Uddrag fra Zerohedge:

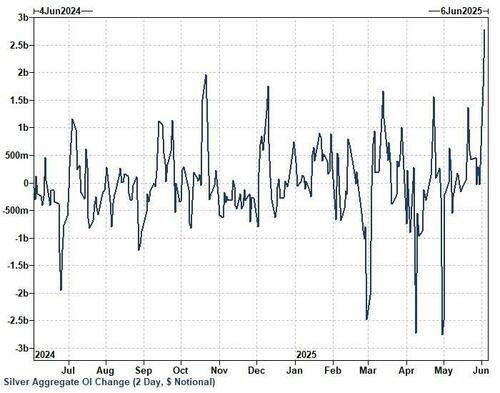

bullish futures traders had dramatically increased the amount of silver net exposure…

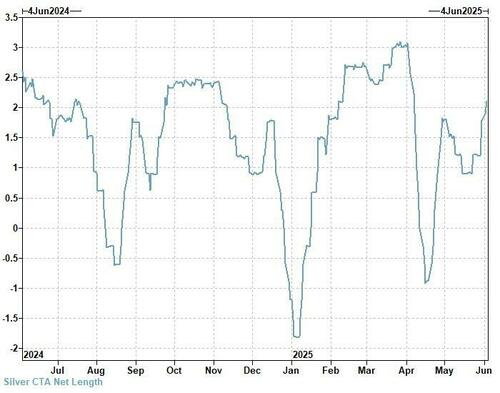

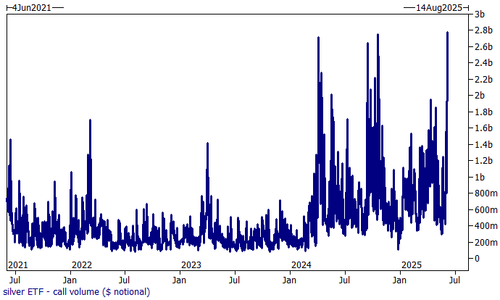

… which was coupled with a spike in bullish posturing in the options market via the upside call wing as well as systematic/CTA buying.

That said, Goldman founds that discretionary euphoria “seemed a little more tempered.”

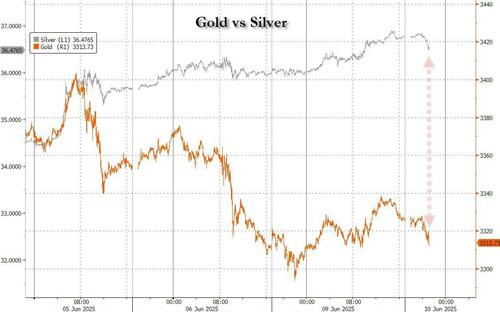

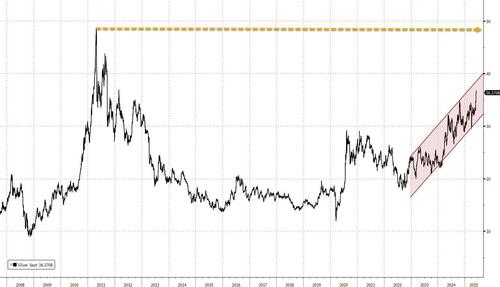

Well, not any more, because while gold put in another interim peak of $3400 last Thursday and has dipped since, silver has found a powerful bid ever since it rose to a 13 year high above $36, and the result has been a dramatic divergence between the trajectory of silver and gold…

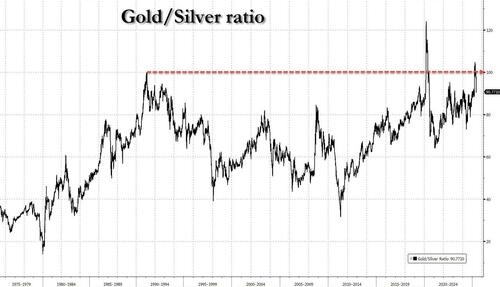

… one which has seen the ratio of gold/silver retrace back from its near all-time high above 100 – where gold peaked in the early 90s and where it again peaked during the covid gold meltup – to 90 and falling fast.

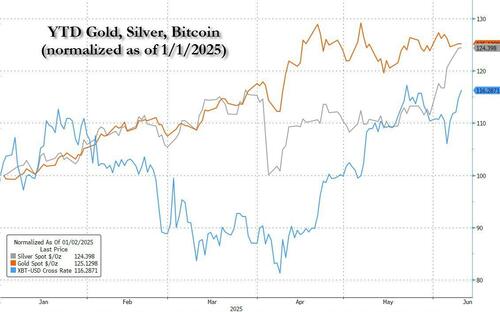

It may come as a surprise to some that while gold enjoyed a runaway surge in early 2025, and bitcoin has also come storming right back after tumbling in early April, it is actually silver which is about to overtake gold as the best performing asset of 2025 (those looking for a 60% off silver physical premium deal, please check here).

Perhaps the biggest reason for the latest leg higher in silver is the arrival of the “discretionary euphoria” which was missing as recently as last week.

As Goldman’s ETF desk writes today, silver caught a strong bid last week, with spot prices (XAG) up nearly 9% – its second-best week of performance since June ’24, driven by renewed interest of steel and aluminum tariffs.

This coincided with a surge in broader market activity:

1) The largest silver ETF registered its strongest week of inflows in nearly a year (+$460mm), and

2) notional call option volumes for the fund reached record highs on Thursday.

Meanwhile, Goldman’s Chris Lucas notes that he saw “an array of clients engage across the spot silver ETF complex, with desk flows skewing better purchased on the week.”

Of course, we have seen breakout attempts before, so Goldman understandably is watching if this theme is here to stay. Some at the bank are skeptical, such as commodity strategist Adam Gallard who writes that “we do not think there is a fundamental headline given slowing solar growth (down y/y in May), Chinese exports, and a loose London physical market, rather, a macro bid given ratio (vs gold) underperformance, exacerbated by CTA and Chinese buying through a key resistance level” (full note here to pro subs).

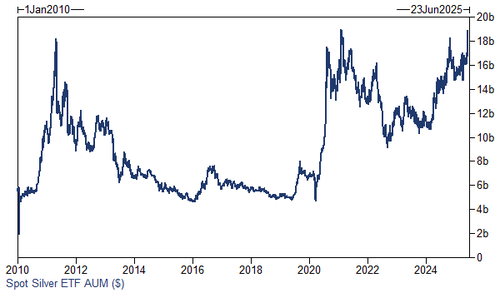

One can counter by taking the other side, and pointing out that there is substantial potential upside via ETFs. As the Goldman ETF desk he notes, “while silver ETFs have registered robust inflows (best week in nearly 1yr) and spot flirts with 5yr highs, ETF demand, as interpreted through shares outstanding, remains below December levels…”

Translation: once the breakout is seen as real, that’s when the real ETF buying will kick in and that’s when the old nominal highs will finally be in play.