Uddrag fra JPMorgan:

- Ahead of Trump’s April 2 tariff “Liberation day” JPM’s Market Intel desk has published a primer laying out its Tactical Tariff Thoughts. The trading team starts off by immediately noting that it remains Tactically Bearish (as a reminder, it turned bullish around the time of the October 2022 lows and was bullish up until a month ago). The team, led by JPM’s Andrew Tyler writes that “policy uncertainty is the dominant factor in the markets and that neither the Trump Put nor Fed Put activate in the near-term.” Further, they see downward pressure on the soft economic data though hard data is likely to remain resilient, potentially putting a floor on the next US downdraft. That said, one potential event that could break the bearish outlook is the announcement of a trade deal, or framework of one, with a G7 country ahead of the announcement, e.g. US/UK deal could allow the market to look through tariffs on places such as the EU and/or Japan.

JPM’s proposed Monetization Menu:

- Country-Level: we look at Australia, Japan, and the UK as being relative safety havens. China may work, too, given the potential to add fiscal stimulus but that is a lower conviction long.

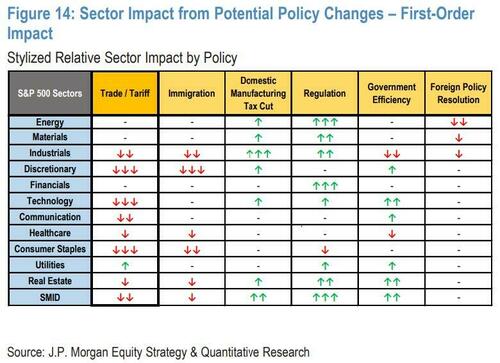

- US Sector Level: Energy and Utilities (ex-AI plays) are the two best longs and look for Lower-Income Discretionary and higher beta TMT plays as being among the more consensus shorts. Separately, parts of Fins (GSIBs, Insurance, Payment Processors) could be safety havens.

- FICC: Look for Credit to outperform Equities on the move lower. We like precious metals, crude, and natgas as longs.

CLIENT Q&A: The following includes Q&A from recent conversations between JPMorgan’s Andrew Tyler and their US and International clients as the world is focused on the April 2nd tariff announcement.

WHAT IS CONSENSUS?

- Most investors are operating under the assumption that a Trump Put exists and thus tariffs are temporary. Further, that Trump Put is thought to exist in the 5,000 – 5,300 range for the SPX.

- There is also the belief that the US will outperform in all scenarios now that we have seen the TMT sector get materially cheaper this week.

- Lastly, the view on the Fed is that it will step in to establish the Fed Put no later than the June meeting.

DO YOU AGREE WITH CONSENSUS? “No, not exactly.”

- First, Trump believes that he can remake the global manufacturing status quo in short order and given the longer-term view, Trump has significantly more tolerance for stock market pullbacks. Thus, the Trump Put does not yet exist, or if we are wrong, may have a strike below 5,000.

- Second, on the Fed, I think the key is unemployment rate vs. inflation. With unemployment at 4.2% and CPI at 2.8%, it would be very difficult for the Fed to set in until you see unemployment closer to 5.0%, assuming CPI stays at current levels.

- Given the current expectations for tariffs to create a spike to inflation, it puts the Fed in a difficult place with monetary policy looked at having limited ability to cure stagflation. So, the Fed Put may not activate until sometime in Q3, or later, if the economy proves to be more resilient than expected.

WITH THE TARIFF ANNOUNCEMENT WHAT ARE YOU LOOKING FOR?

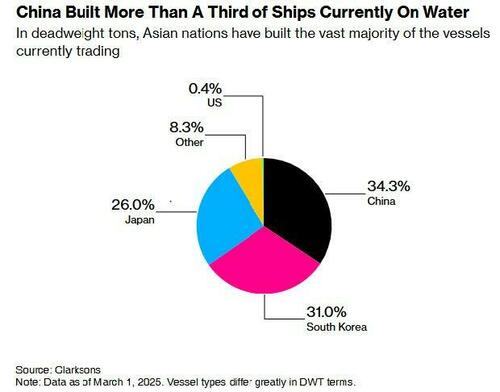

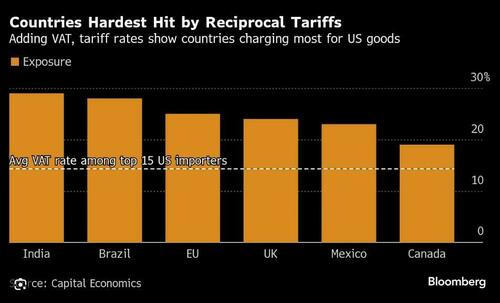

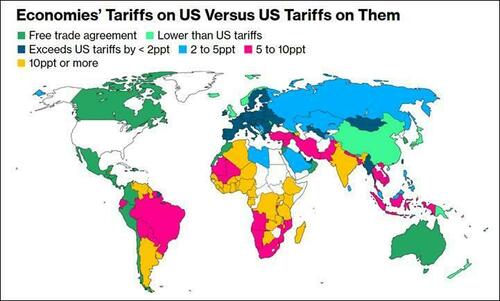

While Trump mentioned that reciprocal tariffs will be announced, it is possible that other features of the trade war will be disseminated, too, such as tariffs on Chinese-made shipping vessels. Trump mentioned potentially doing less than reciprocal level tariffs, presumably with countries willing to negotiate/re-negotiate trade deals.

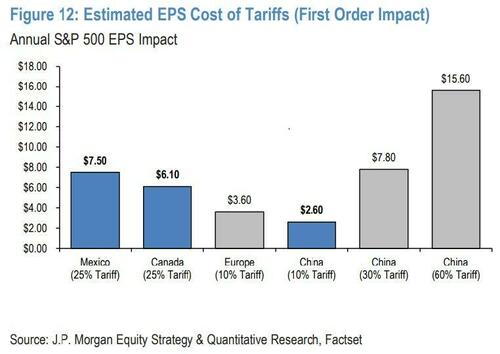

TARIFF LEVELS

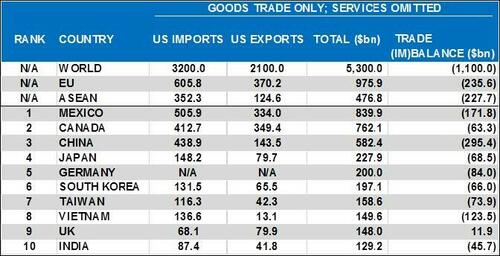

- CANADA / MEXICO – We do not think that we see additional tariffs mentioned, instead sticking with the 25% tariffs that were delayed.

- CHINA – currently, the tariff level is 20% but given that China consumes Venezuelan oil, that adds another 25%. A deal on TikTok could reduce these levels, but that announcement may be on/before the current April 5 deadline to sell or restrict TikTok.

- EU – while Trump had mentioned 25%, Bloomberg reported last week that the EU planned concessions for Trump so this could mean a lower rate in the 10% – 15% range.

- JAPAN – given the willingness to negotiation and to add further investment in the US, it seems possible that Japan receives a lower rate, perhaps lower than the EU, say 10%.

TARIFF FEATURES

- WHAT ABOUT VAT – it is unclear if Trump will include the VAT in the opening salvo or if he uses that as an escalation tool should a country/region retaliate. For now, we do not include VAT in the estimates listed above.

- WILL THESE ELIMINATE SECTORAL TARIFFS – No, we anticipate more to come.

- IS A BLANKET TARIFF POSSIBLE – Yes and it was initially thought that the Tariff/Trade Study due on April 1 would be the legal basis to implement a blanket tariff rather than doing reciprocal tariffs.

- HOW LONG DOES THIS PHASE OF THE TRADE WAR LAST – Scott Bessent mentioned that we could see discussions lasting until June. So, we use that as our guidance. Look for Trump’s announcement and then retaliation, escalation, and then reconciliation. With this in mind, we do not think Wednesday represents a clearing event for stocks and we do not think tariffs are fully priced into the market.

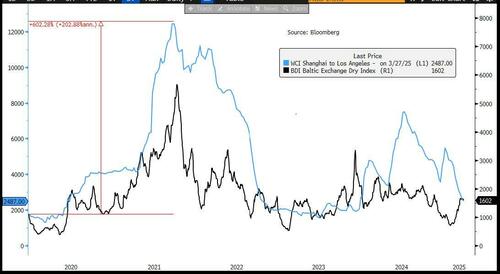

- ARE THERE ANY OTHER FEATURES TO BE AWARE OF – Trump has mentioned potentially adding fines or tariffs on Chinese-made containerships. The risk here is that this could push freight rates back toward COVID levels, spiking global inflation. Additional color on this is available from Bloomberg (here) and CNBC (here).

SHANGHAI-TO-LOS ANGELES SHIPPING RATES vs. BALTIC DRY INDEX

MARKET IMPACT

WHAT DOES A GOOD OUTCOME LOOK LIKE – A low (10% or less) blanket tariff that does not include VAT with a stated willingness to discuss sectoral tariffs which include 25% on aluminum/steel, 25% on Autos, 200% on Champagne/wine from the EU, and potentially 25% on Chips and Pharmaceuticals. Further, avoiding tariffs on shipping vessels would be a positive.

There are some clients who have mentioned that significantly higher than expected levels are preferrable, despite the more acute likely market impact, as that would signal a willingness to negotiate, and that escalation would be a maintain of tariffs at those levels rather than a lower level with unknown increases.

WHAT DOES A BAD OUTCOME LOOK LIKE – A higher than expected blanket tariff, which includes VAT, plus additional sectoral tariffs. Further, any bans on sales or the implementation of fines/tariffs on shipping vessels would be a materially worse outcome, e.g., a full ban on chip sales to China. According to Blomberg, NVDA received ~17% of its FY24 revenue from China.

HOW ARE YOU THINKING ABOUT SCENARIOS –

- 10% TARIFF – assuming a 10% blanket tariff that also cancels/replaces Can/Mexico tariffs but not China: SPX +2 – +2.5%. 10Y yield higher by ~10bps. EUR/USD falls to 1.06 – 1.07 (currently 1.08).

- 25% TARIFF – SPX falls 1.25% – 1.75%. 10Y yield declines 12-14bps. EUR/USD lower as USD behaves as a safety haven, with EUR/USD falling to 1.03 – 1.05

- 35% TARIFF – SPX falls 2% – 3%. 10Y yield falls 20bps. EUR/USD falls to 1.01 – 1.03.

ANY ADDITIONAL THOUGHTS – While tariffs have been well-flagged, we do not think tariff outcomes are priced into the market nor do we think investors views on the Fed Put and Trump Put are accurate, at least in terms of either coming to fruition in 25Q2. In terms of potential downside, the two biggest questions are (i) can MegaCap Tech act as a defensive and (ii) what happens to the USD.

- We have a low conviction view that parts of Mag7 can be defensive but the uncertainty around chips means that NVDA may fail to rally, capping the defensive prowess of Mag7.

- On the USD, the changes in growth inflection points (US strong and weakening, EU/Japan strengthening) have allowed for a sell-off, among other factors. Typically, a US recession pulls the world lower with it, so the USD likely shifts back to “flight to safety” position.

- Also, we received inquiries on whether the European outperformance over the US can continue. The answer is almost wholly based on the behavior of MegaCap Tech. That aside, do we see other EU countries follow Germany’s lead on fiscal stimulus or do we see a bifurcation between Scandinavian countries and Core EU based upon the bullish commodities trade?