Fjerde kvartal viste et blandet billede af svensk økonomi: Forbruget steg, men eksporten faldt. Det kan betyde, at centralbanken vil stimulere økonomien.

Uddrag fra Nordea:

Swedish Q4 GDP preview: Consumption up but exports down

The Swedish economy showed decent growth in Q4, slightly exceeding the Riksbank’s forecast. The bank may nevertheless step on the accelerator.

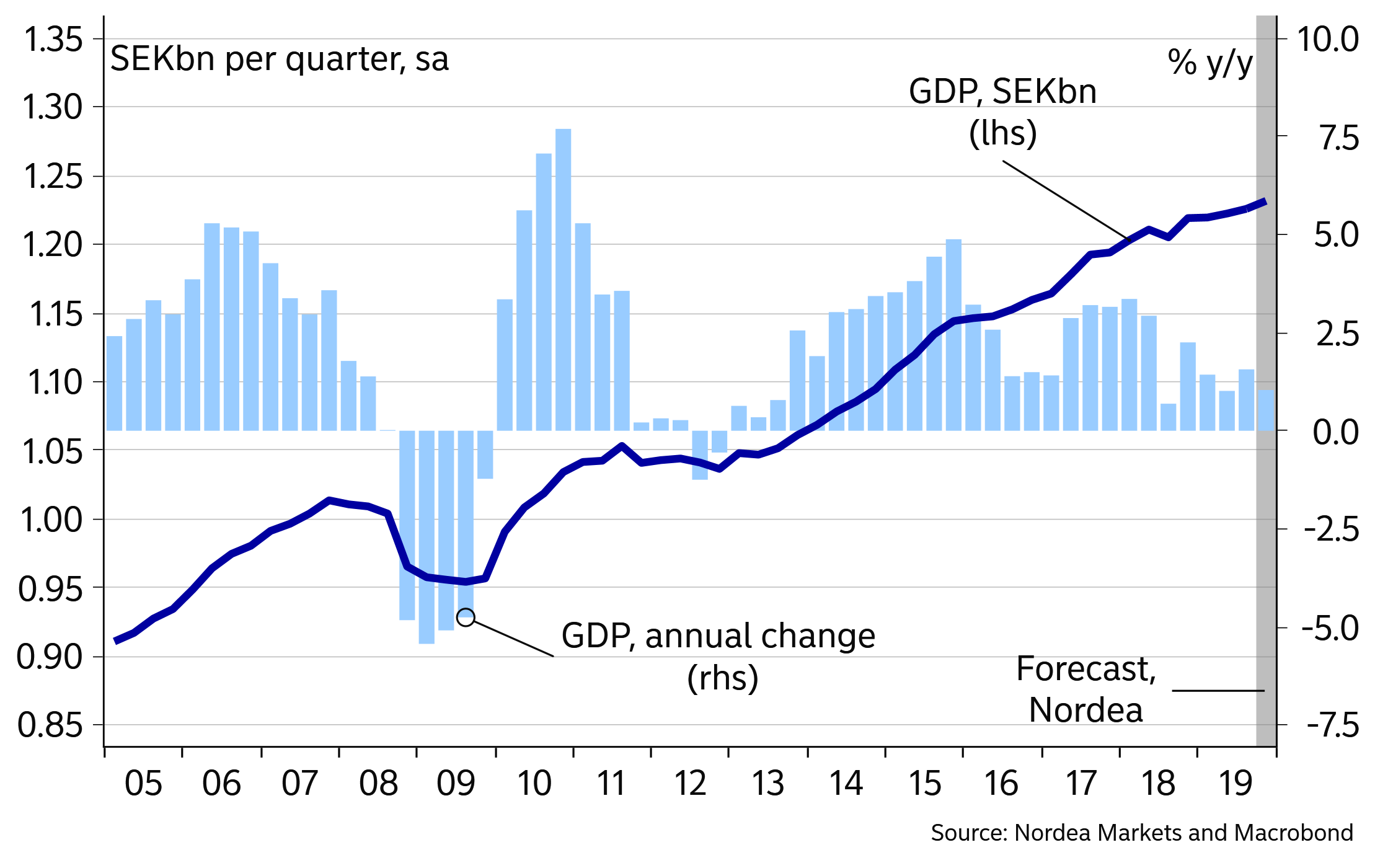

The economy gradually gained momentum during 2019. We see Q4 GDP growth at 0.5% q/q, thus somewhat stronger than the 0.3% and 0.2% reported for Q3 and Q2, respectively. The year-on-year figure stood at 1.0% in Q4, according to our estimates.

Our call is stronger than the Riksbank’s forecast of 0.3% q/q and 0.8% y/y.

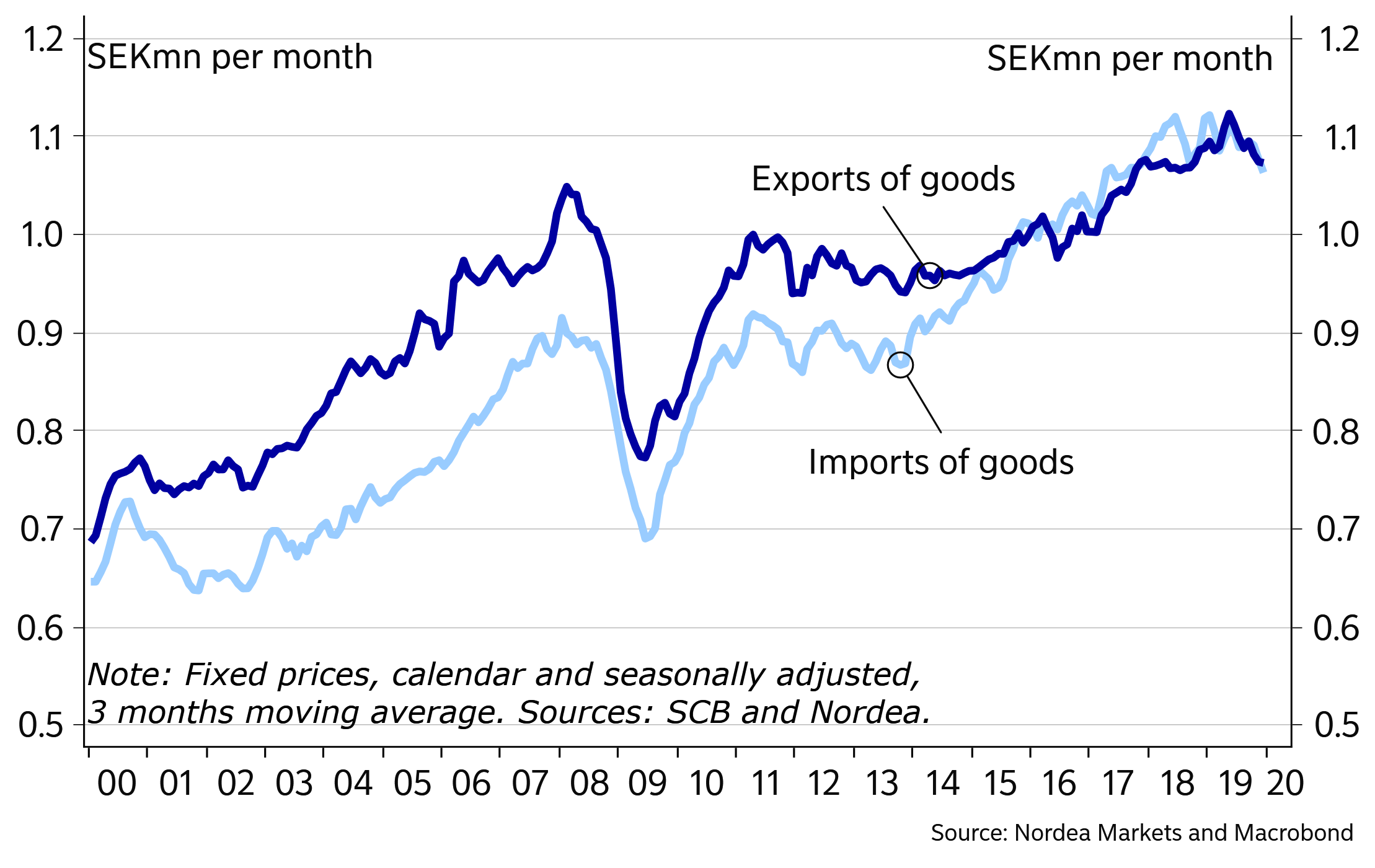

The key features of Q4 are rising household consumption, falling exports of goods and very low imports of goods. Moreover, hours worked declined.

The plummeting imports of goods mainly reflect weak exports as many input goods for the export industry are imported. However, it could also be a consequence of parts of domestic demand being sluggish, not least fixed investment. Low imports mean that foreign trade added to year-on-year growth, despite dropping exports.

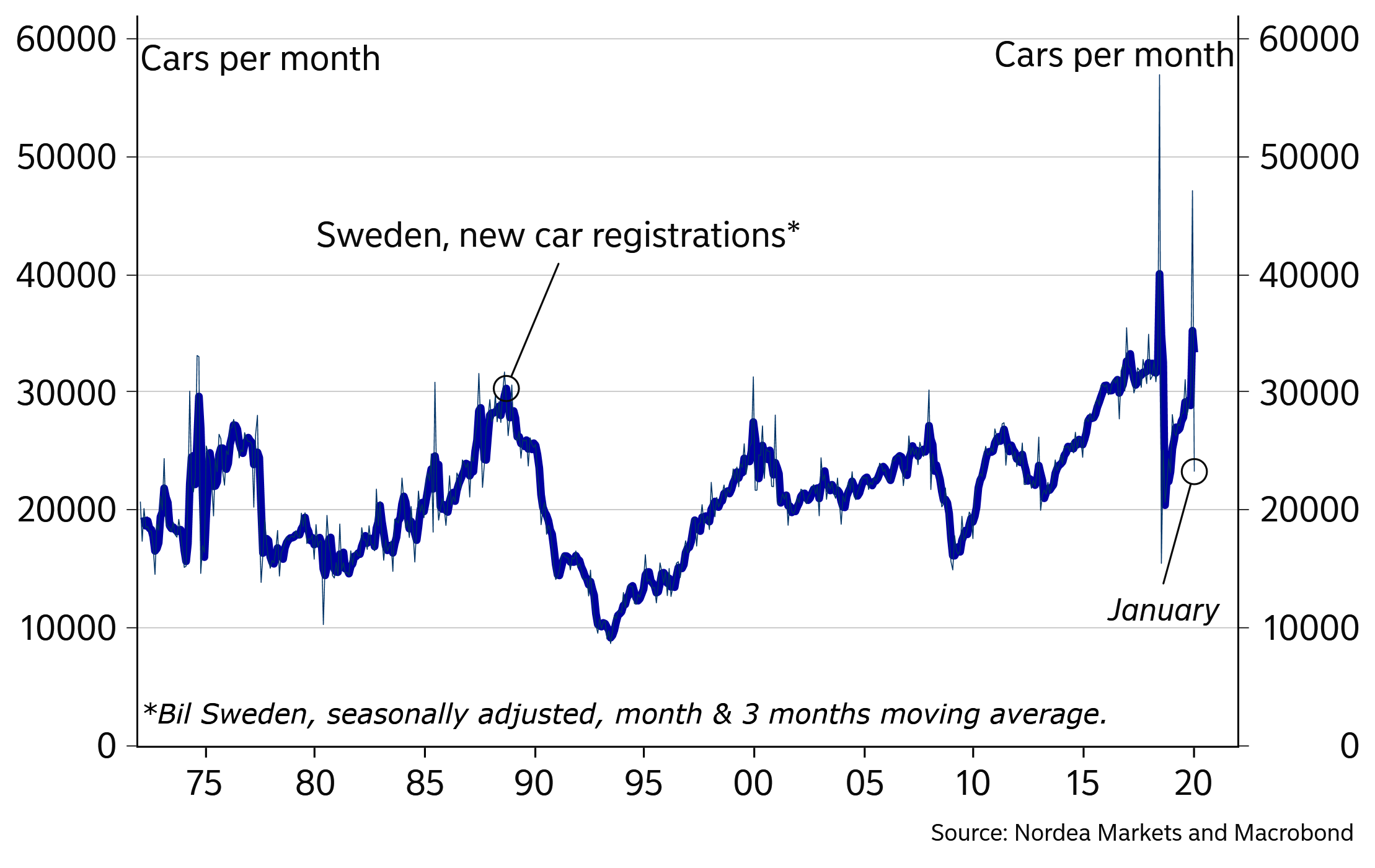

Household consumption, the most important part of domestic demand, is on the other hand picking up. Consumption rose by a healthy 0.7% q/q, according to our forecast. Consumption is boosted by a temporary surge in car registrations ahead of the change in taxes at the turn of the year. Car purchases will decline in Q1 this year. However, conditions are favourable for households, and we expect consumption to show healthy growth going forward.

In Q3, production numbers were weaker than the expenditure side of GDP. This pattern was repeated in Q4, we think. While production in the business sector hardly grew over the year in Q4 (adjusted for calendar effects and inventories), especially consumption indicates stronger growth. As was the case in Q3, Statistics Sweden will probably choose the middle way when determining Q4 GDP growth.

Hours worked declined both on the quarter and over the year in Q4. Thus, productivity rose, keeping cost pressures in check.

Exports of services dropped on the quarter after the sharp uptick in Q3, we think. Services are increasingly important, but we nevertheless lack indicators of foreign trade with services, adding to the uncertainty when assessing the volatile quarterly GDP growth numbers.

All in all, exports were down in Q4, and household consumption is recovering after the slowdown one to two years ago. Improving domestic demand usually points to rate hikes, but the bank’s focus on the low inflation means that there is a risk of further easing measures. For now, we keep our view that the Riksbank will stay on hold this as well as next year.