Energy prices in Europe are falling from the sky

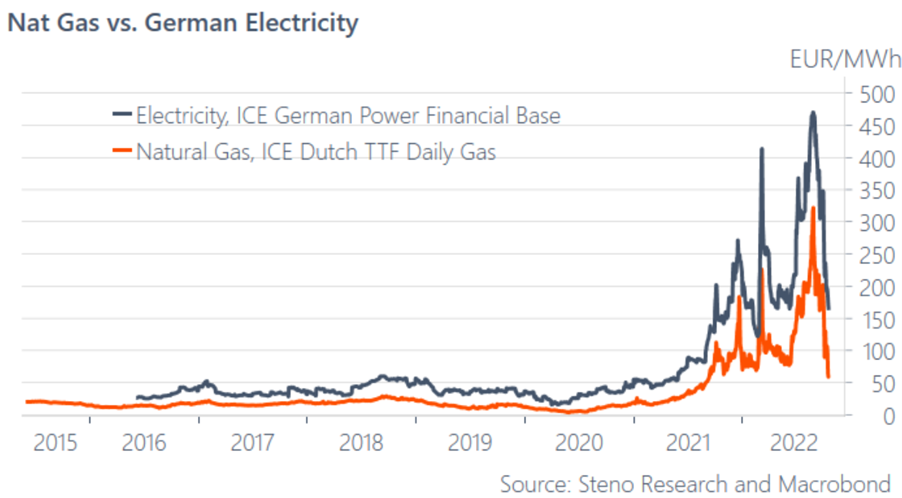

In Europe we are starting to see the absolut crazy price levels in natural gas and electricity cooling off. Natural gas prices have dropped from >300 EURs per MWh to levels just north of 50 EURs and day ahead prices are even lower in many areas of Europe. Even though this will not be reflected on the bill of households and corporations immediately, this is still great news going into the heating season. Furthermore we have had a warm October allowing storages to remain very high.

Chart 9: Nat Gas & Electricity dropping like a stone

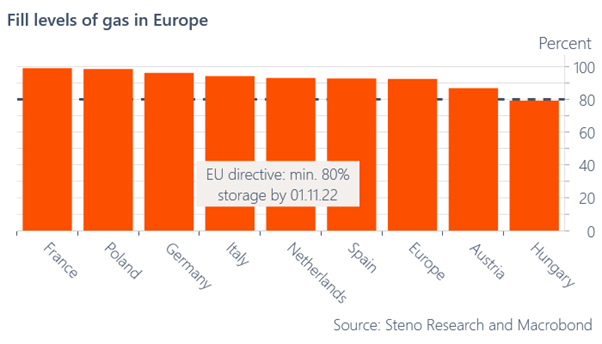

Prices in Spain have dropped as low as 27 EURs per MWh for natural gas as there is currently a queue of ships waiting to off-load outside of Spanish LNG ports with fill-levels in European storages already close to 100% way ahead of schedule.

It seems as if everyone mail-ordered natural gas at the same time a couple of months back and now all the sudden there is no way to store all of the mail-orders… I would NOT be surprised, if spot natural gas prices went very close to zero in the weeks ahead due to a bizarre over-supply short-term.

I have been talking about this issue over the past 6-8 weeks, while most other pundits were stuck in doom-mongering about the supply for this winter.

Chart 10: Fill levels are WAY ahead of schedule in Europe

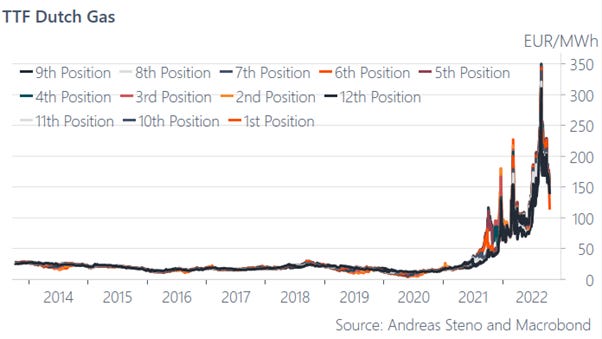

Interestingly, the futures curve has a positive beta to spot developments, which means that even if the price action is currently driven by a short-term oversupply, it brings the ENTIRE curve down with it. This is not particularly rational, but that is often how a market works. The best trade is hence probably to fade December or January contracts for TTF natural gas still and look for a reversal in 1-1.5 months from now.

Chart 11: When the spot price drops, the entire curve follows

It also seems like Europeans are listening to calls asking them to save heating and electricity. Through September and October German households have saved 20% or more on their gas consumption compared to last year. This lowering of demand is also necessary given the market’s expectation of a pick up in prices over the next months..

For now, given that 1) flows are solid, 2) temperatures are hotter than usual and 3) storages are already full, we should expect prices to continue towards zero in the coming weeks.

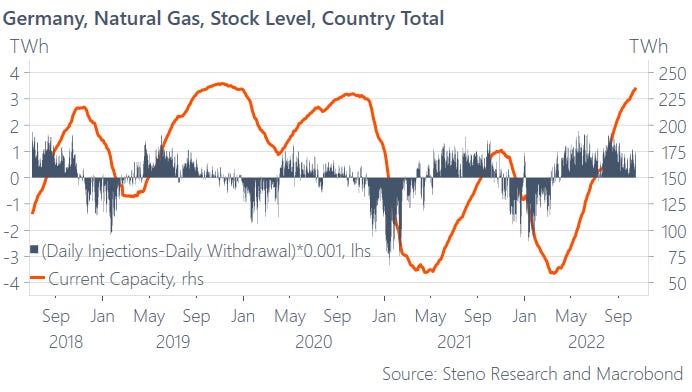

Through November, the net-injection into storages typically flips due to the heating season commencing, which will allow for a bigger net spot demand for natural gas, but we can call off the worst case scenarios for this winter. 2023 supply is now the issue that we need to discuss.

Chart 12: There is still a solid net injection into storages in Germany through mid October

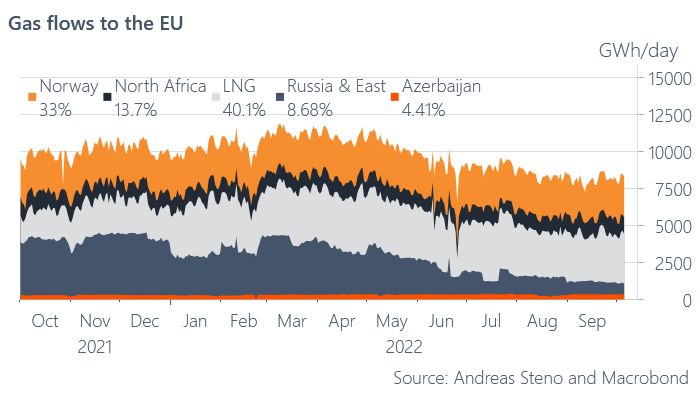

The 2023 supply is much less certain! LNG makes up 40% of the current supply of gas in Europe, but we are still running 20-25% below usual flow levels due to the lack of Russian gas. This is likely not an issue this year, but how are we going to replace 25% of the total gas flow throughout 2023 without big political moves?

Chart 13: Current source of flows of gas to Europe

The winter just ahead of us seems to be save, but in 2023 we may be in for renewed turbulence in Europe unless politicians wake up to the reality, but thankfully they have solved the test right in front of us and probably even overdone it to the extent where we now see OVER-supply of natural gas short-term. Interesting times indeed.