Den tyske Forfatningsdomstol tager i næste uge stilling til, om Den europæiske Centralbanks opkøbsprogram strider mod EU’s lovgivning. Den europæiske Domstol har tidligere sagt god for opkøbsprogrammet, der har fået en ny version og betydning under coronakrisen. Det får enorme konsekvenser, hvis Forfatningsdomstolen siger nej.

Uddrag fra Nordea:

ECB Watch: Breaking the law?

The German Constitutional Court will make another ruling on the ECB’s bond purchases and there is a clear risk that the Court’s decision would limit the flexibility of the purchases and cause sizable adverse moves in the financial markets.

- The German Constitutional Court will announce its ruling on the ECB’s bond purchases on Tuesday 5 May.

- While the European Court of Justice has already ruled in favour of the ECB, the German Constitutional Court has been more critical in its past decisions.

- The chance of an adverse ruling cannot be ruled out, and a restrictive view has the potential to hit financial markets hard in the near term

The German Constitutional Court (GCC) will announce another ruling on the ECB’s bond purchases on Tuesday 5 May at 10.00 CET. The uncertainty regarding the decision is large, given that many of the legal aspects are open to interpretation. Further, it is unclear whether the GCC will consider the ECB’s new Pandemic Emergency Purchase Programme (PEPP) in its deliberations.

From a financial market perspective, the GCC announcement is a highly asymmetrical event. An approval of the purchases would probably not lead to particularly large market action, but a restrictive ruling could cause sizable adverse market moves.

ECB bond purchases faced numerous legal challenges

The ECB’s public-sector bond purchases have always been a very divisive topic, and courts, both the German Constitutional Court and the European Court of Justice (ECJ), have ruled on the topic several times.

In 2017, the German Constitutional Court said it was doubtful whether the ECB’s Public-Sector Purchase Programme (PSPP) was compatible with the prohibition of monetary financing, but it reserved judgement on the matter and referred the case to the European Court of Justice (ECJ).

Late in 2018, the ECJ found the ECB’s PSPP legal as long as sufficient safeguards were in place, referring eg to distributing the purchases according to the capital key, issuer limits and stringent eligibility criteria. The GCC should now interpret the ECJ ruling in the context of German domestic law.

The PEPP has made the case even more complex. The GCC was supposed to rule on the PSPP in March, but postponed its ruling until May, just two days before the ECB’s PEPP was unveiled. It is unclear whether the GCC will include the PEPP in its considerations, or whether the ruling will apply only to the PSPP. Especially in the latter case, the PEPP will surely be challenged in the courts separately.

A restrictive decision would have major consequences to the financial markets

If the GCC limits its views on the PSPP, the verdict is unlikely to be very restrictive, given that the ECJ gave the ECB quite broad discretion regarding its actions. However, the decision becomes much harder, if the PEPP is taken into consideration. After all, many of the safeguards present in the PSPP have been considerably relaxed for the PEPP. The issue/issuer limits of the PSPP do not directly apply to the PEPP, there is more flexibility regarding the use of the capital key and the purchases are much less transparent, as much fewer details about the breakdown of the purchases are published.

A restrictive verdict would raise difficult questions regarding the future of the ECB’s bond purchases. Would the ruling of the GCC take precedence over European law? Could the Bundesbank continue to be part of the ECB’s bond purchases? Could the purchases continue without the Bundesbank? Would the ECJ need to rule on the PEPP as well? At the very least, uncertainty about the limitations of the ECB’s purchases would greatly increase, likely hitting financial markets hard in the near term, including rapidly rising bond spreads and a weaker EUR.

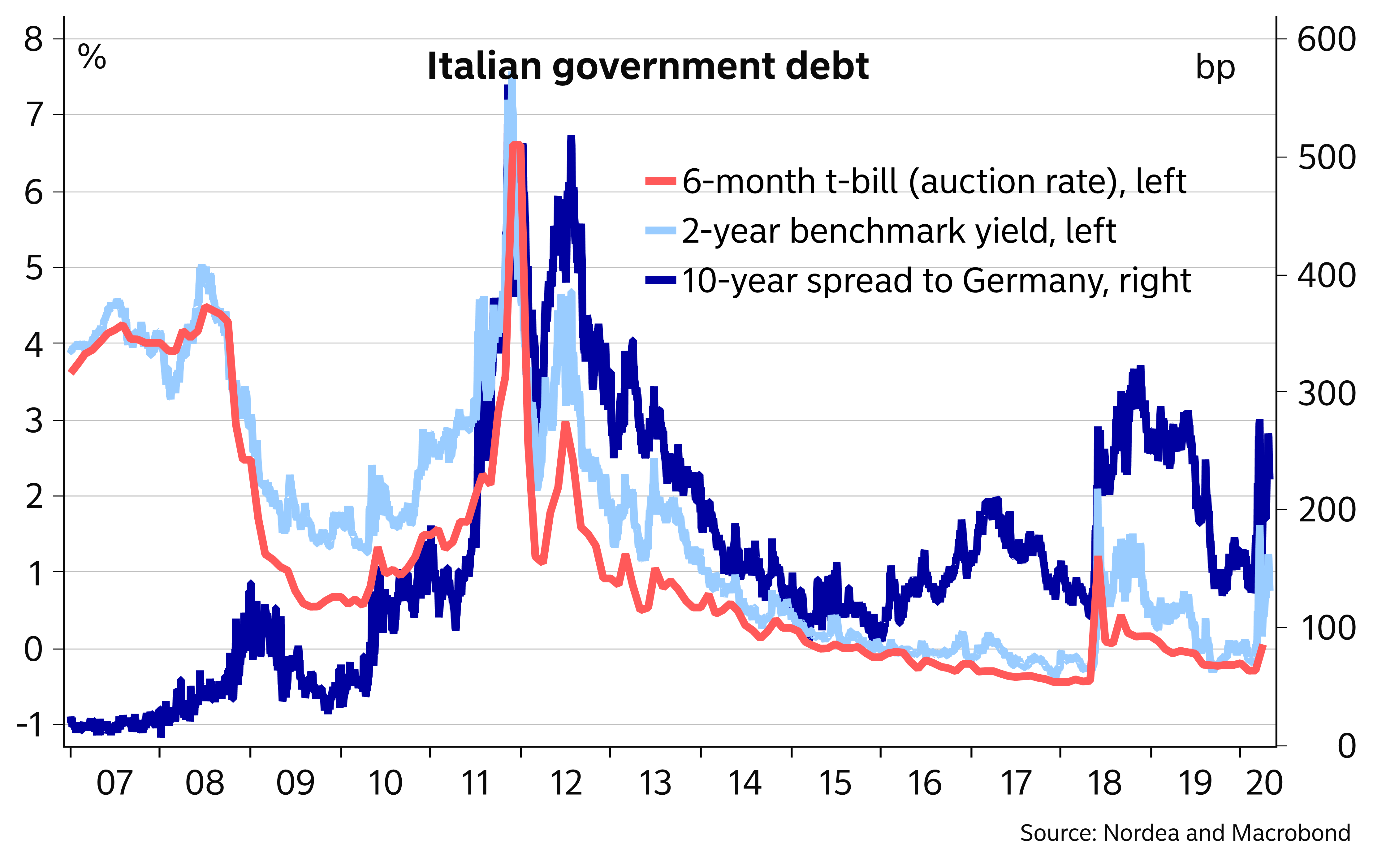

Given the ballooning issuance needs governments are facing, the ECB purchases are currently critical in keeping markets orderly. Especially Italy looks vulnerable, being one of the epicentres of the corona crisis and already having a huge government debt pile.

Even a restrictive verdict would not necessarily lead to detrimental consequences for the ECB’s interventions, but it could put additional limitations on what the ECB can do or force the central bank to change some of the parameters of PEPP. It would also illustrate that the ECB cannot keep the Euro area together on its own. Euro-area governments need to do their part.

While the ECB has given legal aspects a lot of consideration, when planning its bond purchase programmes, many of the issues remain open for interpretation. The vicinity of the GCC ruling will decrease the odds of major changes to the bond purchase programmes at this week’s ECB meeting, such as increasing the size of the PEPP or raising the issuer limits on the PSPP.

The ECJ has been quite favourable to the ECB in its previous rulings and is likely to continue to be so in any future rulings. The GCC may come to different conclusions. The legal issues of the ECB’s bond purchases are real and need to be taken seriously.