Singapore havde sidste år den højeste vækst i 10 år – med en vækstrate på 7,2 pct. Da coronaen slog til i 2020, havde Singapore et fald på 5,4 pct. i væksten. Det er en af de kraftigste økonomiske forbedringer i verden, og det skyldes især Singapores hurtige og konsekvente håndtering af pandemien. Singapore, der har lige så mange indbyggere som Danmark, har haft 829 døde og 280.000 smittede – langt lavere tal end i Danmark og Europa. Singapore betragtes ofte som målepind for den globale økonomi. Regeringen vil i år hæve momsen, som har været sænket under pandemien. Pengepolitikken er også blevet strammet for at bekæmpe inflationen. Væksten ventes i år at blive mellem 3 og 5 pct.

Singapore’s 2021 GDP grows at fastest pace in over a decade

Singapore’s economy expanded at its fastest annual pace in over a decade in 2021 as the country emerged from its worst recession on record, caused by the deep hit to activity from the coronavirus pandemic.

The city-state’s economy grew 7.2% in 2021, preliminary data showed on Monday, broadly in line with the government’s official projection and rebounding from the record 5.4% contraction in 2020.

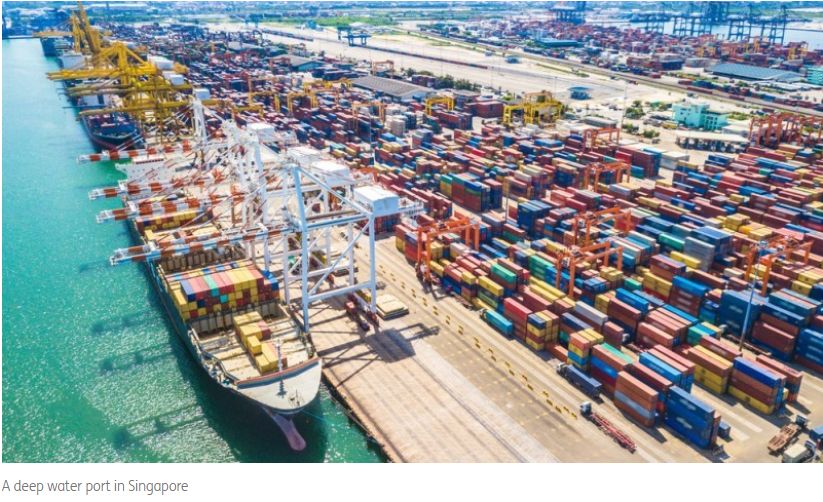

The financial and transport hub, often seen as a bellwether of global growth, has staged a rocky recovery as governments around the world shift their coronavirus strategies to living with the pandemic, away from “zero-COVID” policies.

Singapore’s annual gross domestic product growth was the fastest since a 14.5% expansion in 2010, when the economy emerged from the global financial crisis.

“I’m expecting growth to be relatively buoyant. As the world economy starts to improve, I think that will also help to support the overall external demand conditions for Singapore,” said MUFG analyst Jeff Ng. “The main threat continues to be inflation.”

The government has previously said it expects GDP to grow 3% to 5% in 2022.

PRICE PRESSURES

Separately, the Southeast Asian city-state on Monday posted a preliminary 5% rise in private home prices in the fourth quarter, the most since 2010.

The government implemented a package of measures to cool its property market https://www.reuters.com/markets/rates-bonds/singapore-announces-measures-cool-property-market-2021-12-15 last month, including raising stamp duties and tightening loan limits.

Prime Minister Lee Hsien Loong said last week in his New Year message Singapore’s economy is recovering steadily and that the government sees a need to start raising sales tax.

The government has flagged a plan to raise the goods and services tax by 2 percentage points to 9% between 2022 and 2025.

While analysts expect the economy to continue to grow, they cautioned that the Omicron coronavirus variant could become a drag if social distancing rules are tightened again.

The city-state has vaccinated 87% of its population. As of Saturday, 41% of the population has received their COVID-19 booster shot.

Sung Eun Jung at Oxford Economics expects growth to be led more by the service sector than the manufacturing in 2022 as domestic demand momentum improves.

“We expect monetary and fiscal policies will further tighten this year with planned GST hike adding to rising price pressures,” she said.

Economists widely expect the central bank to tighten again in April this year as price pressures persist. Similar to major financial hubs around the world, Singapore has seen its inflation rate rise in the past few months with headline prices up 3.8% in November, the fastest in nine years.

The Monetary Authority of Singapore unexpectedly tightened its monetary policy at its last meeting in October amid mounting inflationary pressures caused by supply constraints and a recovery in the global economy.