Uddrag fra Steno Research:

The “inflationistas” in the FOMC have basically warned us that inflation will arrive now—and by now, I mean already in the report tomorrow and over the coming 2–3 months. While the new August 1st deadline and the raised tariff levels (on some trade partners) will allow Powell to once again claim that he needs more time to assess the consequences, it still feels like the FOMC is painted into a corner. They have a base case of a material increase in inflation and a base case of two rate cuts despite that expected inflation wave.

So what if inflation never arrives in the size they expect—or what if they have the timing wrong, as per usual? I see a pretty decent probability that this will be the case once again.

Why, then, is inflation not really a concern despite tariffs? It seems so straightforward to expect prices to increase. I think we have a couple of effects at play.

First, the material impact on decision-making will lead to a long lag between tariffs and the actual price increases. Chart one is taken from my monthly “State of the Union” macro address from April, which I used to prove a point just after Liberation Day. Order books were incredibly weak compared to “front-loaded” inventories, as everyone had scrambled to secure the supply chain ahead of tariff implementation. Just take a look at local inventories of metals in the US compared to normal—we’re talking about a 10–20 standard deviation move in inventories. And even if prices are increased at the border now, it will obviously take quarters to eat our way through those stockpiles imported at tariff-free levels (or under older duties).

We’ve only seen a similar setup once before—during the very first round of lockdowns in the first Covid year. And for those of you who participated in markets at the time, you’ll remember that it took at least 6–9 months before the COVID inflation truly appeared. The first wave was incredibly soft, and prices remained benign. A similar development is happening right now, and it will most likely wrongfoot the Fed—who have promised us that inflation will show up now.

Chart 1: A similar setup has only been seen during Covid

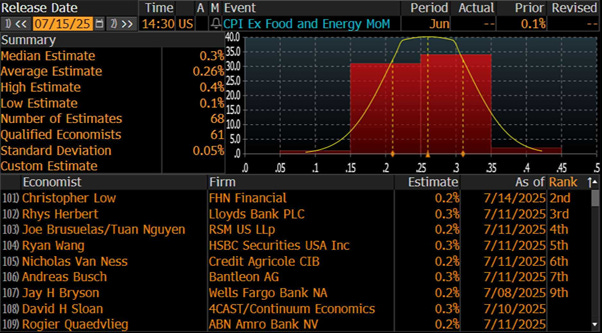

It’s not that I cannot see the risk of a decently hot inflation report in June—it’s actually my expectation. The base case is a 0.3% print on the month for June (released tomorrow), with some mixed elements to it. But remember that July is seasonally incredibly soft—and that various live price aggregators, such as our own (expect more info on that soon on Real Vision), as well as others like Truflation and State Street, have seen fairly soft price developments again over the past 20–25 days.

So even if we don’t get a “home run” for those hoping to see inflation come down (they seem to be fairly few these days, as most people want to see Trump’s policy end in tears), the July report is likely going to be super soft again. That leaves another couple of months of inflation sufficiently soft to typically warrant a rate cut—even Powell admits to that.

The big if is whether Powell and his ilk will ask for another couple of months of data before delivering cuts, but that risk probably diminishes as we approach the nomination of a new Chair. It was visible from the last set of minutes that a faction fight is brewing, but there is a tiny majority in favor of “pleasing Trump”—and that majority will likely grow as the nomination intensifies.

Chart 2: Expectations at 0.3% on the month for June inflation

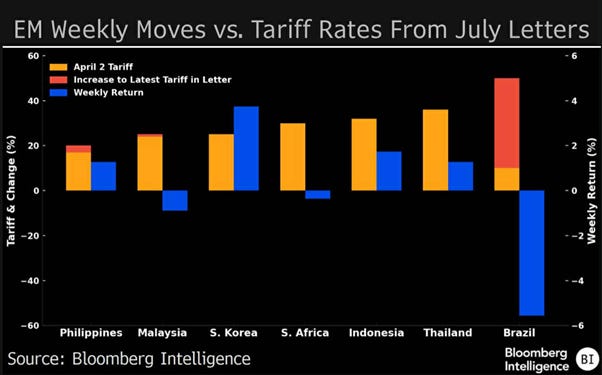

Regarding tariffs, it’s worth noting that Japan, Korea, and other trade partners were “hit by the tariffs letters” already early last week, yet still managed to post gains in equity markets in the days that followed.

We are in the part of the business cycle that is distinctly re-inflationary—typically associated with a rebound in trade volumes, positive side-effects from a weakening USD, and Manufacturing PMIs bouncing back above 50. This is the phase where equities, even outside of the U.S., tend to perform in tandem with digital assets and commodities. Think of the 2020/2021 playbook: that’s where we are in the cycle, and in many respects, it feels more like mid-to-late 2020 than 2021.

We therefore remain unconvinced that the threats made against the EU and Mexico are worth worrying too much about. Of course, Trump is an eager beaver and things can change, but for now, it just looks like another wall of worry that is being over-subscribed to.

Chart 3: Those receiving letters performed last week

And while markets remain hyper-focused on the timing of the next Fed rate cut, the real game-changer is quietly unfolding in the plumbing of the financial system. The recent FOMC meeting and proposed revisions to the Supplementary Leverage Ratio (SLR) mark a major inflection point—one with far-reaching implications for USD liquidity and risk markets.

These changes, driven heavily by Treasury pressure and likely to be finalized by September, would relax capital buffer requirements for the U.S. G-SIBs, unlocking over $200 billion in lending firepower. That’s a liquidity injection on par with 1.5 to 2 months of peak Covid-era QE—but without the Fed expanding its own balance sheet. Instead, it’s a green light for private banks to do the heavy lifting.

This is a powerful, procyclical boost to credit that shifts the focus from monetary policy to regulatory policy as the dominant driver of macro liquidity. The implications are profound: more USDs sloshing through the system, downward pressure on the dollar, and a risk-on tilt to global assets. While rate cuts dominate headlines, this stealth balance sheet shift—enabled by politicized monetary policy—is arguably the more consequential development as we approach the September FOMC.

We hence stay long digital assets, US equity indices, select RoW exposure, and metals/miners and Dronetech-manufacturers and our portfolio is currently through the roof.