Det er ifølge ING alt for tidligt at vurdere, om finanspakkerne gør det berettiget at investere. Krisen er ikke overstået. ING peger på Singapore som test på en effektiv håndtering af krisen. Væksten faldt med 10,6 pct. i 1. kvartal, så i Europa og USA kan vi se langt værre tal den kommende tid.

Uddrag fra ING:

Buy or sell the rally

What you need to consider now is, are the stimulus measures in place sufficient to justify buying risk assets against the moving target of the spread of this pandemic? And the answer that you have to come up with is, I don’t know…

Round and round and round she goes, where she stops, nobody knows

All in all, the pandemic still looks to be on a runaway path, though there are some signs that some of the European hotspots are cooling very slightly. But with the piecemeal containment measures undertaken in the US unlikely to be effective except locally, and their large population with its challenging health and age characteristics coupled with variable health care coverage, I think that the prospects of a real problem for the US still exist.

So in my summary, I take the somewhat cowardly approach of saying that it is impossible to look at the (still unpassed) stimulus bill in the US and conclude that the time is ripe for piling into risk assets, simply because the other unknown, the virus, is still accelerating, with no prospect of guessing how much damage it will deliver.

Reallty though, I think it is still far too early to buy, but I concede that the turn, when it comes, might be sharp and that there is a danger of missing out on a chunk of the upswing when it comes. The US though, even if it isn’t the centre of global GDP growth anymore, is still where the market cycle starts and ends. So what happens with the virus in the US is critical.

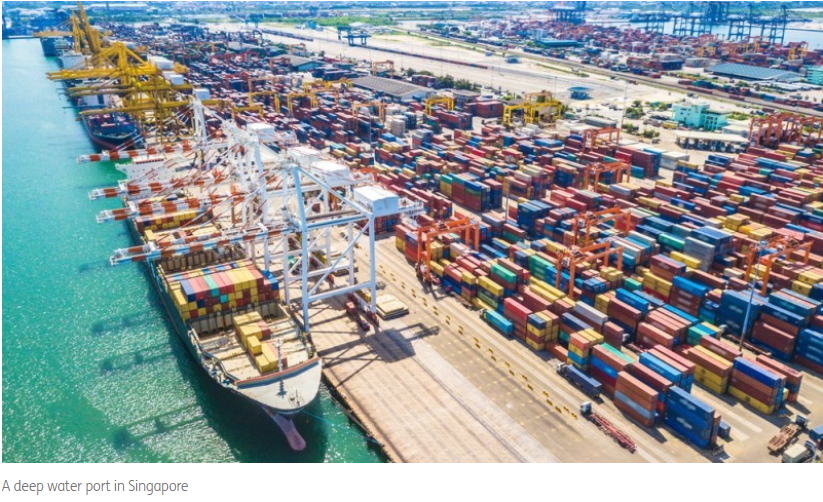

Singapore shows the way

Singapore’s preliminary 1Q20 GDP figure is one of the first regionally, indeed, globally, and it is mainly for that reason that it is important as it is about the first piece of hard evidence of what is facing countries across the world.

At -10.6% (annualized QoQ%), the 1Q20 GDP result was a little worse than consensus, but the consensus really hadn’t any clue, with a low of about -18 and a high of about -2, so the deviation from the median is not significant in my view.

Singapore, of course, was one of the first countries globally to be affected by the coronavirus as Chinese tourism with the island was strong before the outbreak, and that could have weighed more on these numbers than elsewhere. More importantly, in our view, are the containment measures undertaken, that have meant the island state still operates close to normality except for international travel and tourism, unlike many European countries. A lockdown may yet come, but the measures that have been taken have massively alleviated the economic burden on Singapore. It really is the role model to follow.

So when thinking about the GDP numbers elsewhere, in Europe and the US, you’d have to think that they would be lucky to see only a 10% annualised downturn in activity. And the actual figures could be magnitudes worse.

The limited detail we have on these numbers so far shows us that the people-intensive sectors of services (-15.9%QoQ) and construction (-22.9%QoQ) are the biggest victims of the virus. Manufacturing was actually up on the quarter (+4.2%). I don’t expect that to last though, so a figure as bad or worse probably looms for 2Q20.

These numbers cement our expectation for some remedial action from the MAS this month (not waiting until their scheduled April meeting). Prakash Sakpal expects the MAS to re-centre the currency NEER close to current levels and remove the appreciation slope.