Fra Sentix’ måneds survey:

The recent recovery of the European economy has come to an abrupt end.

After eight consecutive improvements, the sentix economic index for the eurozone fell by a whopping 7.6 points in July. Expectations slumped by 8.5 points to 1.5 points. The moderate economic momentum in Germany is also faltering again. The positive mood due to the European Football Championship 2024 is not spilling over into the economy. The already gloomy assessment of the situation deteriorated to -32.3 points, while expectations fell to -4.8 points below the April value. The French elections are contributing to the growing concern, as is the increasing slowdown in the US economy. The overall index for the US fell for the third time in a row to its lowest value since January 2024. Expectations are now also negative there at -2.5 points.

Headlines of the month

- After eight consecutive improvements, the sentix economic index for the eurozone fell by a whopping 7.6 points in July. At -7.3 points, the overall index is now more clearly in the red again. Expectations plummeted by 8.5 points.

- The moderate economic recovery in Germany has also come to an abrupt end. The positive mood due to the European Football Championship 2024 is not spilling over into the economy. The assessment of the current situation even deteriorated to -32.3 points, while the expectations component fell to -4.8 points below the April value.

- Internationally, the economic headwind is also increasing. A significant slowdown is indicated for the US economy: The overall index there falls for the third time in a row to its lowest value since January 2024, while the Expectations values deteriorate by 4.8 points and fall below the zero line.-

Uddrag fra Authers:

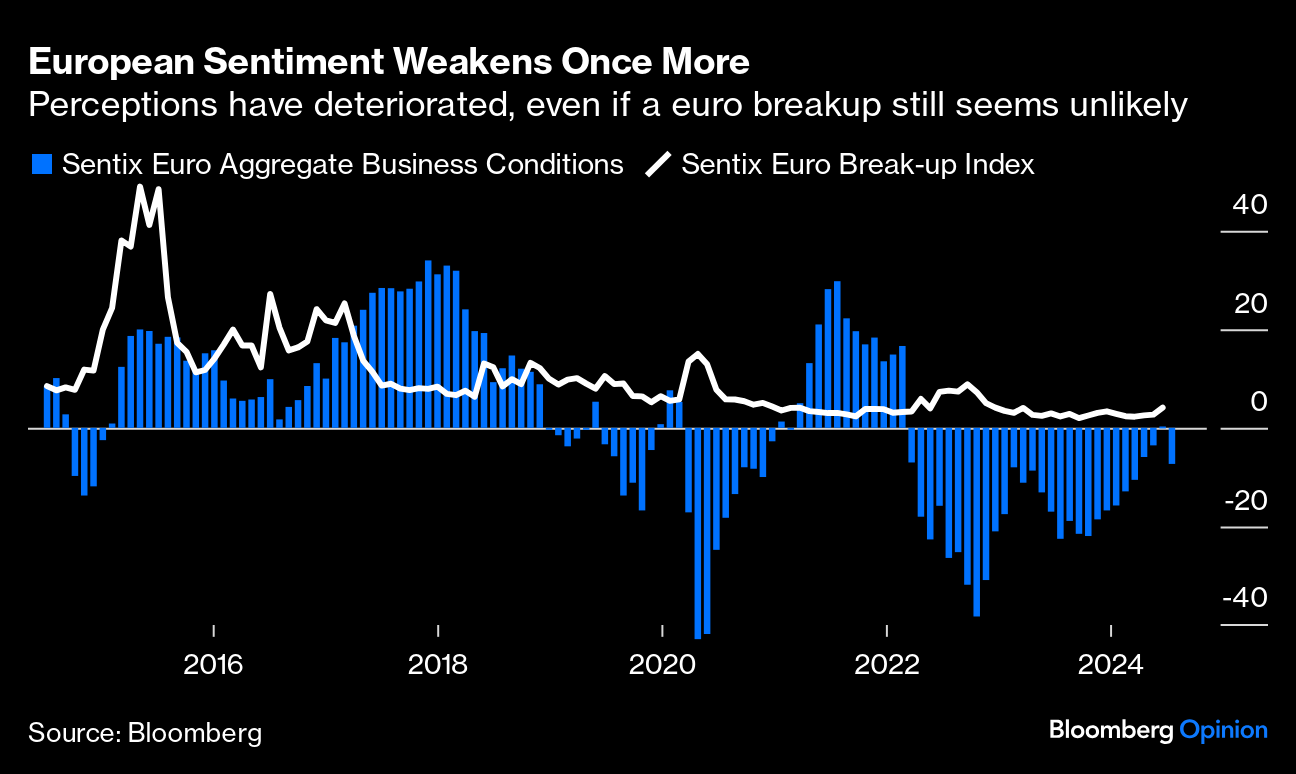

the latest Sentix survey, an increasingly influential survey of opinion among European investors and business, also came out Monday morning and showed a sharp dip back into negative territory after eight successive months of improvement. The perceived risk that the eurozone will break up is tiny, certainly compared with its peak above 40% during the Grexit crisis of 2015, but hopes for growth are dim:

It’s the nature of black swan-type events, which any move to break up the eurozone would be, to hog attention. Markets are really bad at judging them. But long, drawn-out underperformance, while much more conceivable, is predictably bad for risk assets.