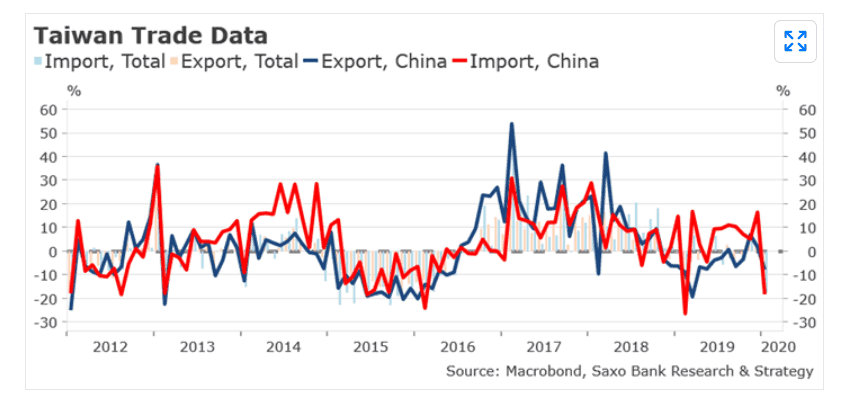

Virkningen af corona-virussen kan blive værre end frygtet. Det indikerer et dramatisk fald i handelen mellem Kina og Taiwan. Der er ingen chance for at den globale handel kommer på rette køl i 1. kvartal.

Uddrag fra Saxo Bank:

Summary: It is obviously too early to know exactly the impact of the coronavirus on the global economy and the supply chain. We have some ideas, but we don’t have accurate figures yet to corroborate our hypothesis. I remain deeply skeptical about forecasts i see here and there saying that the coronavirus will reduce global economic growth for this year by 0.2% or 0.3%. In this macro update, I want to share with you my humble understanding of the situation and some key risks I have identified related to the coronavirus crisis.

Based on the official number out of China, the coronavirus is worse than the SARS. The number of people affected is five times higher and the number of deaths is 41% higher. On the upside, a major difference with the SRAS is that the authorities are now fully able to implement in a very short period of time efficient methods to contain contagion.

We are unable to assess the exact economic impact of the coronavirus in China, but we can guess the amplitude of the slowdown. China has decided to delay the release of a bunch of economic data, including January trade, retail sales and many other indicators. There is basically nothing to analyze and plenty of room for conjecture. However, we already have some clues pointing out the slowdown in Q1 is likely to be more important than expected at first. We use Taiwan January trade data as a proxy to estimate the amplitude of the economic effect of the coronavirus…and it’s ugly. Taiwan’s export to China decreased by 7.8% YoY in January and imports to China fall by 18.2% YoY. This very sharp decline is partially explained by some Lunar New Year effect, but not totally. There is also a clear impact due to the coronavirus breakout. Obviously, we don’t expect any improvement in February. It also means that; contrary to market expectations, there is no chance that global trade rebounds in Q1.

China cannot afford the closure of factories and property sales showrooms much longer. During the Lunar New Year, it is quite common that factories close down, but if the shutdown is prolonged until March, it may put at risk of bankruptcy many companies. Earnings would fall, which would increase repayment pressure on the most vulnerable and indebted companies, notably in the real estate sector. As of today, more than 100 Chinese cities have temporarily close property sales showrooms and investors we have talked to are already wondering how some companies, such as Evergrande, one of the top Chinese real estate firms, will cope with the situation.

My base case scenario assumes a sharp drop in GDP growth in Q1 followed by an asymmetric recovery in Q2. We are still more optimistic than our Chinese colleagues, but we strongly believe that China’s whatever it takes, composed of high inflow of liquidity from the PBoC, via open market operations, and further fiscal stimulus (both tax cut and public spending), will be able to restart growth engine at some point in the next quarter. China will have no other choice than prioritizing growth over deleveraging this year.