Uddrag fra Zerohedge:

it finally happened: what we’ve been warning for the past year, namely that the Fed’s aggressive rate hikes will break something…

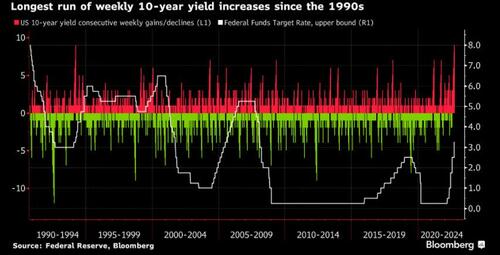

…did in fact break something, actually quite a few somethings: first the BOJ, then the BOE (just maybe Credit Suisse), and as Bloomberg’s Garfield Reynold writes, Treasury 10-year yields are surging relentlessly higher in a way rarely seen, as they have “finally” realized the Fed’s resolve to tame inflation.

They just climbed for a 9th-straight week, the longest such streak since early 1994, jumping 1.18 percentage points in that time. That bond sell-off is only the most savage move since the April-May rout that sent yields up 1.4 points in a nine-week span, but its persistence is noticeable. The message is that the bond market has finally realized just how determined the Fed is about raising and raising and raising interest rates to contain and then cool inflation.

You see, the problem is not the tightening itself: a slow, methodical, gradual hike by the Fed would be more than welcome to offset over a decade of catastrophic monetary policy which saw QE and ZIRP (as well as NIRP) become the law of the land. The problem, as Kumal Sri Kumar noted correctly, is that what the Fed is trying to do – in response to Biden’s constant proddings, with the White House desperate to undo 14 years of excesses in a few weeks – is equivalent to a patient hoping to undo more than a decade of weight gain by stopping eating altogether in hopes of losing all the weight in a few days. The result is always one and the same and it’s always tragic. And yet, looking at Reynold’s chart, 10Y TSYs have gone on a crash diet and haven’t eaten for a near record 9 weeks, so to speak.

And amid this unprecedented food deprivation prompted by the Fed’s hyper-aggressive tightening path, it’s no longer just us warning that something will break, especially after both the BOJ and BOE broke: in just the past weeks virtually every economist and strategist has joined in the chorus, culminating on Friday with Bank of America’s credit team which warned that the bank’s proprietary Credit Stress Indicator (CSI) jumped 4 pts on the week to close at 74th %ile, exceeding the June peak of 71 and entering the “critical zone” (north of 75) beyond which the risk the of credit market dysfunction rises exponentially.

While its warning was ominous, BofA’s conclusion is that it’s not yet too late to avoid a catastrophic outcome: as the bank’s credit strategists said, it is imperative for the Fed to slow down the pace of rate hikes in “immediate upcoming meetings” to wit:

This means slower pace of rate hikes at immediate upcoming meetings and a potential pause subsequently, to allow the economy to fully adjust to all the extreme tightening already implemented, but still working its way through the financial system’s plumbing. Failure to do so raises the risk of credit market dysfunction, which, if occurred, would be difficult to contain and fix.

But while few are expected to read a late Friday note from BofA’s credit team (available to pro subs here), everyone – at least those who pretend to be in control – will read what the Fed’s mouthpiece, Nick Timiraos, tweeted on Saturday, when he pointed to the latest blog by Greg Mankiw who “endorsed” Paul Krugman’s view that “the Fed might be tightening policy too aggressively.”

Greg Mankiw endorses Paul Krugman’s view that the Fed might be tightening policy too aggressively https://t.co/Cl4VFonPLd pic.twitter.com/tcEXqVdLf4

— Nick Timiraos (@NickTimiraos) October 1, 2022

Coming from Timiraos, who as everyone knows by now is Powell’s media voice, practically signals that the Fed chair himself is telegraphing that he made another mistake, first by waiting too long to hike (because “inflation is transitory”) and then tightening too fast.

But what if the Timiraos tweet is just a fluke, and what if contrary to a rising number of indications, Powell has no intention of slowing down, what happens then? Well, besides the countless observations we have already made, today we highlight a brand new one, and this one comes from the very top: no not Powell, or Biden, or some Klaus Schwab-fellating, private jet-flying “environmentalist” – we are talking about the man that tells the Fed what to do – just as he did weeks before the Fed was forced to start “NOT QE” in 2019…

… just as he did three days before the Fed stared buying corporate bonds in March 2020, when we flagged his research predicting just that outcome generating massive profits to those who read and acted upon his insight), and the man that even Zoltan Pozsar listens to – we are of course talking about former NY Fed analyst and current BofA rates guru Mark Cabana, who just like his credit peers at BofA, had a rather timely note sent out late on Friday, in which he makes a not too subtle point: unless something changes, and liquidity in the Treasury market isn’t promptly refilled, then forget credit, it’s the world’s biggest and most important market that is about to break.

Below we excerpt the key sections from Cabana’s note, which centers around the biggest question in finance: will the Fed pivot (i.e., pull a BOE), and when? Well, as Cabana answers, the “Fed could follow BoE” if not for any other reason than US Treasuries, “are fragile, breakdown is risk.” Here are the details:

Last week we discussed the rates market “impossible trinity” of

- high debt loads / unsustainable fiscal policies

- restrictive regulations

- markets free from CB intervention / asset purchases.

The rates market can’t have all 3 at the same time. This “impossible trinity” concept was proven true sooner than we thought with the BoE rates market intervention this week.

Cabana then says that “clients have asked if the Fed could follow suit.” His response: “yes, in extreme stress” a situation which is fast approaching because as “the Fed wants to blindly pursue its quest to get inflation down but deteriorating market functioning or frozen credit could push them to intervene.”

Cabana then briefly pivots to a topic we covered previously, namely his conviction that QT will end far sooner than the market, and the Fed of course, expect, then progressing to the topic of growing TSY illiquidity which is a direct byproduct of the Fed’s current policy error, the hyper-fast tightening:

We have long argued Fed QT would stop under one of 3 conditions: (1) reserve scarcity, likely in late ’24 (2) recession & Fed rate cuts (3) market functioning breakdown. QT stop with recession seems most likely but market functioning breakdown risk has grown. The risk of UST market functioning breakdown has grown due to:

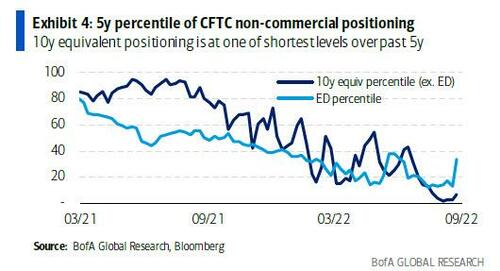

Limited risk taking: the Fed wants higher rates but does not know where to stop. Rates investors have heard the Fed message and are short / underweight duration. Speculative investor positioning remains at near historic shorts (Exhibit 4). Rates investors won’t shift positioning long until (1) data softens (2) Fed pivots. Until positioning shifts, there is a demand vacuum where USTs lose their risk off hedge value.

Weak UST demand: most common ’22 client question = “who will buy the bonds?” Our prior work suggests asset managers must step in to offset lack of UST buying from banks / foreigners / Fed. Asset manager UST risk taking willingness is limited; they know central bankers want rates higher & won’t fight the Fed. This backdrop supports limited demand & creates potential for rates to re-price higher.

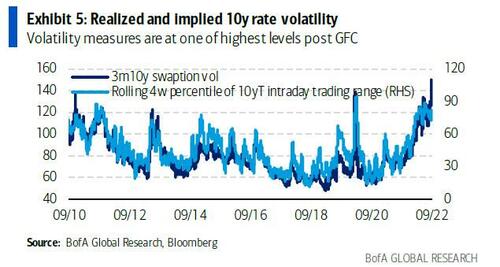

Limited risk taking & UST demand vacuum resulted in a deterioration of rates liquidity. UST order book depth has dried up notably: depth in 2y notes are at March ‘20 lows, 5y+ tenors are not far from it. Realized & implied volatility is at post GFC highs.

Policy makers have not helped to support liquidity. The Fed can’t offer credible rate forward guidance. Treasury won’t adjust issuance to address acute supply / demand imbalances on the curve (front end = demand > supply, back end = supply > demand). Practical steps like liquidity providing UST buybacks are far in the future. Policy makers assume the UST market will always be liquid, it won’t; liquidity is a privilege, not a right.

Understandably, in a world in which the (formerly) most liquid instrument suffers a sudden sharp collapse in liquidity, the outcome should be rather straightforward, and if it isn’t, Cabana frames it just in case: “UST breakdown is a growing risk.” He explains further:

Thin UST liquidity & limited demand may make the US market vulnerable to a market functioning breakdown, similar to UK. UST breakdown catalyst is unclear but could include: large scale foreign FX intervention to weaken USD / sell USTs, US fiscal shock in Nov with surprising D Congress hold, higher spending for natural disasters, etc.

Cabana predicts that the coming Treasury market breakdown would likely be similar to March ’20 “where back end rates rapidly re-set higher & investors stay sidelined despite attractive yields.” Of course, such an unanchored Treasury back end “would have rapid spillover effects into other markets; IG issuance will halt (similar to HY), credit creation will slow, bank funding will tighten.” Think credit market collapse on steroids, and this time not due to covid but as a result of the Fed’s own catastrophic actions. The silver lining: “An unanchored UST market may be fastest & most disruptive way to tighten conditions & lower inflation” according to Cabana; of course, a broken Treasury market would have far more terrifying and catastrophic consequences than just “lower inflation” – it would destroy the US, and western economy, overnight.

Here’s how the next TSY crash would look like:

A true UST back end market breakdown would likely require large scale forced selling, akin to UK pension margin calls. Forced selling would risk exacerbating rate market moves amidst insufficient liquidity. We are unsure where this forced selling might come from today but see mutual fund outflows as a risk. Margin calls also inevitably increase in highly volatile markets.

And while Cabana says that “A UST breakdown is not our base case” – of course, he would never make such a dire, catastrophic prediction his base case while employed at a major bank – it would be seen as one of the most erudite rates strategist shouting fire in a crowded theater, and sparking a bond market crash in minutes – until it is effectively the case, “but it is a growing risk” he adds.

So what could, or should, the Fed do to avoid such a catastrophic consequence?

Well, naturally, the Fed will never tolerate a UST market breakdown, similar to the BoE. And yes, the Fed will promptly capitulate on its inflation-fighting quest if the alternative is a complete collapse of US bond, and therefore capital, markets no matter how much some bears want to believe that the Fed will just sit there and do nothing until CPI prints 0% even as economic mushroom clouds scatter across the landscape. As Cabana counters, Fed officials are aware of the rapid & negative spillover effects from an unanchored UST market especially for credit creation, i.e., the beating heart of the economy.

Or as one of the most respected Fed watchers puts it “The Fed wants to slow the economy, not have it come to a crashing halt.”

What happens then? Well, it’s not exactly rocket surgery, but since some are still confused, Cabana explains:

The Fed would likely fix a UST market functioning breakdown by buying bonds. Fed QE would run counter to its aim of tighter fin conditions & slower inflation. Therefore, we might guess any rate market intervention would be sterilized: the Fed could twist again.

We expect that any UST market breakdown & Fed intervention would be concentrated at the back end of the curve, not the front end. The back end has the most duration risk, most volatility, & least risk taking willingness. A Fed that needs to support the back end via asset purchases would likely seek to offset it via front end sales or runoff. The Fed might also aim for any twist to be duration neutral to avoid easing conditions.

Fed intervention sterilized at the UST front end would likely be met with strong demand. The Fed has nearly $1.25tn of UST holdings maturing in <1Y, including $315b bills. Any front end sales would likely be offset with strong front end investor demand, including the $2.4tn at ON RRP. The Fed could help the acute US rates supply / demand imbalance Treasury has been unwilling to do via its issuance decisions.

You got it: it’s almost Chubby Checker time…

… or as we have also said for the past year: the Fed may still be hiking rates, even as it resumes buying bonds (sterilized at first, similar to the NOT QE phase in Sept 2019, then going all in again and buying pretty much anything). Incidentally, Cabana is not the first one to warn the world that the “Twist” is coming: on Friday it was his fellow Bank of America, Michael Hartnett who wrote that the Fed started the original ‘Yield Curve Control’ Operation Twist just 4 months after Pearl Harbor (April’42) to help fund war and keep interest rates flat. Expect no less during this war.

Don’t believe us? Here again is the former NY Fed Markets Group officer (i.e., the guy tasked with implementing QE):

The rates market “impossible trinity” & UST breakdown risk remind that (1) Fed is buyer of last resort (2) monetary policy may be increasingly implemented at back end. Elevated debt burdens & fragile market functioning may push central banks to control economic & financial conditions by buying more or less long dated bonds (vs adjusting overnight rates). Central banks may be forced into YCC due to too much debt & restrictive regs.

And while there is much more in the full must-read note, Cabana’s conclusion is relatively straight-forward, and echoes that of his credit strategy coworker Oleg Melentyeb who reached the same conclusion, if only not in the context of rates but credit:

“UST market functioning breakdown is a growing risk & may see long-end duration sell-off + curve bear steepen. The Fed is unlikely to tolerate a UST market functioning breakdown for long; if the UST market doesn’t work, broader markets likely don’t work. Fed intervention would likely mean a flatter curve as long end purchases support market functioning but are sterilized via twist and / or offset with rate hikes.”

The last time Cabana warned that a Twist was coming was August 2019 (we wrote about it in “Forget China, The Fed Has A Much Bigger Problem On Its Hands“). His prediction was mocked then… until the Fed launched the “Twisting” NOT QE some 4 weeks later when the repo market imploded. How long until Cabana is proven correct again this time?