Der har været en række positive udviklinger i den globale økonomi i den seneste tid, men Nordea er ikke overbevist om, at risikoen for en nedtur er overstået.

Uddrag fra Nordea:

More positive market sentiment has continued lately, and while we do note that some downside risks have been reduced, we are not convinced that we have seen the last of the slowdown. We expect bond yields to fall back clearly towards the summer.

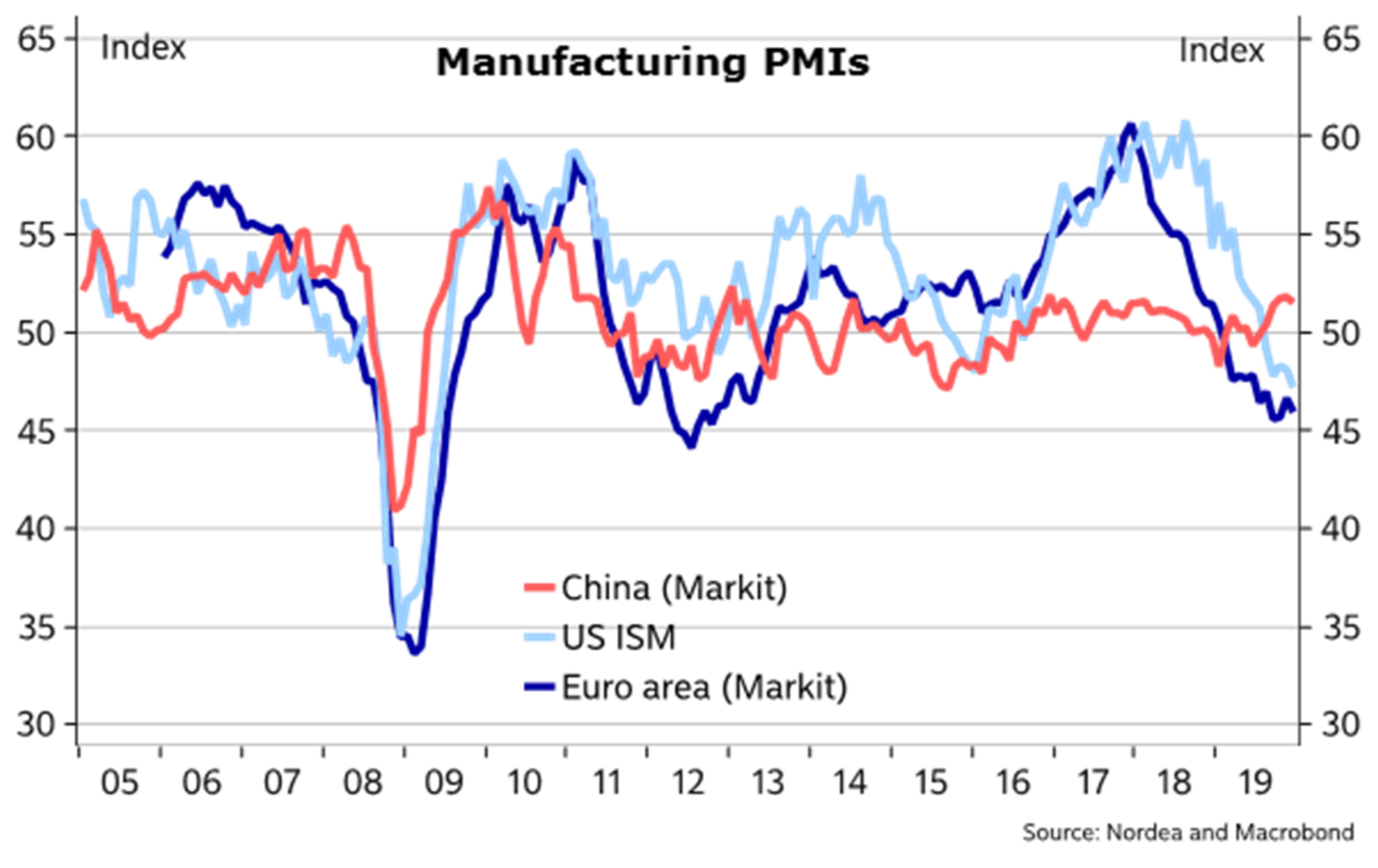

The global manufacturing PMI has risen in four of the past five months, the OECD leading indicator is pointing to clear rebound in growth, the US and China have struck a trade deal, the worst Brexit related uncertainty seems to have lifted and the tensions between the US and Iran have been pushed back to the background. It should be no wonder then that bond yields have been heading higher lately, expectations of more central bank easing have been disappearing and equity prices have stormed higher.

We are far from convinced that we have seen the last of the slowdown story. For a start, the global uncertainties have not disappeared, merely eased temporarily.

Regarding economic data, we are not convinced by the tentative stabilization we have seen in the data. Our broader GDP models show a further slowdown in growth ahead, especially in the US, and the weakness that has so far concentrated mainly on the manufacturing sector is likely to spill over more to the services side as well.

As a result, we do think that recession worries will return before we see more convincing signs of an improvement in the outlook. We do note, however, that some of the downside risks have been reduced lately.