Nordea har analyseret indekset for den svenske industriproduktion, PMI, der blev svækket i februar – til 61,6 mod 62,5 i januar. Det ser i virkeligheden værre ud, for “delivery times” er de dårligste nogensinde, og det viser en række flaskehalse i den globale afsætning.

Swedish PMI: Delivery times up, orders down

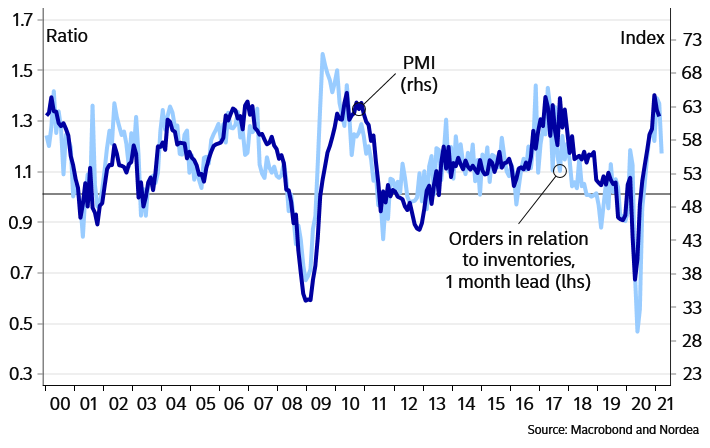

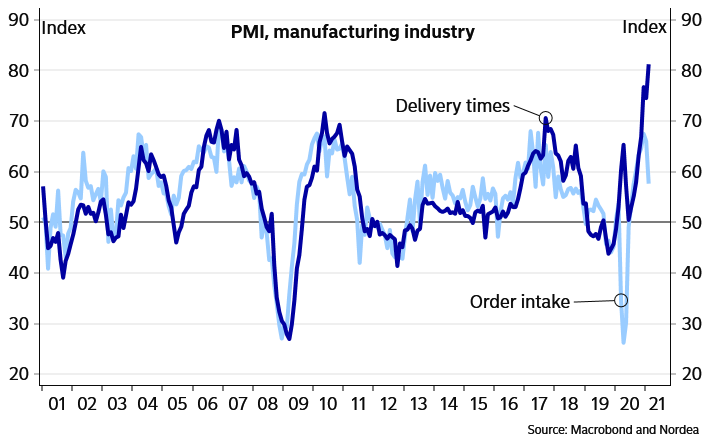

The manufacturing PMI stood at 61.6 in February, down from 62.5 in January and the multi-year high at 64.7 in December.

The report is weaker than the headline number suggests. The reason is that delivery times rose further to levels never seen before (81.2). Rising delivery times boosts the headline index. The rise reflects high capacity utilization but probably also bottlenecks as for some components as well as shipping problems.

The sub-indices for order intake declined. They are still at good levels, albeit lower than during the past six months.

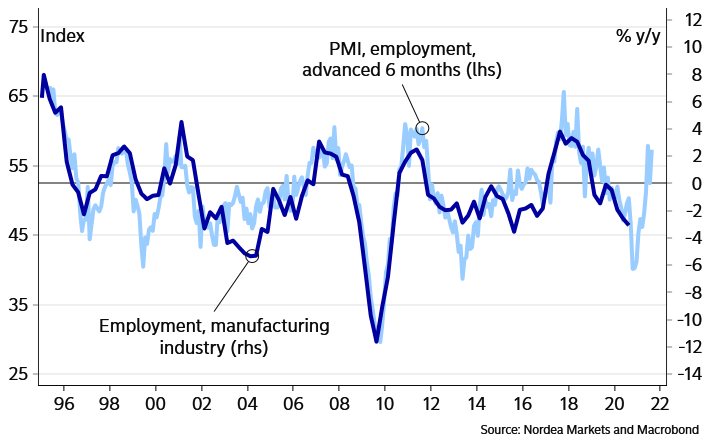

The employment index picked up and suggests that companies are hiring staff, which is encouraging.

The high reading for the price index should be seen on the back of the upsurge in metal prices on the world market.

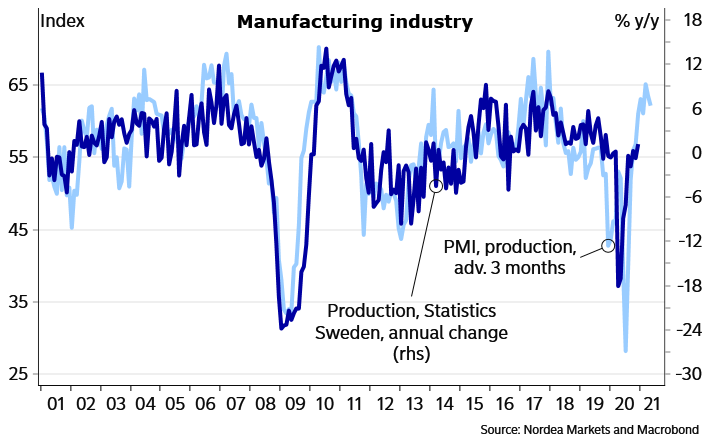

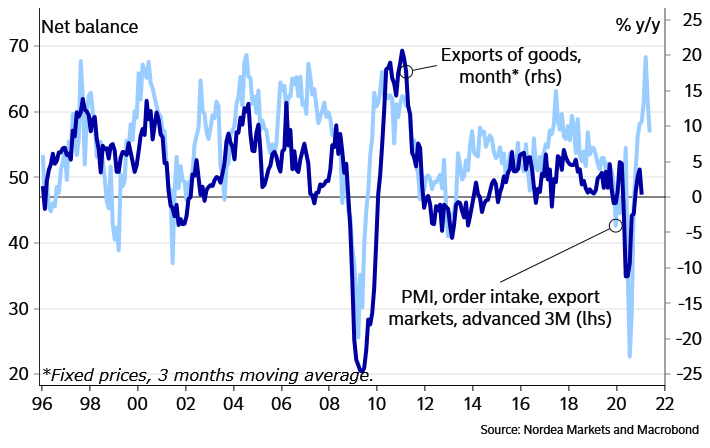

All in all, the PMI is coming down, roughly as expected. The drop illustrates that production has recovered after the slump last year. With production back to more normal levels, growths slows too. Disruptions in the global supply chains could hamper growth the coming months, but these problems should abate longer out.

Details, February:

PMI: 61.6 (prior 62.5)

Order intake: 57.6 (prior 66.0)

Export orders: 56.9 (prior 61.6)

Production: 62.1 (prior 63.5)

Employment: 57.3 (prior 52.5)

Inventories: 49.2 (prior 48.2)

Production plans 6 months ahead: 72.5 (prior 72.6)