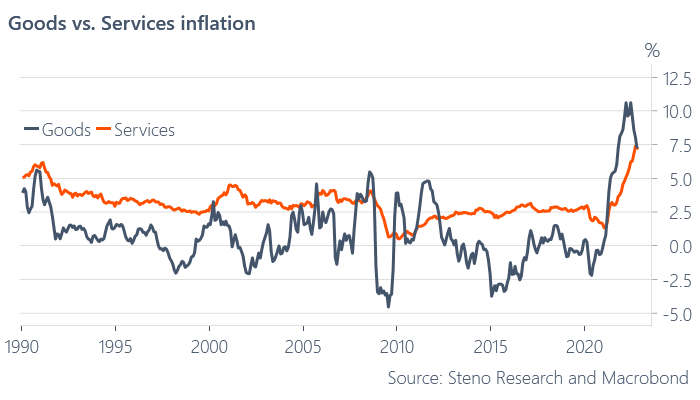

The monthly inflation report solidified what we knew already. Inflation is moving from goods to services and this trend is likely going to continue in coming months. We need to remember that CPI weights will be updated in January (earlier than the usual bi-annual schedule) as the weights are currently (too) tilted towards goods due to the pandemic consumption patterns

Chart 1. Goods and services sitting in a tree KISSING!

I know I have sounded slightly out of tune over the past months, when I have highlighted the risk of ACTUAL deflation in 2023, but I am getting increasingly convinced that it may turn out to be a decent call.

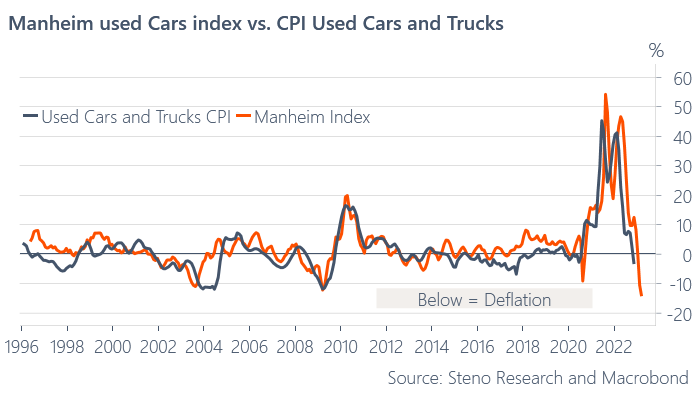

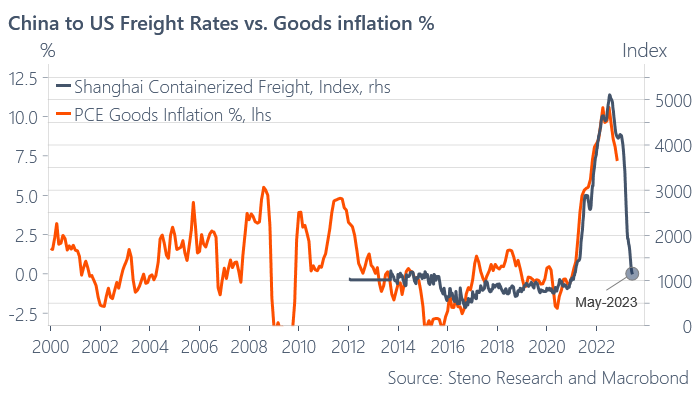

Freight rates point to 0% goods inflation in April/May 2023 on usual correlations, likely mostly as a result of a lack of demand for goods as the Chinese lockdown is still broadly as severe as earlier this year.

Chart 2. Goods inflation at 0% in 4-5 months from now… prepare accordingly

We already have outright deflation in various goods categories on a year over year basis and judging by auction data (Manheim index), we are ripe for the most severe deflation in car prices in the past several decades. When you shoot for the moon, you’ll often land among the stars. The drop in goods prices is even more severe on a 3 month annualized basis, which now hints of outright deflation risks.

Chart 3. If you want to buy a car, then wait

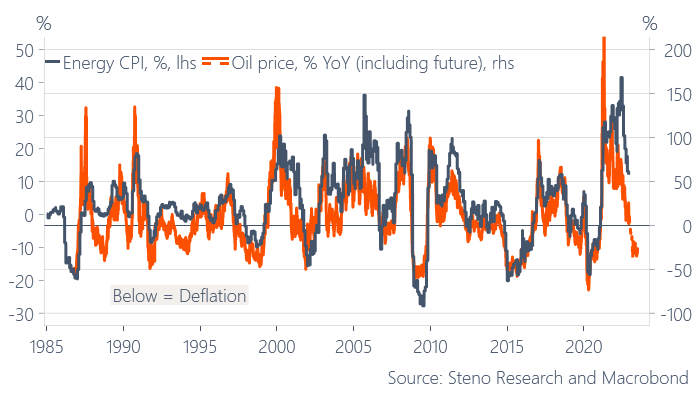

Energy is needless to say a CLEAR drag on inflation now and unless we get a remarkable bounce in oil prices over the coming 3-5 months, energy is bound to deflate in the CPI also in YoY terms by the early spring.

As the energy intensive sectors are currently faced with 1) high and rising inventories, 2) a weakening order book and 3) weak purchasing power developments among households, I remain bearish on energy (not least in stock space) for the time being.

Chart 4. Without a big rebound in oil prices, energy deflation is on the cards during the spring