uddrag fra Bloomberg macro strategist:

S&P predictions for next year are more optimistic than usual compared with the trailing return of the market.

Equity forecasters are an implacably upbeat bunch.

No-one ever got sacked for predicting the market will go up. Forecasters in the aggregate have never expected a down year for the S&P over the last 25 years, with the average rise expected over the following year +8.2%.

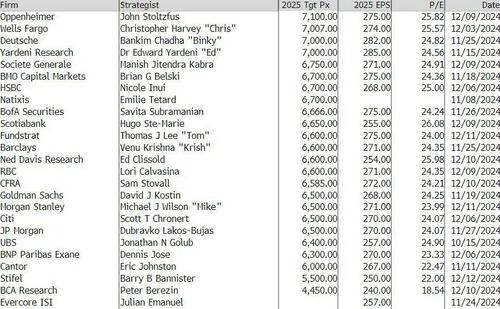

Strategists’ forecasts can be seen by loading the S&P on the Bloomberg terminal.

For 2025, the expected return is currently very close, at 7.5%, to the 8.2% average.

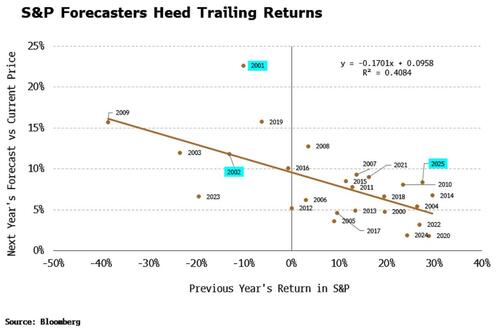

But how does this fit with the trailing returns in the market? Specifically, when the trailing return is strong, as it is for this year, do forecasters moderate their bullishness? I took the forecast return of the S&P for each year and compared it to the market’s return in the previous year. As the negative sloping line in the chart below demonstrates, forecasters do tend to temper their optimism based on how well the market is currently performing.

As the chart shows, when returns are strong, forecasters tend to lower their expected return – although never to less than zero – and vice versa when returns are weak.

The 2025 dot is above the line in the chart, showing that strategists’ 7.5% return expectation for next year is more optimistic than the average, given the current year-to-date S&P return of 28%.

One of the biggest outliers was in 2001, when strong returns were expected after a poor market performance in 2000. We need only look at the 2002 dot showing the previous year’s return of less than -10% to see how that worked out.

Of course, the elephant in the room is that forecasts in the aggregate are invariably wrong.

But strategist over-optimism is another sign of the increasingly fevered mood that is infecting the market.