Erhvervsstemningen i Sverige forbedres, f.eks. er indikatoren ESI steget fra 64,4 til 75,2 point i juni, men der er stadig krisestemning, og den er måske mere pessimistisk end forventet, skriver Nordea. Eksportindustrien kæmper. Forbrugerne ser dog relativt optimistisk på deres finansielle situation.

Uddrag fra Nordea:

Sweden Macro Flash: Confidence recovering but still gloomy

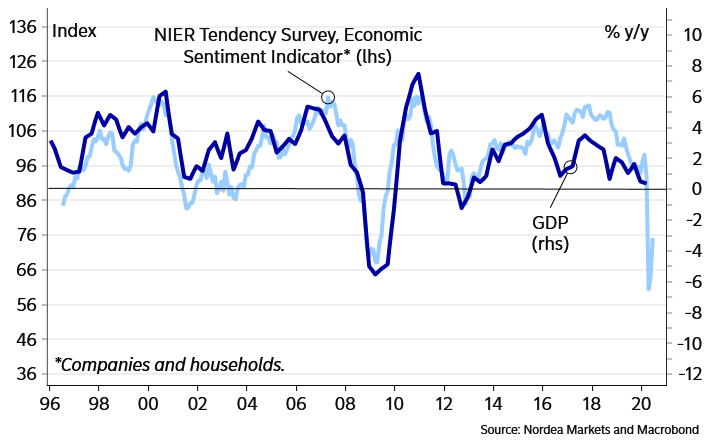

The Economic Sentiment Indicator (ESI) rose in June to 75.2 from the historical lows at 64.4 and 60.4 in May and April. Households are showing some resilience.

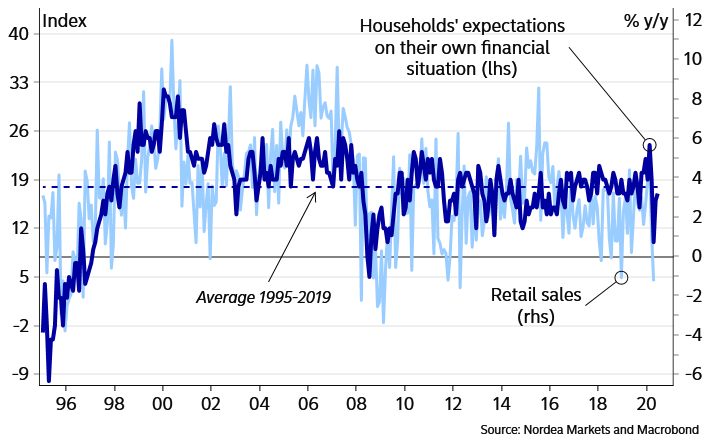

- The consumer confidence rose further to 84.0 (previous 74.2). Households’ expectations for their own economy is close to normal levels.

- Confidence in the total business sector was up to 68.6, up 10bp from May. Sentiment edged up in all sectors but remain well below normal levels across the board.

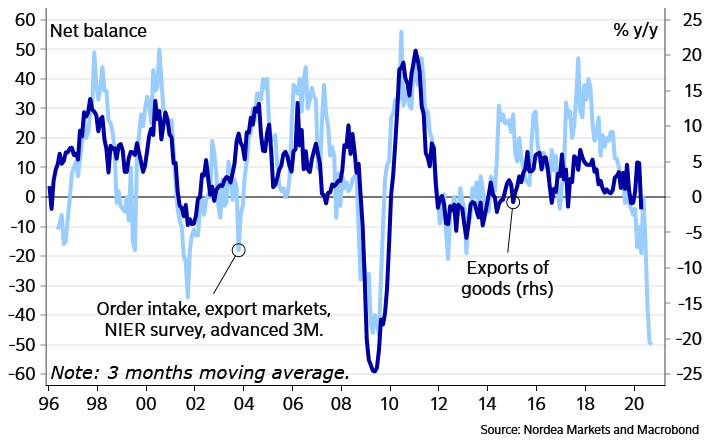

- Confidence in manufacturing industry rose as production improved. However, order intake remains depressed, which is concerning.

- Employment plans rose but are still pessimistic.

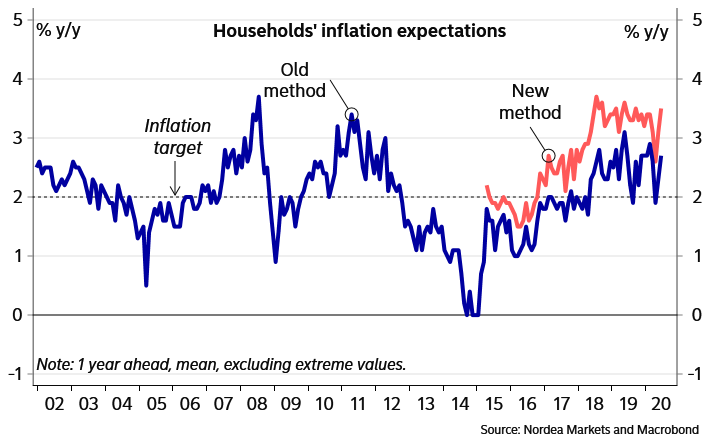

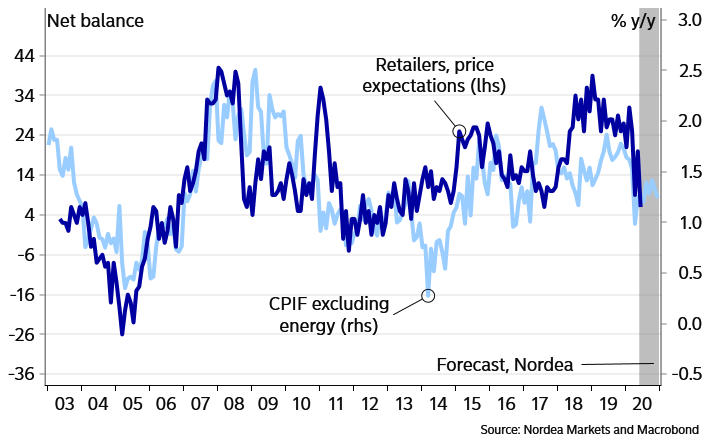

- Households’ inflation expectations remain high, probably reflecting rising food prices, which is of some comfort for the Riksbank. On the other hand, retailers’ price plans dropped markedly.

- All in all, sentiment is recovering from the initial shock, but is still gloomy and perhaps somewhat more pessimistic than expected. The export industry continues to struggle. A good sign is households’ relatively optimistic view on their own financial situation.

Details:

NIER, June Tendency Survey

Overall economy (ESI): 75.2 (prev. 64.4)

Total business sector: 68.6 (58.9)

Consumer confidence (CCI): 84.0 (prev. 77.7)

Manufacturing industry (MCI): 89.1 (76.4)

Private services sector: 61.8 (53.7)