Uddrag fra Goldman og Zerohedge:

From Goldman FICC trader Bobby LIen

Seven things you need to know:

- Payrolls soft, but not soft enough for 50bps Fed cut

- GS Weekend – FX, equities, rates; Weekend macro call

- GS currencies + EM Virtual Symposium – 11-13 Sep – pls register

- OPEC+ extends voluntary cuts – still downside risks to our 70-85 Brent range

- PBOC Official sees room to ease RRR again (BBG)

- THB Views – equities inflows (highest since Dec 2022) extends THB rally

- Proposed changing weighting methodologies for US equity benchmarks

1. Payrolls soft, but not soft enough for 50bps Fed cut

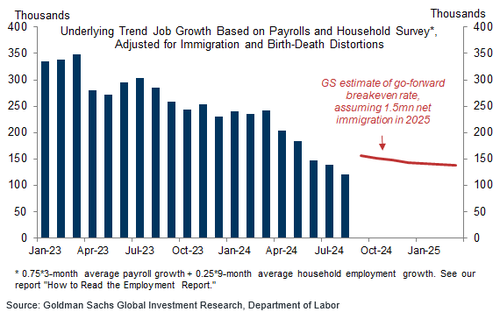

GS economist take on payrolls: Nonfarm payrolls rose 142k in August, below expectations. Payroll growth was revised down by 25k in July to 89k and by 61k in June to 118k, and 3-month average payroll growth now stands at 116k. The industry composition of job gains was somewhat stronger than last month’s, as job growth decelerated by 42k relative to its 6-month average in industries that usually have a negative first-print bias in August and the payrolls diffusion index rose 5.4pt to 53.2 (vs. 58.8 on average in 2019). The unemployment rate ticked down by 3bp to 4.22%, partially reflecting a -11bp contribution from a decline in temporary layoffs but a +4bp contribution from unemployed new entrants as a share of the labor force and more neutral contributions from other components. Our estimate of the underlying pace of job growth based on the payroll and household surveys now stands at 120k after adjusting for the undercounting of immigration in the official statistics, below our estimated breakeven rate of 150k jobs/month. Average hourly earnings increased by 0.4% month-over-month in August, somewhat above expectations, and our estimate of the underlying pace of average hourly earnings growth stands at +3.9%. We [GS economics] don’t believe today’s report is sufficiently weak to push the FOMC to a 50bp cut at the September meeting, and we have therefore left our forecast unchanged for a 25bp cut in September.

Remarks from Fed’s Waller and Williams post payrolls

Fed Governor Waller and New York Fed President Williams’ remarks post payrolls suggest that the Fed leadership sees a 25bp cut as the base case for the September meeting but is open to 50bp cuts at subsequent meetings if the labor market continues to deteriorate. Waller said that he expected that “cuts will be done carefully,” that the FOMC can act “quickly and forcefully” if “subsequent data show a significant deterioration in the labor market,” and that he would be an advocate of “front-loading cuts … if that is appropriate.” Williams said that “the stance of monetary policy can be moved to a more neutral setting over time,” that the recent data was “consistent with the good labor market that existed in the period before the pandemic,” and that the unemployment rate “remains relatively low by historical standards.”

2. GS Weekend – FX, equities, rates; Weekend macro call

Adam Crook (FX) – Changing USD Correlations to Risk… We have received a lot of questions about whether USD-correlations with Equities/Risk could be reverting back to the relationship we saw in the early days of Covid, and during the risk-drawdown in early-August this year -> Lower stocks accompanied by a weaker USD…. Especially if the case continues to build that the US economy is slowing in a more pronounced manner, that the Fed might have held policy-rates too high for too long, and therefore if an acceleration of the imminent Fed easing-cycle, to larger or more sequential increments, is a signal that the Fed is ‘behind the curve’, with the inherent risks to Growth that would entail. Link

Tony Pasquariello (Equities) – if you take a quick step back, I’d argue the equity market is struggling with the fact that two of the biggest variables in the trading equation — what the Fed will do in September, and who will win the US election — both currently feel like a flip of the coin. in turn, S&P leaked considerably lower, implied volatility firmed and US 2-year note yields fell to their lowest level since September of 2022. perhaps the bigger point is this: at the end of the summer, with many parts of the market making fresh highs, stock operators were dreaming the “mid-cycle adjustment cut” dream. Link

Cosimo Codacci-Pisanelli – The weakness in stocks post Waller suggests the equity market wants more than 25bps and the price action across asset classes (risk, front end rate curve flattening eg z4/z5) looks like the market showing concerns of the Fed getting behind the curve. Everything the Fed has communicated though suggests a willingness to act quickly on further deterioration, the Fed put is struck high. An extended move lower in risk and tightening of financial conditions, or further weakening of the labour market, will quickly push the Fed towards 50bps. Link

3. GS currencies + EM Symposium – 11-13 Sep

Next week GS Currencies & Emerging Markets are hosting our Annual Virtual Macro Conference which will take place on 11-13 Sep. There will be two sessions per day, commencing at 11am EST / 4pm BST (11pm HK/SING), each one will last approx 30 mins (one hour per day):

We are thrilled to have participation from pre-eminent external speakers:

- Jason Furman: Former Chair of the Council of Economic Advisers for President Obama.

- General Sir Tim Radford: Former NATO Deputy Supreme Allied Commander Europe 2020-23

- Meg Rithmire: Professor at Harvard Business School + author ‘Land Bargains + Chinese Capitalism’

- Sir Alex Younger: Former Head of MI6 (also a GS Advisor).

- Stephen Myrow: Beacon Policy Advisors.

An EM Investor Panel including: Cathy Hepworth (Prudential), Amer Bisat (Blackrock), Mahmood Pradhan (Amundi + former Deputy Director at the IMF)

The conference will also include GS thought leaders, with participation from Ashok Varadhan, Jan Hatzius, Jared Cohen, Dom Wilson, Tony Fratto, Hui Shan + Andrew Tilton; as well risk-views from GS Trading Leadership across products.

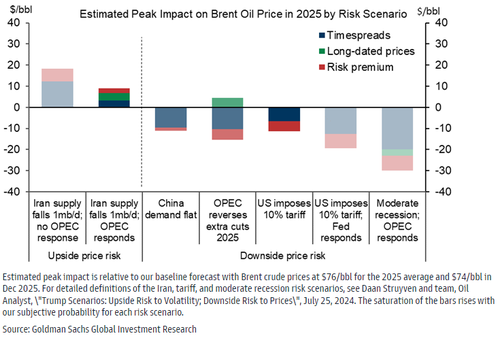

4. OPEC+ extends voluntary cuts – still downside risks to our $70-85 Brent range Marquee

The 8 OPEC+ countries agreed to extend their extra voluntary production cuts for two months until the end of November, underscoring the flexibility of the producer group. We still expect three months of OPEC+ production increases, but have pushed out the start date to December (vs. October previously).

We stick to our $70-85 Brent range and our December 2025 Brent forecast of $74/bbl. We expect the tightening impact of modestly lower OPEC+ supply in coming months to be roughly offset by the easing effect from ongoing softness in our China demand nowcast and from a quicker than previously expected recovery of Libya supply.

We still see the risks to our $70-85 range as skewed to the downside given high spare capacity, and downside risks to demand from weakness in China and potential trade tensions.

Risks to our $70-85 range still skewed to the downside

5. BBG: PBOC Official sees room to ease RRR again

“China’s central bank has signaled that lowering the amount of money lenders must keep in reserve remains on the table this year, in comments by an official with a track record of telegraphing such moves. Zou Lan, head of the central bank’s monetary policy department, said there’s still space for more cuts considering the average reserve requirement ratio for financial institutions is at about 7%. But he also cautioned over constraints on decreasing deposit and lending rates further due to narrowing bank profit margins and money flowing into asset management products. “For rate reductions and other policy adjustments, it’s necessary to observe the trend of the economy,” he said Thursday, in response to a question on whether the People’s Bank of China saw the need to cut policy interest rates or the RRR again this year.” BBG

Elsewhere, our economist expect government fiscal support to step up. Despite high market expectations for proactive fiscal support early this year, China’s fiscal challenges appear more severe and persistent than previous years – especially from falling tax and land sales revenue – while the pace of government bond issuance was much slower than normal years during January-July. Our China economists believe more fiscal easing is necessary to help secure the “around 5%” full-year growth target, and expect the augmented fiscal deficit to widen meaningfully in H2 vs. H1. One of the low-hanging fruit is to accelerate government bond issuance and proceeds spending. They note that of the RMB9tn full-year government bond issuance quota approved in March, only 46% were issued by end-July, well below normal years and implying an RMB4.8tn quota available for use for August-December

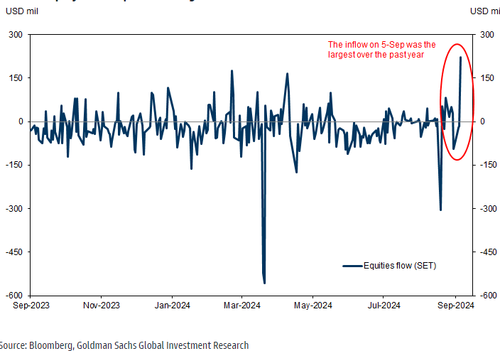

6. THB Views – equities inflows (highest since Dec 2022) extends THB rally

The Thai equity market has rallied 5% in the past week on the back of the news that the government backed “Vayupak fund” would invest an additional THB 150bn (approx. USD 4.4bn) into the domestic equity market, according to local news. This prompted foreign investors (most of whom are underweight versus global benchmarks, according to our equity strategists) to re-renter the Thai equity market in anticipation of the Vayupak fund buying local equities, recording USD220mn inflows on 5th September (highest daily inflow since December 2022, chart below). We expect the prospectus to be available in the coming week since the subscription date starts around mid-September, and the fund should be able to start buying local securities from October 1st. Note that THB 150bn is almost twice the average daily turnover in Thai stock market (SET) and hence should be significant if the equity purchases are conducted in a narrow trading window and if it continues to spur foreign investment. This development is part of what has allowed the THB to extend its near-term outperformance. However, over the medium-term, we still think THB strength will fade given structural issues facing the domestic economy. Beyond the Vayupak fund (which is likely to garner good local demand), we think domestic investors will still look for other overseas investment opportunities and the BoT are liberalizing FX measures to allow more outflows.

Equity inflow spur THB strength

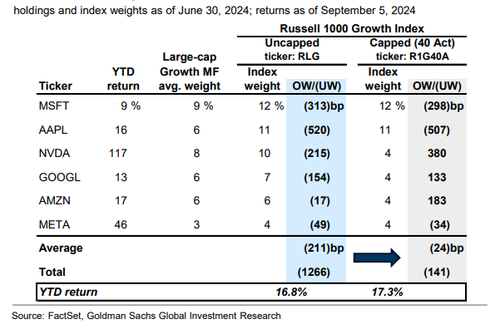

7. Proposed changing weighting methodologies to equity benchmark indices

The high concentration of widely-followed benchmarks such as the S&P 500 and the Russell 1000 Growth indices has caused several actively-managed mutual funds to approach or exceed key SEC and IRS diversification thresholds. There are two key regulations for portfolio weightings:

- the Investment Company Act of 1940 (“40 Act”) sets limitations for mutual funds to be classified as “diversified.” Under section 5(b), the total weight of securities with individual weights in the portfolio of 5% or greater cannot exceed 25% of the portfolio.

- in addition to the 40 Act, the Internal Revenue Code’s (“IRC”) test determines whether a fund qualifies as a regulated investment company and may take advantage of pass-through tax treatment. Under section 851(b)(3)(A), on the close of each quarter of the taxable year, the total weight of securities with individual weights in the portfolio of 5% or greater cannot exceed 50% of the investment company’s total assets. Additionally, no single stock may compose more than 25% of the portfolio.

Index providers Standard & Poor’s and Russell Investments recently proposed changing their weighting methodologies to cap some benchmark indices to align with IRC guidelines. We believe indices weighted by market cap should not be capped but that index providers should offer capped versions that can be used as benchmarks. If funds used a capped version of the Russell 1000 Growth index that complies with the 40 Act, the average large-cap growth mutual fund would move from 1,266 bp to 141 bp underweight mega-cap tech.