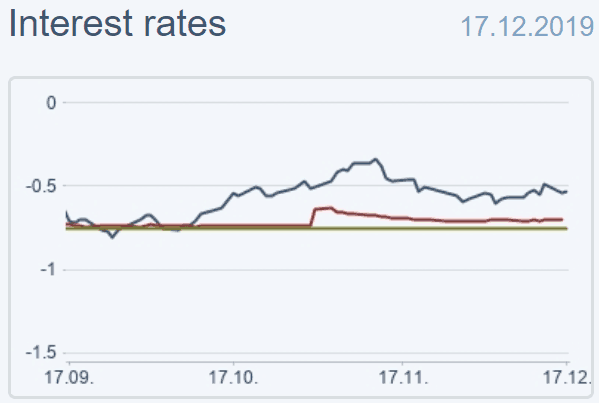

Nationalbanken i Schweiz vil ikke udelukke flere rentesænkninger. Nationalbankrenten på minus 0,75 pct. er allerede en af de laveste. Voldsom kritik af minusrenterne.

Uddrag fra Fidelity/Reuters:

Swiss National Bank Chairman Thomas Jordan cannot exclude more interest rate cuts, he said in an interview published on Wednesday, although such a step was not needed now.

“We can’t rule it out,” Jordan said told Swiss newspaper Blick when asked whether the SNB’s minus 0.75% interest rate – one of the lowest in the world – could be lowered further.

“But we carry out a very precise cost-benefit analysis and we would never simply cut the interest rates if that brought no benefit. At the moment, however, a further reduction is not necessary.”

Negative interest rates have become increasingly controversial in Switzerland. Banks say they punish savers and risk producing asset bubbles.

Several Swiss banks, including UBS, Credit Suisse and Julius Baer, have passed on the cost of negative rates to rich customers, triggering an outcry from the Swiss Bankers Association, which said ultra-low rates damage the country’s pension system.

The SNB last week kept its rates locked down at minus 0.75%, the same level it has for nearly five years, and indicated negative rates would remain in place for the foreseeable future.

In the interview, Jordan said it was difficult to predict how long the measure would remain in force.

“That depends very much on the economic development, above all in Europe,” he said.

He added that negative rates were needed to prevent a rapid appreciation in the Swiss franc which would damage the country’s export-reliant economy.

“Imagine what would happen if we raised interest rates, for example to zero. That would mean the franc would strongly appreciate,” Jordan told the newspaper.

“Inflation would turn negative, economic growth would be significantly slowed. That would benefit neither savers nor the pension funds.”