I have stated earlier that “Karl Marx had the model right” is playing out again.

Karl Marx got a lot wrong but his model of capitalism – he did invent the word, after all – is correct: Capital, labor and investment need to be allocated and float (upwards) simultaneously. Before some left leaning newspaper gets the wrong idea, I am still a card carrying, socio-liberal economist with a taste for objectivism and liberal thinking, but first and foremost I am a “thinking human being”, who believes justice, social contracts and equal opportunity to access what our world has to offer drives us all to a better life and world.

Here comes the kicker: We are now into early phases of a “Culture War” between young vs old, state vs. private ownership, privacy rights vs. all dominant “platforms”, freedom of speech vs. dictated political correctness, educated vs. non-educated, home ownership vs. renters, rentiers vs. productive alternatives, tunnel thinking-narratives vs. open societies, but not least productive vs. non-productive (in some cases zombies companies dragging our economy’s potential down).

We have the highest ever stock market, house prices, energy prices (as a % of cost to household), liquidity, fiscal expansion and all at the same time? The result is clear for everyone to see. Something is broken. Surely more of the same will not help?

- We live in most un-productive economic system ever. The record low negative real rates proves that point.

- We live in society where the physical world is too small for political and policy responses. The more we want to “do right” – the worse we will make it.

- The ESG initiative is the largest and most expensive political project ever mounted and will act as a driver of values, elections, and what economic actors can gain access to capital. If it doesn’t work, then more will be needed, making the first two points above even worse.

- There are ever fewer people in poverty according to the UN and World Bank, but their deficit in terms of disposal income is alarming and increasing……

The worst part: all policy actions we will see this autumn will make things worse not better:

- More liquidity will accelerate the culture war and inequality

- More fiscal spending / government interventions will accelerate the discovery of the fact that “the world is too small, in terms of physical limits on, productivity and the marginal return on capital”.

The economy will heal, alternative energy sources with a higher baseload will be invented, capital return will turn positive and best of all, human research, thinking, learning will and should focus on solving the climate issue with real plans not pseudo plans built on fantasies and political ideas rather than hard, physical realities.

What we will get however is the opposite, and more of the same.

In conclusion, fasten your seatbelts, this sell-off is different. This time it may finally be about the limit of resources and nature versus the unbounded aspirations of political forces. I know who will win, do you?