Udviklingen i tysk økonomi bliver værre på grund af afmatningen i Kina og på grund af en alvorlig under-investering i it-sektoren

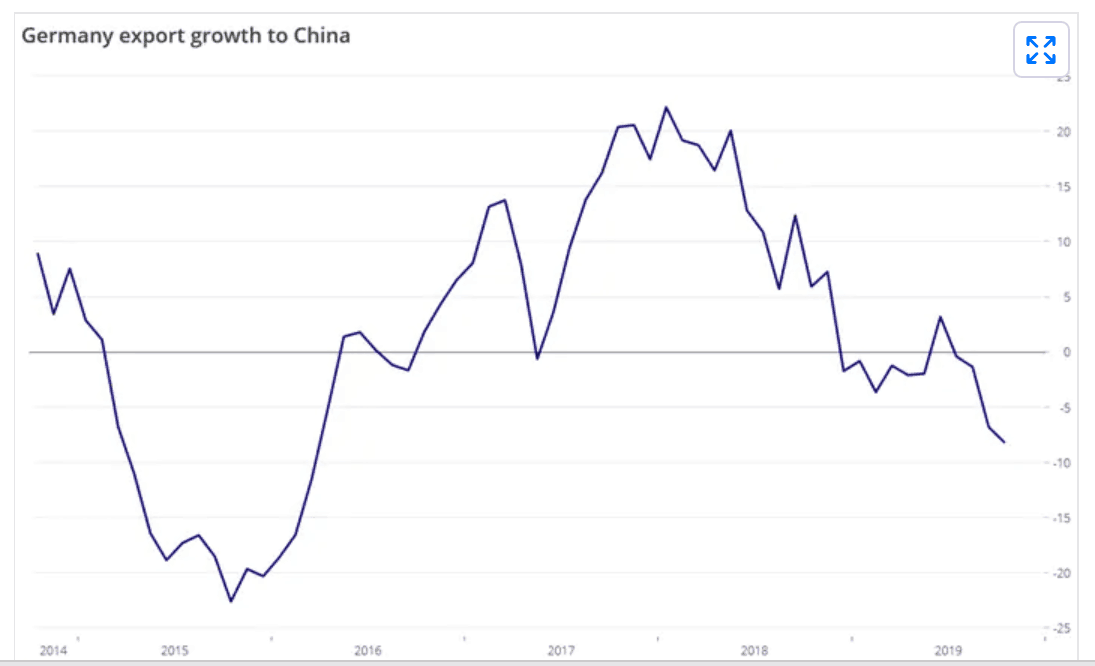

The below chart explains why the worst is yet to come for the German economy. The country avoided falling into technical recession in Q3 this year due to a rebound in external demand reflecting improved export growth to Turkey and the United Kingdom. However, the economic momentum remains fragile as China, its most important trading partner with a total trade volume of around 200 billion euros (in 2018), is still facing economic turmoil.

The latest data shows that Germany export growth to China is at its lowest level since early 2016, at minus 8.2% YoY in October. Based on preliminary trade data, all indicates that the contraction is not over yet, and could get worse.

On the top of that, Germany is also facing a structural challenge linked to misallocation of investment that will hurt growth in coming years. Looking at the global level, the country is very well-ranked in terms of R&D investment. The problem is that a big chunk of it is attributable to the struggling automotive sector (which represents roughly more than 50% of total R&D investment over the recent years vs 6% in the United States).

As a result, the ICT sector suffers from chronic underinvestment which negatively impacts potential growth and leadership in key technological innovation. In our view, the massive imbalance in R&D investment along with the high economic dependence on the automotive sector (around 15% of the country’s GDP) certainly constitute the most important economic challenge for Germany.