Uddrag fra Goldman Sachs og andre finanshuse:

Ahead of tomorrow’s start of Mag 7 earnings season (MSFT, META and TSLA all reporting after the close on Wednesday followed by AAPL on Thursday, representing a total of $10.5 trillion in market cap) Goldman Delta One head Rich Prvorotsky writes that at the end of the day it will all simply boil down to “who is spending less and who is spending more. The bar for numbers feels low given the aggressive starting point of sell tech/sell America/buy everything else.”

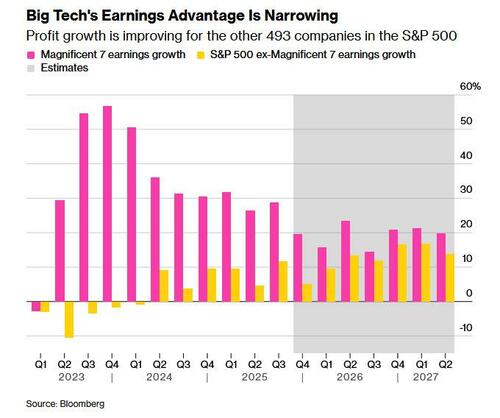

The group is expected to post 20% profit growth for Q4, which would be the slowest pace since early 2023. So the companies are under pressure to show that the vast sums they’ve committed to capital expenditures are starting to pay off in a bigger way.

With a third of S&P 500 companies (by market cap) reporting results this week, robust figures from the Mag 7s should boost sentiment and help push stocks into record territory. Almost 80% of the firms in the S&P have reported results thus far have beaten analyst earnings estimates, according to data compiled by Bloomberg.

“We expect tech earnings to be strong,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “But we also expect earnings growth to broaden across sectors, with cyclical areas of the economy poised to benefit from supportive fiscal and monetary policies.”

Despite these very solid results, share prices of companies beating on the top- and bottom-lines have witnessed negative relative price action after reporting, according to Chris Senyek at Wolfe Research. “Said differently, double beats are being punished for solid results,” he said. “We do not view this trend as sustainable through earnings season and expect double beats to exhibit positive price action as more companies report.”

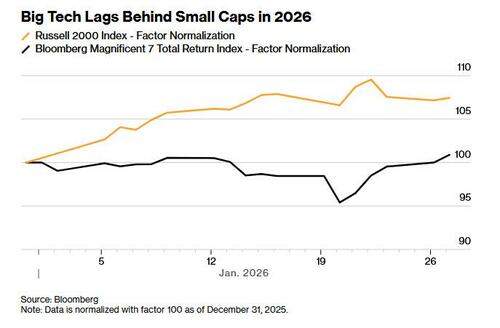

While big tech is rebounding ahead of earnings, so far this year, the high-profile cohort of megacaps is lagging behind small firms

Meanwhile, amid persistent debate around an AI bubble, Ari Wald at Oppenheimer highlights a more nuanced dynamic: the widening gap between large-cap growth and the rest of the market has been driven less by excess in leadership and more by persistent underperformance among lagging benchmarks. Long-term rate-of-change measures for the Nasdaq 100 remain well below late-1990s extremes, underscoring how steady, not speculative, the index’s advance has been, he said. By contrast, comparable momentum measures for small caps sit near the lower end of their historical range.

“This divergence argues that a reversal in the internal spread is more likely to come via catch-up – broader participation – rather than catch-down via a market-wide unwind,” Wald concluded.

And before we dig into the all important capex estimates, let’s take a closer look at the Mag 7 names on deck this week, courtesy of JPM’s Mark Schilsky and Doug Anmuth:

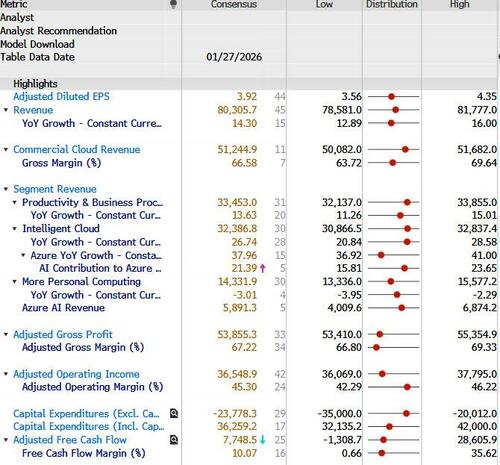

MSFT 25Q4 EARNINGS PREVIEW – Too Much SaaS, Not Enough AI: From an investor standpoint, MSFT is currently stuck between a rock (SaaS) and a hard place (OpenAI). According to Schilsky, the only way they extricate themselves is by meaningfully accelerating Azure growth into the low-to-mid 40’s quickly…. we probably don’t get that this quarter, but there’s a real chance we cross the 40 threshold on the guide. But, much of that potential acceleration is out of Satya’s hands. It’s in Sam’s. The market is modestly convinced that OpenAI is losing to GOOGL. It’s up to Sam to prove investors wrong with the launch of GPT-6.

While overall SaaS/Software sentiment remains garbage, investors will pick their spots by focusing on companies with accelerating toplines. For example, MDB, SNOW and ORCL (for a time) had a great 2025 due to accelerating topline KPIs. I do not see why MSFT will be treated any different than quality infrastructure software plays despite having exposure to a lot of ‘legacy SaaS’.

Fun fact: MSFT (~26.5x) is cheaper than GOOGL (~29.5x) based off CY26 Bloomberg Consensus EPS.

MSFT Q226 earnings on Wednesday 1/28 after the close.

Q2 2026 Earnings Expectations:

- Azure FXN Revenue Growth: Amy guided Azure to grow ‘approximately’ +37% Y/Y FXN in Q2. The Street is right in line with her. Investors expect a beat on the order of two points so call the bogey +39% Y/Y FXN growth. [Yes, MSFT and overall software sentiment are depressed, but MSFT beat by two points last quarter so in my estimation most investors expect a similar-sized beat again. It’s the multiple that has been compressing, not Revenue growth estimates.] If by some chance MSFT hits +40% Y/Y this quarter I think that would decidedly be enough to power the stock higher, no matter how terrible software sentiment remains.

Q3 2026 Guidance Expectations:

- Azure FXN Revenue Growth: Assuming MSFT puts up +39% Y/Y growth in Q2, investors will want a guide that either explicitly shows Azure accelerating or strongly suggests it, despite the fact that the Street has growth decelerating about -150 bps sequentially. As such, investors believe that the guide needs to be ‘approximately’ +38% Y/Y FXN – perhaps a point higher.

Consensus:

* * *

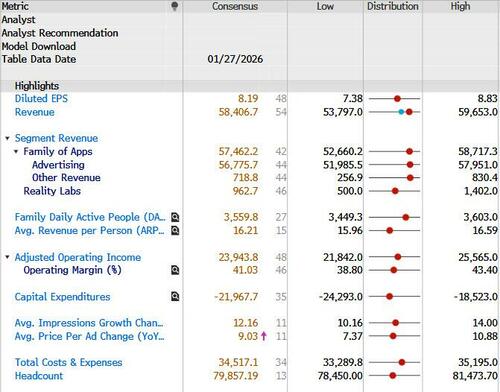

META 25Q4 EARNINGS PREVIEW – Avocado Toasted: Investor sentiment has soured considerably on META since the Q3 25 print when it became abundantly clear that Zuckerberg’s foot remains firmly pressed down on the OpEx/capex accelerator. To date, investors have seen little tangible evidence that the Meta Superintelligence Lab is capable of producing a leading edge model – and we won’t receive clarity on that issue this print. (But we may get some in the March/April timeframe when Avocado might launch.) Looking at this quarter specifically, investors’ attention is focused squarely on the 2026 OpEx guide (can’t be bigger than feared) as well the Q1 26 Revenue guide (needs to show a modest FXN acceleration on an easier comp). All told, I’d characterize investor sentiment on META heading into this print as ‘timid’.

From Doug’s META Q425 Earnings Preview: “Investor Sentiment: Cautious, w/concern around 2026 expenses/capex & AI strategy, despite continued outsized revenue growth…Our View: Expecting strong 4Q results & outsized spend in ‘26, but looking for greater commitment to financials, along w/MSL guideposts. We’re bullish on AI Ad improvements across content, ranking, retrieval, & automation. We model capex of $115B in ’26 (+61% Y/Y), along with GAAP expenses of $153B (+30% Y/Y) in ‘26, but Street should be there & above. Valuation attractive on GAAP P/E.”

META reports Q425 earnings on Wednesday 1/28 after the close.

Q425 Earnings Expectations

- Revenue: This is the only Q425 reported KPI that matters. Per usual, investors expect a modest beat above the high end of the $56B to $59 guidance range. Broadly, investors expect a ~$1B beat so call the Revenue bogey ~$60B (+24% Y/Y). The Street is at ~$58.5B.

Q126/2026 Guidance Expectations

- Q126 Revenue Guidance: The Street is at ~$51B (~+21% Y/Y, -12% Q/Q). Despite the stock being relatively unloved this quarter, investors expect a guide above that;a guidance range that looks like $50B to $53B (+18% to +25% Y/Y & -12% Q/Q off of Buyside expectations for Q425 Revenue) – maybe $500m lighter. [Note that the +16% Y/Y Revenue comp off Q125 looks easy, but it includes 3 points of an FX headwind so the organic growth comps is really +19% Y/Y FXN. As such, the organic Revenue growth comp FXN is ‘only’ two points easier in Q126 relative to Q425.]

- 2026 Buyside Revenue Estimates: Investors are broadly above the Street’s 2026 Revenue growth estimate of ~18% Y/Y. I’ve heard anywhere from +20% to +22% Y/Y for 2026 Revenue growth. Regardless, if investors are going to incrementally get interested in buying META’s shares this year, Revenue estimates are going to have to come up a few billion dollars.

- 2026 Opex Guidance: This is the first number most investors are going to look at when the print his the tape. It’s the KPI the most investors are ‘afraid’ of. Last quarter, Susan qualitatively guided 2026 opex to, “grow at a significantly faster percentage rate in 2026 than in 2025.” Looking at Street estimates, 2025 opex is going to grow about +23% Y/Y. What does ‘significantly’ mean? No one truly knows, but I think it’s clear that most investors believe that means >>30%. The Street is currently at ~$150B (+28% Y/Y) which investors universally have told me is too low. To wit, I would characterize investor expectations for 2026 opex to be $155B+. Assuming Susan widens the guide out from $5B wide to $7B wide, investors would broadly expect the initial guide to look something like $150B to $157B (+28% to +34% Y/Y). Perhaps it can touch $160B on the high end if they crush Q1 Revenue expectations, but I would expect an initial guide that high to be met mostly with investor revulsion. Furthermore, investors have nearly universally told me that they expect Susan will go back to the ‘usual’ pattern of slowly lowering the opex guide throughout the year – perhaps not to the low end, but certainly lower over time. I hope they are right.

- 2026 Capex Guidance: On the margin, this matters less to investors than the opex guide because investors still broadly value META on GAAP EPS. The range of expectations I have heard has mostly been in the $115B to $125B range vs. the Street’s ~$110B. I’d characterize the bogey as ~$120B. As such, a guide $7B wide that looks something like $118B to $125B would be ‘ok’ to a majority of investors. Similar to the opex guide above, Susan told us last quarter that, “our current expectation is that capital expenditures dollar growth will be notably larger in 2026 than 2025.” What does ‘notably’ mean? No one truly knows, but I think it’s clear that Zuckerberg wants to spend as much as the incremental buyer of his stock will allow. [Assuming the Street’s expectation of ~$70B in 2025 capex is correct, that means 2025 capex will have grown ~$33B Y/Y. If investors are right that META’s target capex is $120B that would suggest incremental capex growth of $50B. Is that ‘notably larger’ than 2025? I’d sure say so. After all, $50B is equivalent to META’s Reels’ annual run-rate as of January 2026.]

- 2026 Revenue/OI/EPS Guidance?: Some investors have suggested that perhaps Susan should put some guardrails around 2026 Revenue (a commitment like ‘greater than 20% Revenue Growth’) or 2026 OI/EPS (‘it will grow’). Personally, I don’t think she has to do that – or really should – as long as the Q126 Revenue Guide shows an acceleration in the Y/Y FXN growth rate.

- 2026/2027 Buyside Operating Income Estimates:Basically, investors want some sort of assurance that 2026 Operating Income will grow Y/Y. Flat to slightly down is decidedly a no-no. Furthermore, investors want clarity on 2027 Opex/Capex growth so they can credibly underwrite 2027 Operating Income and FCF. Too bad we will not get that sort of clarity on this call. Perhaps mid-year.

- 2026/2027 Buyside EPS Estimates: Based on recent investor conversations, most buyside estimates for 2026/2027 GAAP EPS are currently hovering around ~$30/~$35 vs. the Street at ~$30/~$33.50. [Buyside 2027 GAAP EPS estimates range widely, from $34.00 to $37.50.]

Other Issues:

- Meta Superintelligence Labs: Investors want to see progress. They want to see Avocado. They want to know what META is getting for all of this increased opex and capex spend. Unfortunately, we probably won’t get true clarity on this call. We will only get it once the next LLM drops and is ranked by LMArena.

- FRL Cuts: Will we get any incremental clarity on the magnitude of the net savings here? Have FRL losses peaked <$20B per year? It’s worth asking given that the Street has FRL losses deepening by another ~$5B in 2026.

- The EU:THIS could be meaningful this quarter. META has been warning about the negative impacts of the personalized ad opt-in/opt-out rule since the Q125 Earnings Release. Most investors seem to think the impact could be on the order of 1 to 2 points of revenue growth on a fully annualized basis.That’s not nothing.

Consensus:

* * *

TSLA Q4 2025 EARNINGS PREVIEW – What else: the Elon Musk show: Morgan Stanley sees a particularly wide dispersion in financial KPIs into the 4Q print and for 2026. The stock reaction will depend on the incrementality of updates around scaling robotaxi/Cybercab, launching Unsupervised FSD, Optimus Gen 3, and AI5 on the earnings call.

KPIs and Bogeys

- Deliveries. 9% below consensus in 2026 at 1.6m units (-2.5% Y/Y). We assume -13% Y/Y growth in North America, -5% in Europe, +0.5% in China, and 19% in RoW.

- Auto gross margin (ex-ZEV credit). 4Q25 MSe of 14.2% vs. consensus of 14.8%. For 2026 MSe of 14.2% vs. cons of 15.0%, in part driven by our lower volume growth expectation.

- Energy: +37% Y/Y volume growth to 64 GWh in 2026. Energy gross margins decline 50 bps Y/Y to 30%.

- Free Cash Flow. We estimate TSLA will burn $1.5bn of FCF in 2026 (vs. cons. of +$3.1bn). The company has indicated a significant step-up in capex in 2026, which we do not think is appropriately reflected in consensus.

- FSD: We assume global attach rate increases to 17.5% (from ~12% today) by year end. Approval in Europe and China, and launch of Unsupervised FSD will be key in driving higher penetration over time.

- Robotaxi: We assume 1,000 vehicles in fleet by year-end 2026.

Outside of the numbers, here’s what we’re tracking through earnings.

- Updates on robotaxi rollout and Cybercab production. Timing of public launch with no safety monitor in Texas is a critical near-term catalyst in proving out the technology and safety of its robotaxi platform. An update on miles driven in Austin through its robotaxi fleet will be helpful in measuring safety improvements. Lastly, keep an eye out for an update on Cybercab production, planned for April 2026. Note that Cybercabs have already been seen testing across various markets (Austin, TX, Bay Area and Fremont, CA, Chicago, IL and Buffalo, NY).

- Path to Unsupervised FSD. FSD miles driven have increased at an exponential pace, from ~90mn cumulative miles (150K per day) in 2022 to ~7.4bn cumulative miles today (~11mn per day in 2025). Concurrently, third-party-reported data highlight fairly meaningful improvements in the quality of the FSD offering. The next big unlock, in our view, comes when Tesla is able to offer a more enhanced “eyes off” experience (Unsupervised). We expect this to be rolled out in phases throughout 2026, but believe that Tesla’s decision to pull the robotaxi safety monitor in Austin is likely a precursor to personal unsupervised FSD rollout. Additionally, Tesla’s decision to move to a subscription-only service for FSD could be indicative of tiered FSD/pricing. Unsupervised FSD is critical to support our 17.1% vehicle volume growth assumptions in 2027.

- AI5 and beyond: We expect an update on Tesla’s AI5 chip design progress and how its chip program and compute efforts will evolve over time (AI6+, Dojo, etc.).

- Optimus. The company has pointed to Feb/March 2026 for the initial unveil of its Gen 3 Optimus bot. This is becoming an increasingly important part of the Tesla story and valuation. An update on timing of product unveil and start of production will be watched closely, particularly following a humanoid-packed CES.

- Convergence of the Muskonomy. The convergence of Elon’s other ventures into Tesla has come much more into focus. Look for updates from the company on how these ventures may prove symbiotic over time.

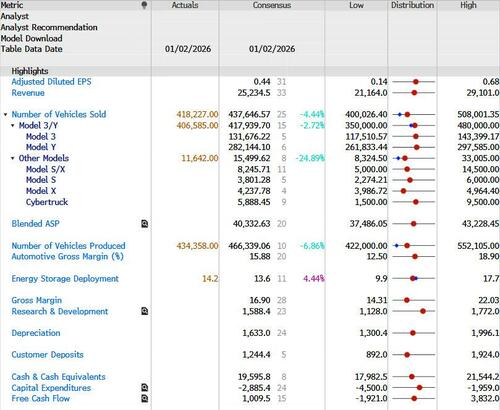

Consensus

* * *

AMZN Q4 2025 EARNINGS PREVIEW – The Andy Jassy Show: AMZN remains the most frustrating Internet stock for the most Internet investors, easily. (SPOT is #2.) AMZN is decidedly a crowded long, despite underperforming for the past several months (and years). Seemingly is long the stock headed into 2026 on a similar thesis of: 1) AWS Revenue growth will accelerate meaningfully – partially due to Anthropic’s continued rapid growth, 2) the stock is genuinely cheap now. It’s literally as cheap as it’s ever been on GAAP P/E, and 3) investors anticipate meaningful Retail margin expansion in the coming years as AMZN leverages the usage of robots inside their warehouses at an accelerating pace. “It’s a great, simple pitch. But the only KPI that truly matters this quarter is AWS Revenue growth. If we start to see modest AWS Revenue beats that allow investors to start penciling in mid-to-high 20’s growth by YE26 then yes, I would anticipate AMZN materially outperforming this year. Will we be able to do that sort of napkin math this quarter? Only Andy Jassy knows…”

AMZN reports Q4 2025 earnings on Thursday February 5th after the close.

Q425 Earnings Expectations:

- AWS Revenue: Like most quarters, AWS Revenue growth is the KPI this quarter. Investors expect a beat despite the alt data providers offering up estimates in a wide range from +21% to +23% Y/Y. The Street is at ~+21% Y/Y growth and most investors I spoke with are in the +22% to +23% Y/Y range. If I had to narrow down the bogey range further, I’d characterize it as +22.5% to +23.0% Y/Y. Again, AMZN is a crowded long. Furthermore, investors expect AWS growth to accelerate again in Q1 and then again in Q2. Anything less will be viewed as a disappointment – especially given that investors anticipate a similar accelerating cadence for GOOGL and MSFT.

- Collectively, if we are ‘wrong’ about AWS Revenue growth this year, it will be due to the fact that we all anchor to the alt data which has a massive Anthropic-OpenAI-Rainier blind spot. If AWS Revenue growth beats materially this year, it will likely be due to significant AWS capacity coming online in a way that is difficult for the market to ascertain in real time. I’ve heard from some AMZN bulls that AWS Revenue growth could exit the year in the very high 20’s. (The Street is decidedly too low with Q426 AWS Revenue growth at ~+20% Y/Y.) If this high 20’s AWS Revenue bull case comes true, I’m going to go out on a limb and state that AMZN’s stock will outperform this year.

- Retail Revenue: North American Retail Revenue growth is the concern this quarter. One of the major alt data providers estimates a moderate miss here. The Street is at ~+10% Y/Y growth whereas investors are broadly anticipating a -50 bps miss (or more) so call the bogey for North American Retail Revenue growth ~+9.5% Y/Y. Int’l Retail Revenue is anticipated to be better; the Street is at ~+14.5% Y/Y growth. Investors expect a figure here that I would broadly characterize as in-line.

- Total Revenue: Management guided Q425 Revenue in the range of $206B to $213B (+10% to +13% Y/Y – including a +190 bps tailwind from FX). Investors expect a figure right near the high end.

- Operating Income: Management guided Q425 Operating Income in the range of $21B to $26B (the Street is at ~$25B). Per usual, investors expect a modest beat above the high end. Call the bogey $27.0B to $27.5B – with more people at the high end of that narrow range.

Q126/2026 Earnings Expectations:

- Q126 Revenue Guidance: The Street is at ~$175B. Most investors are in the high $170s. Assuming the guide is $5B wide, investors would anticipate a guide that looks like $174B to $179B.

- Q126 Operating Income Guidance: The Street is at ~$22B. Investors want/need Street estimates to continue marching higher this year. As such, assuming the guidance range is $4B wide, investors anticipate the guidance range to be ‘no worse than’ $19B to $23B. Honestly, that feels a touch skimpy given the midpoint is below the Street. I wouldn’t be surprised if they provide a guidance range +$1B higher.

- 2026 Capex Guidance: We probably will not get this figure explicitly relayed to us this quarter. If all we get is a qualitative guide, expect management to say something like, ‘2026 capex will be materially higher than 2025 capex.’ Ultimately, probably on the Q1/Q226 earnings call, expect management to provide an explicit figure. Investors expect that figure will likely exceed the Street’s ~$150B.

- 2026/2027 GAAP EPS Estimates: Investor estimates for 2026 GAAP EPS are universally above the Street’s ~$8.00. Most investors are right around $9.00 for 2026 GAAP EPS. Interestingly, I’ve heard a wide range for 2027 GAAP EPS – anywhere from $11.00 to $13.50 with the average right around $12.00. The Street is at touch under $10.00.

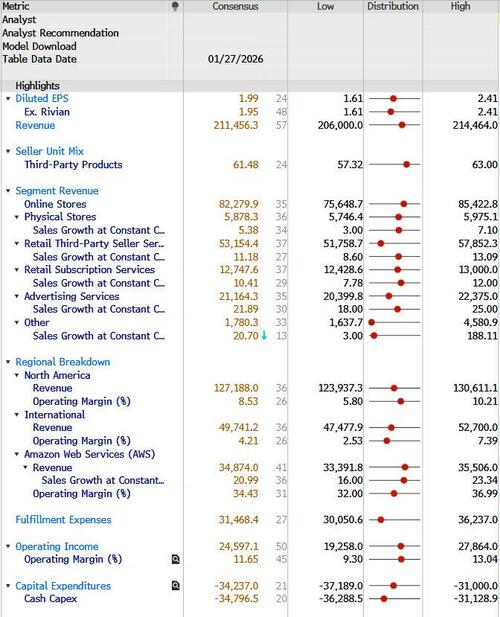

Consensus

* * *

GOOG 25Q4 EARNINGS PREVIEW – The Funding Long: “Owning GOOG the past few months has felt like snuggling up inside a warm blanket: cozy and safe. But I worry that we’re veering, short-term, into ‘lazy long’ territory. Buyside estimates for 2027 EPS are not significantly above the Street, so it feels like investors are playing more for continued multiple expansion rather than material earnings beats.” As Schilsky concludes, “That set-up bugs me given that GOOG is now more expensive than MSFT, AMZN and META on 2026 GAAP P/E.” Yes, GOOGL is going from strength to strength as Gemini continues to take market share from ChatGPT and we still have some major AI-related deals coming online this year (Anthropic TPUs, AAPL Siri, etc.) but the stock just feels a bit too loved to in the short-term to warrant massive overweight/long positions headed into the Q4 print.

*Spoiler Alert* OpenAI’s GPT-6 will probably launch during Q2 2026 and be awesome. It will probably beat Gemini 3 on most, if not all, LMArena metrics. All else being equal, this will be a bad set of headlines for GOOGL. Please keep that in mind in the coming months. [GOOGL bulls will argue it won’t matter unless the quality of the model results in increasing traffic share for ChatGPT. I beg to differ. And then, yes, Gemini 4 will leapfrog GPT-6 again late this year.]

GOOGL reports Q425 earnings on Wednesday February 4thafter the close.

Q4 2025 Earnings Expectations:

- Search Revenue: Investors expect a modest Search Revenue beat this quarter. The alt data has been strong and the channel checks supportive. The Street is at ~+13.5% Y/Y reported growth and investors anticipate a +150 bps to +250 bps beat so call the bogey range +15% to +16% Y/Y reported growth (including a ~1 point FX tailwind). (If I had to pick just one number I’d middle it and call the bogey +15.5% Y/Y.)

- YouTube Revenue: Investors broadly don’t care much about YouTube Ad Revenues, but with that said, investors also expect a modest beat here. The Street is at ~+12.5% Y/Y growth and the buyside expects a reported growth figure in the +14% to +15% Y/Y range.

- Google Cloud Revenue: This is the second quarter in a row where investors genuinely care about Google Cloud Revenue. (Historically, this has largely not been the case.) As such, investorsagain expect a beat above the Street’s ~+35% Y/Y estimate. I’d characterize investor expectations as very high 30’s: call it +38% to +40% Y/Y.And then it needs to accelerate again in Q1, meaningfully. Investors will also be checking out the Backlog figure in the 10-Q. It needs to keep ramping, especially as deals such as Anthropic come online during the year.

- Operating Income: Again, investors expect a material beat. The Street is at ~$37B. Given the magnitude of the Search beat anticipated, investors expect a beat on the order of +$2B so I’d characterize the bogey as approaching ~$39B.

- Capex: Assuming Anat guides 2026 Capex, which she probably should, investors expect a ‘beat’ above the Street’s ~$115B. I’d characterize investor expectations for 2026 capex as $125B++.

- 2026/2027 GAAP EPS Expectations: Based on investor conversations, Buyside EPS Consensus is shaping up to be $11.50/$14.00 in 2026/2027 vs. the Street at ~$11.00/~$13.50. In other words, even the Bulls are not that much higher than the Street on out-year EPS. That bugs me with the stock at the highs…

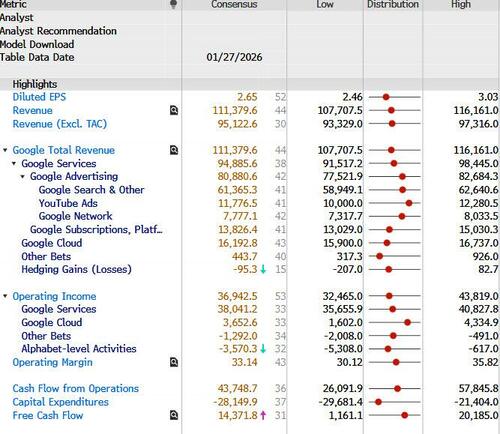

Consensus

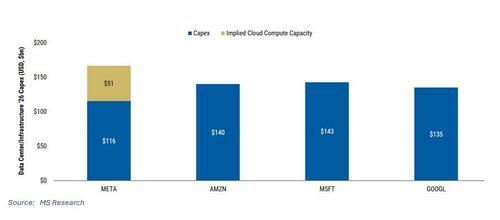

Last, but not least, here is a look at CapEx expectations, courtesy of Morgan Stanley:

- META expectations for 2026 capex guide for ~120BN as management has said 2026 would be ‘notably larger’ than 2025 where they guided $70-72B. MS analyst notes that META’s off balance sheet leases with GOOGL + CRW+ NBIS types are equivalent to another ~$50B incremental capex so ~$170B theoretical.

- MSFT latest commentary was for FY26 (Jun) capex growth to accelerate vs FY25 (>58%) and MS analyst + consensus model $140B+. For the Q, MSFT guided capex dollars up q/q which means >$35B (MS $36B). For FY27, consensus currently models $153B (vs MS $158.5B) but doubtful they will speak to FY27 capex since only F2Q report.

- GOOGL expectations are for ~$135B capex in 2026 but could be as high as $150B given momentum in GOOGL Cloud + TPUs. That’s up from 2025 guide $91-93B and management said 2026 would increase further.

- AMZN capex most opaque since they don’t split AWS Infrastructure vs Retail. MS models $140B infrastructure and $175B total capex in 2026 vs 2025 guide for $125B capex which they expect to increase next year.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her