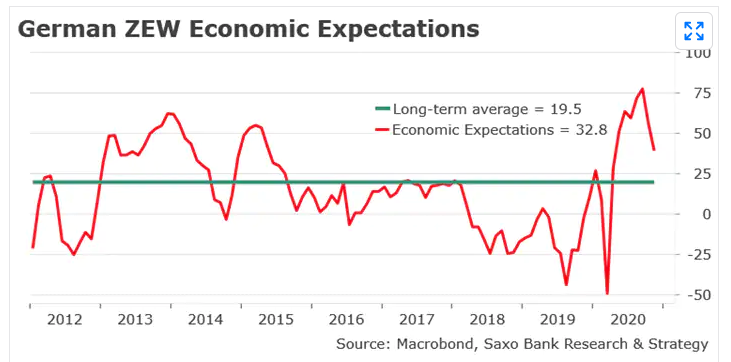

Saxo Bank analyserer det tyske ZEW-indeks for forventningerne i tysk erhvervsliv, og indekset viser en skarp nedtur i forventningerne på 19,5 til 32,8 og indikerer, at Tyskland er tæt på endnu en recession, men den bliver formentlig kortvarig, for tyske produktions- og eksportvirksomheder ser langt mere positivt på fremtiden end f.eks. servicesektoren. Forventningerne ligger trods alt væsentligt over gennemsnitsniveauet. Desuden kan de seneste nyheder om en covid-vaccine skubbe forventningerne op igen.

Uddrag fra Saxo Bank:

German ZEW: A first glimpse of the consequences of the second nationwide lockdown

German November ZEW report gives us a first glimpse of the consequences of the second nationwide lockdown on economic expectations.

The current situation assessment is deteriorating again, sliding 4.8 points to land at minus 64.3 versus expected at minus 65.

Looking into details, there are clear indications in the report that the German economy is once again edging closer to recession territory.

Economic expectations, which are the most watched components of the report, are edging down again. In November, the subindex recorded a massive drop of 19.5 points to 32.8, but it is still standing way above its long-term average of 19.5.

Unlike what has happened during the previous lockdown that occurred last Spring, we don’t see a general decline in economic sentiment across all the sectors.

Firms most exposed to the new restrictions (mostly in the services sector and in the construction sector) are experiencing a new deterioration in economic sentiment. The subindex for the services sector is down at 21.8 vs prior at 26.7 and the subindex for the construction sector is also falling, at 14.3 vs prior at 16.6.

In contrast, all the other sectors are going through stabilization (such as the utilities sector) or are heading north (automobile, mechanical engineering and chemicals/pharmaceuticals).

This gap in economic sentiment is not only indicating that some firms are less hit by restrictions than in the first lockdown but also that higher foreign demand, especially from Asia/China, is fueling increased optimism in the German manufacturing sector. It thus confirms that economic contraction in Q4 will be less important than in Q2 as business continues more or less as normal in the manufacturing sector.

There is light at the end of the tunnel. The survey has been conducted before Pfizer and BioNTech announced vaccine candidate against COVID-19 achieved success in first interim analysis from Phase 3 study yesterday.

It was undoubtedly positive and unexpected news, though it is still too early at that stage to know the exact implications of these announcements. There are still a lot of pending questions such as whether the vaccine will prevent transmission of COVID-19 or how many doses will be necessary etc.

That being said, the increased likelihood of an imminent vaccine might have positive trigger effects on consumers and some firms. Most of the economic damage related to the pandemic mostly results from the fear of the virus, not the virus itself.

Therefore, if there is credible hope of economic normalization in 2021, perhaps in the first semester, we can expect to see in coming months an improvement in sentiment survey, including in the ZEW survey.

Most firms that are currently going through turmoil, typically hairdressers, will get a decisive boost from the vaccine and will be able to see demand going back to normal almost immediately afterwards. That’s why we should not overstate the impact of today’s ZEW report and, in that sense, the market was certainly right not to pay too much attention to it.