Bond yields jolted higher on Friday, thanks to a strong jobs report (of which more later). What effect did they have on the stock market? Tech stocks had a great day. Recall that the popular argument has been that higher long-term yields are particularly harmful for “long-duration” companies, such as big tech groups. Most of their value is in future earnings, which must be discounted at a higher rate. Thus big tech did badly in 2022 as yields rose, and well in 2023 as they came back under control. And so far this year, yields have risen — and so have these stocks. This nifty chart is from Michael Hartnett of BofA Securities:

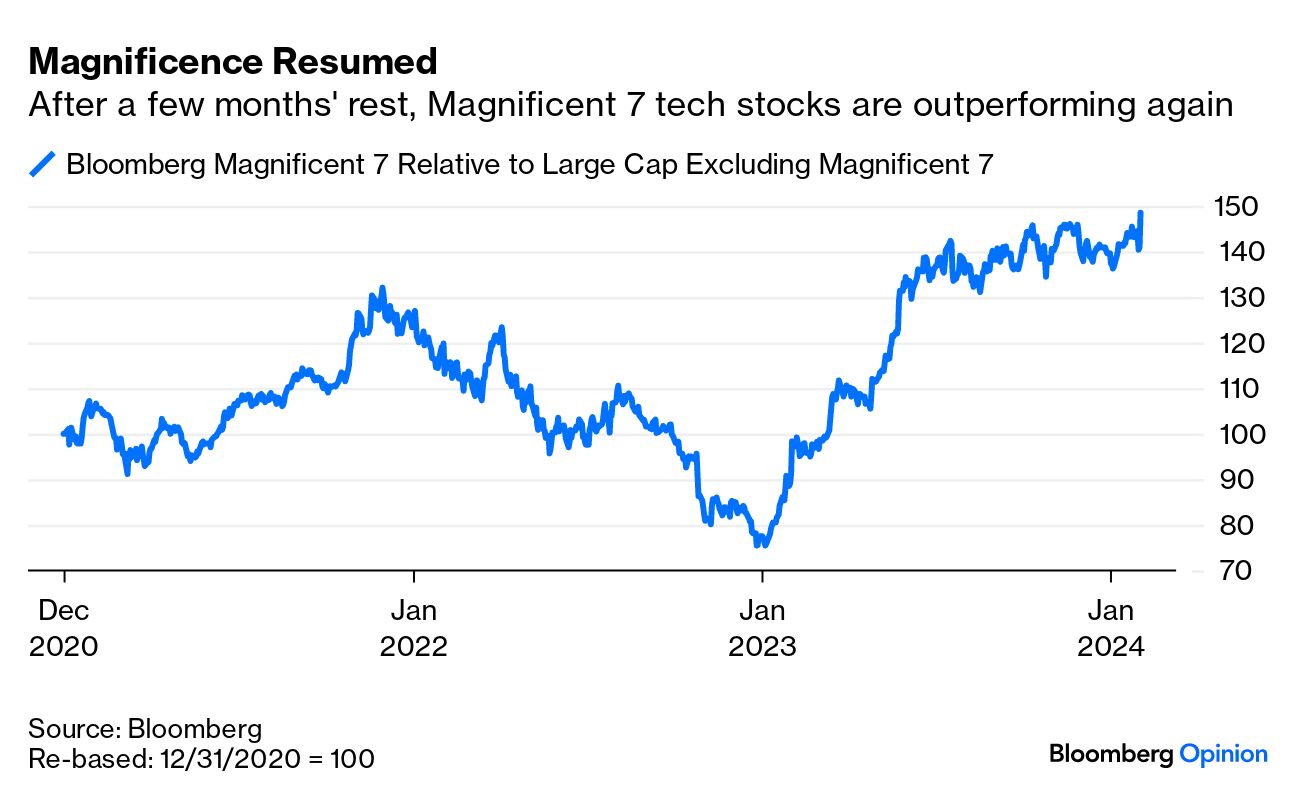

Over history, it’s important to point out that there isn’t a particularly strong relationship between changes in 10-year yields and the Nasdaq. But 2024’s combination of a bounce in yields and a great time for the Nasdaq is very unusual. The only more extreme instance came in 1999, when markets partied ahead of a burst bubble the next year. In general, this combination either happens after a bad recession (as in 2009) as yields rise and people also buy stocks, or in a bubble when people just don’t care. Hartnett’s chart is through Jan. 29, or last Monday. It will be quite a bit more extreme now, after Friday’s Nasdaq surge. That was largely thanks to the Magnificent Seven (Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp., Nvidia Corp. and Tesla Inc.), which led the market rebound in the first half of 2023. After leveling out for the last six months, final quarter results (which we now have from all bar Nvidia) were enough to bring the Seven to a fresh record relative to the rest of the market, using Bloomberg indexes:  How big a deal are the Magnificent Seven? Hartnett points out that they’re jointly worth more than the combined gross domestic product of New York, Tokyo, Los Angeles, London, Paris, Seoul, Chicago, San Francisco, Osaka, and Shanghai. Meta’s gain in market cap on Friday after its results was only just short of $200 billion (about the current market cap of the whole of Cisco Systems Inc.). That’s the largest one-day gain in value for any company ever. But it’s true that the Seven are growing more differentiated as they compete against each other. Investors are beginning to assess exactly which ones will reap benefits from artificial intelligence. Last year, that competition saw Elon Musk, CEO of Tesla, challenge Meta’s Mark Zuckerberg to a cage match. The fight never happened, but financially, Zuckerberg has been inflicting a bruising ever since. Suddenly, the market says Meta is worth more than twice as much as Tesla: Before Meta’s blowout results, the Seven accounted for 45% of the S&P 500’s advance for the year — but the Magnificent Six, excluding Tesla, made up 71%, according to Hartnett. These are strange times. BofA suggests a “barbell” strategy of holding some of the big tech names and balancing them with investments that might do well if the bubble bursts. After 1999, that proved to be value stocks and emerging markets. They might prosper again. |